Silverlake Axis - Stock Analyst Research

| Target Price* | SGD 0.36 |

| Recommendation | BUY› BUY |

| Market Cap* | - |

| Publication Date | 19 Feb 2024 |

*At the time of publication

Silverlake Axis Ltd – Quality of earnings improving

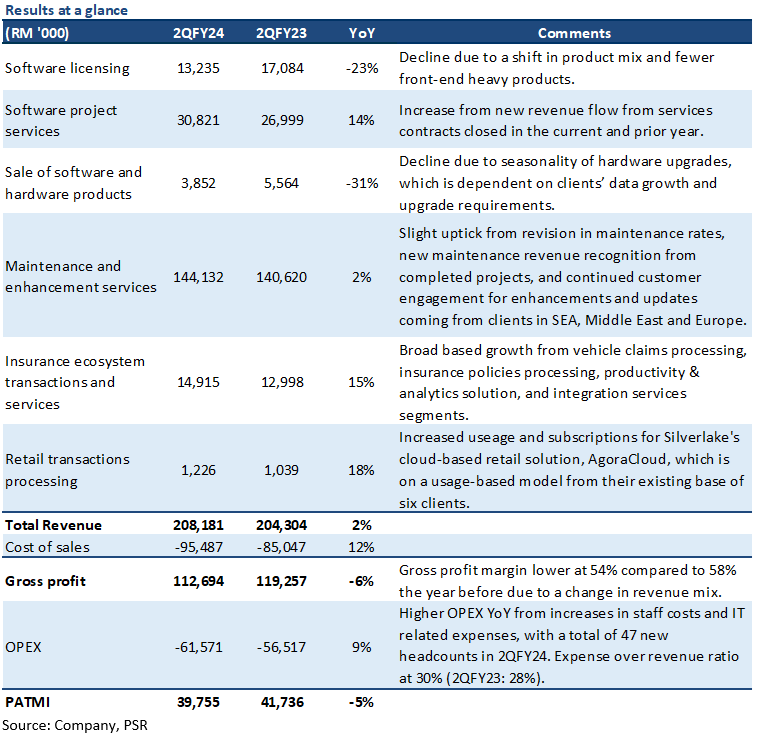

- 2QFY24 earnings of RM39.8mn met our estimates. 1HFY24 earnings were at 49% of our FY24e. The 5% YoY dip in earnings came from lower-than-expected non-recurring revenue and higher-than-expected OPEX.

- 2QFY24 recurring revenue comprising maintenance and enhancement services, insurance ecosystem transactions and services, and retail transactions processing revenue grew 4% YoY, while non-recurring revenue comprising software licensing, software project services and sale of system software and hardware products fell 4% YoY. Orderbook is RM790mn (1QFY24: RM720-730mn) with the total deals pipeline at RM1.4bn. One imminent MOBIUS deal with a Thailand bank worth ~RM30mn.

- Maintain BUY with a lower target price of S$0.36. Our FY24e estimates remain unchanged. The quality of Silverlake’s earnings is improving. Recurrent revenue is building up from new products (MOBIUS, Symmetri), and maintenance revenue expanding with rising security enhancement of core SIBS software. Our target price is pegged to 19x P/E FY24e. We expect MOBIUS and the recovery in bank IT spending after two cautious pandemic years to be the key growth drivers for the company.

The Positives

+ Recurring revenue rose 4% YoY. Recurring revenue comprises maintenance and enhancement services, insurance ecosystem transactions and services, and retail transactions processing revenue. Maintenance and enhancement services grew 2% YoY to RM144mn from revised maintenance rates for some clients upon maintenance renewal and new maintenance revenue recognition for projects that had been successfully completed and handed over to clients. There was also continued engagement from customers to enhance, modernise and provide up-to-date features in the platforms that were previously acquired. Growth mainly came from clients in Southeast Asia, the Middle East, and Europe. Silverlake expects this segment to continue to grow as new maintenance contracts and support will commence when current projects are completed and successfully handed over to clients. Insurance ecosystem transactions and services revenue rose 15% YoY as there was broad-based growth across all segments, from vehicle claims processing, insurance policies processing, productivity and analytics solutions, and integration services. Retail transaction processing revenue grew 18% YoY mainly due to increased usage and subscriptions to new modules for Silverlake’s cloud-based retail solution, AgoraCloud. As this is a usage-based model, Silverlake has seen increased usage from its existing base of six clients as the client base grew from the retail sector in FY21 to the pharmaceutical industry.

