Silverlake Axis Ltd - New cloud driver and recovery in bank spending

6 Jun 2022- New growth driver from MOBIUS cloud-based banking software. Banking customers can deploy MOBIUS to launch new digital loan and deposit products in a more rapid and targeted manner. Almost RM100mn of orders is expected.

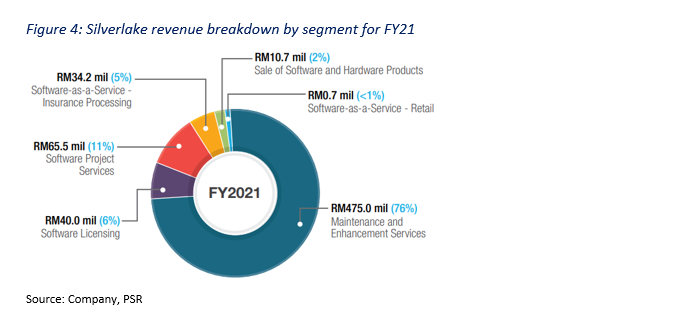

- Silverlake’s recurring maintenance revenue contributed to 72% of FY21 revenue and managed to expand at a CAGR of 4% despite the pandemic.

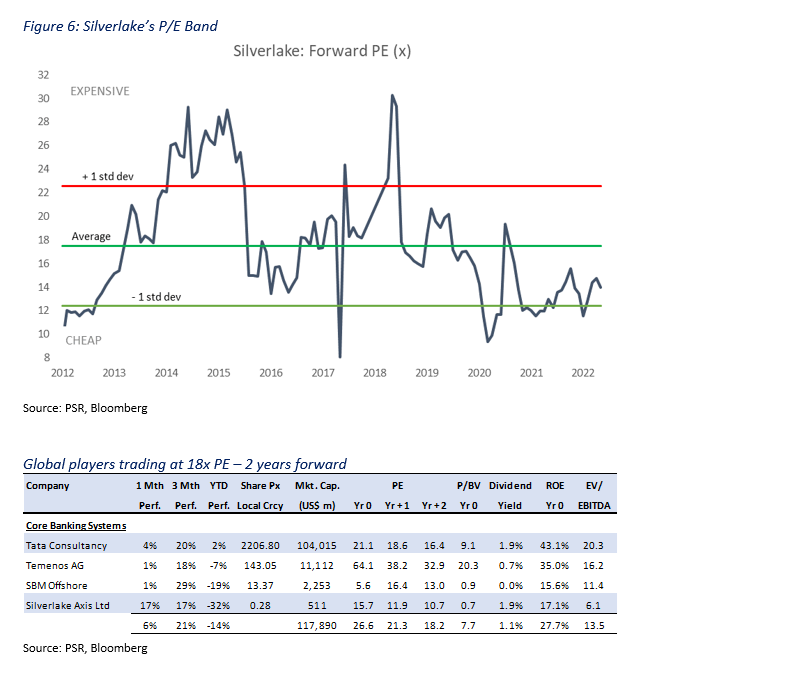

- Initiate coverage on Silverlake Axis Ltd with a BUY rating and a target price of S$0.38. Our target price is pegged to 20x P/E FY22e. We expect MOBIUS and the recovery in bank IT spending after two cautious pandemic years as key growth drivers for the company. In March 2022, Silverlake initiated an equal access offer at S$0.33 each.

Company Background

Silverlake Axis Ltd provides customized software solutions and core banking systems. It provides digital economy software solutions and services to the banking, insurance, payment, retail and logistics industries. To date, it has been the banking solutions provider for 40% of the 20 largest banks in Southeast Asia. As at Dec 2021, the balance sheet is in a net cash position of RM493mn (S$154mn).