+ Order backlog healthy. Silverlake has a long track record and a proven client base in Southeast Asia. Three of the five largest Southeast Asia-based financial institutions use its core banking platform, and it has largely retained all its clients since bringing them on board its platform. Silverlake’s project pipeline is healthy, at RM1.4bn (1QFY24: RM1.8bn), with contract wins of RM114mn in 2QFY24 and an order backlog of RM790mn going into the rest of FY24. Furthermore, Silverlake expects revenue from the multi-million 10-year core and channels digital banking MOBIUS deal with a client in Malaysia to come in FY24. Silverlake is beginning to close more deals and is witnessing an uptick in inquiries about its financial services market solutions and capabilities.

The Negatives

– OPEX rose 9% YoY. Operating expenses were higher mainly due to annual salary increments post-pandemic, effected in 3QFY23, and new headcounts added to support business development and business expansion, sales and market coverage, and retirement gratuity paid to key management personnel. Notably, there was an addition of 47 new headcounts in 2QFY24 as compared to 2QFY23. Other OPEX increases include IT-related expenses, particularly in software subscription and support, as well as laptop leasing for new headcounts; business travels due to the economic recovery post-pandemic, and interest charged on revolving credit utilised. As a result, the expense-over-revenue ratio rose to 30% (2QFY23: 28%).

– Non-recurring revenue falls 4% YoY. Non-recurring revenue comprises software licensing, software project services, and sale of system software and hardware products. Software licensing revenue fell 23% YoY as there was a shift towards cloud-based systems such as MÖBIUS and Symmetri, which do not have as much initial revenue recognition as compared to legacy systems like SIBS. Silverlake continues to see core banking installations in Malaysia, Thailand, Indonesia and the Middle East, and a digital identity and security software project implementation in Africa. The decline was slightly offset by software project services revenue increasing 14% YoY as a result of new revenue flow from strong revenue flow of services contracts closed this year and the prior year, with the projects proceeding as planned.

Outlook

Building a higher quality order book. Silverlake has a tender book of RM1.4bn going into the rest of FY24, with more than half of it coming from its core banking systems, MOBIUS and Symmetri. While the initial revenue from these systems will be smaller than that from legacy core banking systems, such as the Silverlake Integrated Banking Solution or SIBS, we expect it to improve recurrent fees. Cloud banking software, such as MOBIUS and Symmetri, avoid the need for banks to purchase and manage hardware assets, which results in lower initial costs and, consequently, initial revenue for Silverlake. However, there would be a need for continuous enhancement and maintenance of these systems, improving the quality of Silverlake’s order book with the bulk of growth coming from recurrent fees.

Visible growth from new product cycles – Silverlake signed a deal with one of the largest banks in Thailand and its first multi-million 10-year core and channels digital banking MOBIUS deal with a client in Malaysia. The collaboration with the Thailand bank has shown the proof of concept, and it is a significant reference site for MOBIUS. With this, we could see more inquiries for the rest of FY24, with an imminent deal with a Thailand bank worth ~RM30mn. There is also a potential for replacing core banking systems with MOBIUS as several legacy core banking systems approach end-of-life, and banks have fewer limitations to adopt a fully cloud-based core. Silverlake has seen a shift towards Software-as-a-Service (SaaS) and cloud computing. With Silverlake’s offering of cloud-based systems, we could expect the demand for these systems to continue going into the rest of FY24. Silverlake has also begun to offer a repackaged version of its legacy core system, SIBS, where only certain modules will be offered and have seen this banking-as-a-service being taken up by Thailand customers.

About the author

Glenn Thum

Research Analyst

PSR

Glenn covers the Banking and Finance sector. He has had 3 years of experience as a Credit Analyst in a Bank, where he prepared credit proposals by conducting consistent critical analysis on the business, market, country and financial information. Glenn graduated with a Bachelor of Business Management from the University of Queensland with a double major in International Business and Human Resources.

About the author

Glenn Thum

Research Analyst

PSR

Glenn covers the Banking and Finance sector. He has had 3 years of experience as a Credit Analyst in a Bank, where he prepared credit proposals by conducting consistent critical analysis on the business, market, country and financial information. Glenn graduated with a Bachelor of Business Management from the University of Queensland with a double major in International Business and Human Resources.

JPMorgan Chase & Co - NII continues to rise, guidance maintained

JPMorgan Chase & Co - NII continues to rise, guidance maintained Trade of the Day - NVIDIA Corporation (NASDAQ: NVDA)

Trade of the Day - NVIDIA Corporation (NASDAQ: NVDA) Trade of the Day - Applied Materials, Inc. (NASDAQ: AMAT)

Trade of the Day - Applied Materials, Inc. (NASDAQ: AMAT) CapitaLand Ascott Trust - Occupancy to improve with ADRs stabilising

CapitaLand Ascott Trust - Occupancy to improve with ADRs stabilising