Investment Merits

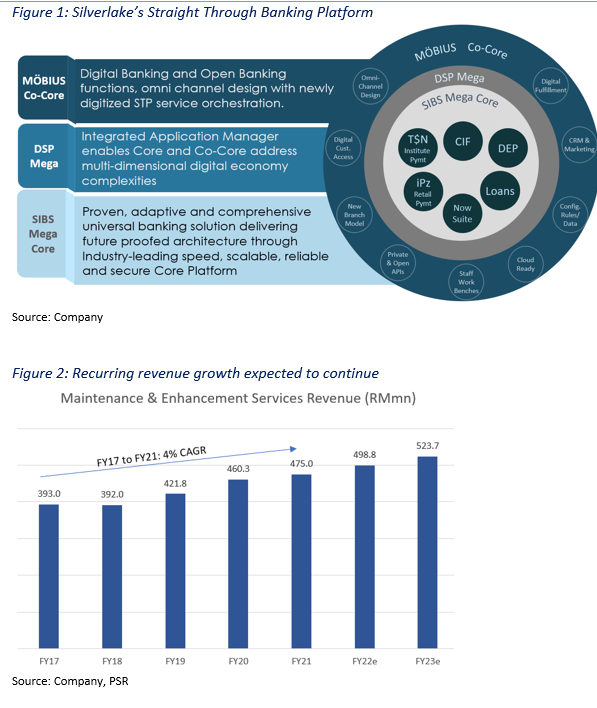

- MOBIUS banking platform is the differentiator. Launched in 2020, Silverlake’s MOBIUS cloud banking software allows banks to roll over new digital products in a targeted and timely manner. Banks can utilise the MOBIUS allows banks to co-exist with existing core banking software and propel them to new digital products (Figure 1). Potential uses of MOBIUS include new digital products in credit cards, debit cards, personal loans and deposits. Cloud based software avoids the need for banks to purchase and manage hardware assets. Silverlake recently signed a deal with one of the largest banks in Thailand and is continuing to see increasing inquiries in the region. We expect MOBIUS to generate almost RM100mn of orders over the next two years.

- Stable recurring revenue despite the pandemic. Silverlake’s recurring maintenance and enhancement revenue contributed to 72% of FY21 revenue and it grew at a CAGR of 4% despite the COVID-19 pandemic (Figure 2). Silverlake’s core banking software (Silverlake Integrated Banking Solution or SIBS) and continuous maintenance and enhancement provide a steady stream of recurring business for the group. SIBS provides core accounting and compliance. With the opening of borders and economies in ASEAN, we should expect Silverlake’s customers to increase their IT spending to accelerate their digitalisation plans to grow.

- Record order backlog. Silverlake has a long track record and a proven client base in Southeast Asia. 3 of the 5 largest Southeast Asian based financial institutions use its core banking platform, and it has largely retained all its clients since bringing them on board its platform. Silverlake’s project pipeline is healthy, at RM1.7bn, with a record-high order backlog of RM450mn, a 50% YoY increase. This should keep them busy for the next 1 to 2 years. Silverlake is beginning to close more deals and is witnessing an uptick in inquiries about its financial services market solutions and capabilities. Silverlake should be able to secure its foothold in ASEAN and look to expand into other regions.

Revenue

Silverlake has several revenue segments: 1) Software licensing (making up 6% of FY21 revenue); 2) Software project services (11%); 3) Maintenance and enhancement services (76%); 4) Sale of software and hardware projects (2%); and 5) Software-as-a-Service (6%).

Software licensing: Silverlake is a digital economy solutions provider to the financial services, retail, and logistics industries. The group’s main products include Silverlake Axis Integrated Banking Solution (SIBS) and Silverlake Digital Banking MÖBIUS Open Banking Platform (SDE). Revenue from software licensing fell 29% YoY in FY21 as customers continue to be cautious in committing to significant new software licensing deals in the first 3 quarters of FY21. Significant new software licensing deals began to pick up in 4Q21 and it is anticipated that this will continue through to FY22.

Software project services: Silverlake’s software project services business is related to the provision of software customisation and implementation services to deliver the core banking, payment, and retail solutions. Software project services revenue declined 12% YoY in FY21 as several key projects were completed, nearing completion or delayed due to client requests. Nonetheless, the decrease in FY21 was mitigated by smaller scale contracts for SIBS technology refresh contracts secured in Malaysia in 2H20 and new MÖBIUS and banking implementation contracts secured in Sri Lanka, Thailand, and Malaysia in 2H21.

Maintenance and enhancement services: This segment is where Silverlake provides round-the-clock software support services as well as enhancement services to support its customers in the delivery and execution of their strategies in making available new capabilities to them. These capabilities can be in the areas of new channels, to augment customer experience and address any new regulatory and emerging governance, risk, and compliance requirements. This segment recorded a growth of 10% YoY in FY21 due to new maintenance contracts secured as well as revision of maintenance fees for existing contracts.

Sale of software and hardware projects: This refers to Silverlake’s non-proprietary software and where its acts as a reseller to customers who require bundled one-stop solutions. The Group is an authorised reseller of IBM hardware and system software in Malaysia. Hardware sales are seasonal by nature and dependent on the requirements and specifications to support the implementation of new or enhancement of existing systems. This segment declined by 60% YoY in FY21, and the lower sales were due to the deferment of capital expenditure during the pandemic period as well as they wait for the launch of the latest IBM iSeries in September 2021.

Software-as-a-Service: This segment consists of insurance processing, where Silverlake’s Merimen built platform processes insurance claims and premiums, and retail, and where Silverlake is a cloud-based SaaS solution provider in the retail industry. Software-as-a-Service revenue for Insurance processing was flat in FY21 while Retail processing grew 47% YoY in FY21 as the Group pivots to SaaS offerings to the larger SME market.

Expenses

The cost of sales fell 12% YoY in FY21, which was in line with the drop in revenue. Operating expenses include selling and distribution costs (15% of total operating expenses), administrative expenses (79%) and finance costs (6%). Selling and distribution costs fell 9% YoY in FY21 as a result of cost control measures during the pandemic period. Selling and distribution costs include staff costs and Silverlake has a total of 2,076 employees in FY21. Expense categories remain largely unchanged over the last 3 years. Notably, Silverlake spent 4% of FY21 revenue (~RM25mn) on research and development.

Margins

Gross profit margin improved from 57% in FY20 to 60% in FY21 mainly due to better margins generated from software project services as well as maintenance and enhancement services in FY21.

Net profit margin fell from 28% in FY20 to 23% in FY21 mainly due to non-operational losses of RM15.6mn and RM8.6mn from remeasurement of put liability for put option and remeasurement of derivative asset in relation to call option on the remaining 20% equity interest in XIT Group respectivly.

Balance Sheet

Assets: Cash and bank balances fell by 16% in FY21 to RM417mn mainly due to the full repayment of their revolving credit line and the cash payment for the acquisition of SISG Group. Intangible assets grew 6% in FY21 to RM317mn mainly due to the capitalisation of software development expenditure incurred on core and digital banking, Fintech and other solutions during the year.

Liabilities: Total liabilities fell 57% in FY21 to RM310mn mainly due to the settlement of the EOC for the acquisition of SISG Group and the full repayment of revolving credit line mentioned above. We expect total liabilities to remain stable as the revolving credit facility has been cancelled.

Cash Flow

Free Cash Flow (FCF) fell 10% in FY21 to RM155mn as operating cash flow fell 6% in FY21 to RM197mn. FCF averaged RM206mn for the past three years. Capital expenditure (CAPEX) fell 10% in FY21 to RM44mn with majority of CAPEX concentrated in Southeast Asia (95% of total CAPEX). Nonetheless, we expect FCF to improve as operating cash flow should increase with the increase in revenue.

Business Model

Silverlake’s primary business is the development of core banking and payment processing technologies. The company also makes money from the license fees for its corporate software platforms. Following the completion of projects for customers, Silverlake gets contracts for maintenance and enhancement services, which pay a recurring fee. The maintenance and improvement services are normally recurring for a period of five years and are strongly tied to the installed base of its core banking system.

Silverlake’s recurring revenue from maintenance and enhancement services makes up the bulk of revenue, at 76% of FY21 total revenue. Nonetheless, it has expanded its services, primarily through acquisitions, to provide digital transaction processing in other industries such as retail and insurance.

Silverlake’s flagship product, the core banking system Silverlake Axis Integrated Banking Solution (SIBS), runs primarily on the IBM AS400 (Power Systems) Platform. SIBS offers the full range of commercial banking functions including financing (loans), funding (deposits), remittances, a general ledger module and the Customer Information Facility (CIF). Over the years, Silverlake has broadened its platform capabilities to include a credit card system, internet banking, trade finance, and treasury solutions.

Silverlake has also introduced its Open Banking Platform, MOBIUS, which combines customer-facing digital capabilities with core banking processing capabilities, i.e., SIBS, to create a digital, unified, open end-to-end platform for commercial banking. This means customers can expand their core banking platforms to the MOBIUS platform, thus integrating their systems into one end-to-end banking platform. Furthermore, MOBIUS can be integrated across different core banking systems, without the need to switch to SIBS. Silverlake is able to target both new and existing customers. With MOBIUS being a cloud-based system, the cost is lower than traditional systems which are usually on-site platforms.

Industry

Core banking is evolving to meet the challenges of significant shifts in the banking industry, especially in digital banking. It is essential to provide enabling technologies that increase business agility and reduce operational costs in order to adapt to these changes.

An increasing number of banking segments and geographies are implementing cloud-only core banking system (CBS) strategies. Gartner estimated that 6.5% of core banking commercial off-the-shelf (COTS) CBS installations ran from the cloud in 2020, and this percentage is predicted to increase to 10% by 2023 when public cloud usage will equal private cloud at 5% each. The increased agility and operational excellence that cloud technology may provide to CBS installations have been the main drivers for this rise. Silverlake is able to offer these services with its MOBIUS platform.

Banks are also keener on buying their software, rather than building it. Purchasing software rather than producing it can be more convenient because it eliminates the need for the bank to maintain a software house with current skills and capabilities. The majority of banks with proprietary CBS aim to replace it with COTS applications. This deliberate choice leads to the need to select reliable suppliers that can quickly deploy the CBS, as well as maintain it in the after-sales process.

CBS’s services are moving away from being isolated islands of functionality and toward becoming open, collaborative platforms. Banks are rethinking many parts of their business models as a result of digital business, and ecosystems are critical to this. With a digital business, banks can expand their digital business platform model options, connect to new sales channels, boost the variety and value of client interactions, and link to new sales channels.

Gartner notes that the number of net new deals for core banking replacement increased in 2021, despite the COVID-19 pandemic. There is a growing demand for core banking renewal, driven mainly by digital banking initiatives for which legacy systems prove to be inadequate.

According to Gartner, there are four market leaders. Gartner’s Magic Quadrant analysis identified four leaders in the CBS industry. However, vendors whose offerings do not fit Gartner’s stated criteria, such as Islamic banking vendors, are excluded from this research, which is why Silverlake was left off the list.

The analysis’ main thesis is that this is a highly competitive field dominated by four big corporations. These four companies have a worldwide installation base of between 400 and 800 users. Silverlake, on the other hand, has between 70 and 80 installations worldwide, mostly in Asia.

Market leaders highlighted by Gartner:

- EdgeVerve Systems (Banking platform: Finacle) – ~500 installations worldwide

- Oracle Financial Services Software (FLEXCUBE) – ~800 installations worldwide

- Tata Consultancy Services (BaNCS) – ~400 installations worldwide

- Temenos (T24) – ~800 installations worldwide

Risks

- Slowdown in spending. A weakening economy could create potential headwinds for spending among banks, which are Silverlake’s main customers. Financial shocks would hit IT spending the first and the banks would cut back. However, Silverlake’s main market is in ASEAN, which is aggressively reopening economies. Companies looking to recover post-lockdowns would need to accelerate their digitalisation efforts to grow.

- Increasing competition. While Silverlake is the banking solutions provider for 40% of the 20 largest banks in Southeast Asia, it is relatively small compared to the global players in the industry. These global players have gained contracts in Malaysia and Southeast Asia, a trend that is expected to continue as key banking systems reach the end of their life cycle in the coming years.

Valuation

We initiate coverage on Silverlake Axis Ltd with a BUY rating and a target price of S$0.38. Our target price is pegged to 20x P/E FY22e. It is an 11% upside to peer valuations of around 18x PE (Figure 7).

Our target PE of 20x is 15% higher than the historical average PE of 17.5x. In our view, Silverlake should trade at a higher premium to its historical PE with the introduction of MOBIUS and resumption of bank IT spending post pandemic.

About the author

Glenn Thum

Research Analyst

PSR

Glenn covers the Banking and Finance sector. He has had 3 years of experience as a Credit Analyst in a Bank, where he prepared credit proposals by conducting consistent critical analysis on the business, market, country and financial information. Glenn graduated with a Bachelor of Business Management from the University of Queensland with a double major in International Business and Human Resources.

About the author

Glenn Thum

Research Analyst

PSR

Glenn covers the Banking and Finance sector. He has had 3 years of experience as a Credit Analyst in a Bank, where he prepared credit proposals by conducting consistent critical analysis on the business, market, country and financial information. Glenn graduated with a Bachelor of Business Management from the University of Queensland with a double major in International Business and Human Resources.

Apr 19th - Things to Know Before the Opening Bell

Apr 19th - Things to Know Before the Opening Bell Trade of the Day - iFAST Corporation Ltd (SGX: AIY)

Trade of the Day - iFAST Corporation Ltd (SGX: AIY) Trade of the Day - Singapore Airlines (SGX: C6L)

Trade of the Day - Singapore Airlines (SGX: C6L) Trade of the Day - COSCO Shipping International (Singapore) Co Ltd (SGX: F83)

Trade of the Day - COSCO Shipping International (Singapore) Co Ltd (SGX: F83)