Silverlake Axis Ltd - Record revenue boosted by new cloud platform

1 Sep 2022- Earnings of RM182mn was above our estimates, at 114% of our FY22e. Variance came from higher-than-expected software licensing and software project services revenue due to two new MOBIUS contracts signed during the year. FY22 DPS was 35% higher YoY at SGD0.7cents.

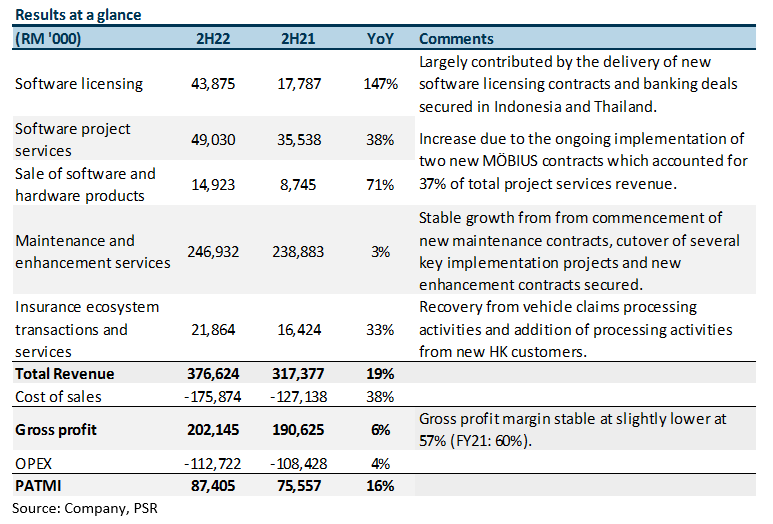

- Project related revenue comprising software licensing and software project services increased by 66% YoY due to the delivery of new software licensing deals in Indonesia and Thailand, and the ongoing implementation of two new MOBIUS contracts.

- Recurring revenue comprising maintenance and enhancement services, insurance ecosystem transactions and services, and retail transactions processing increased by 6% YoY and contributed >70% of total revenue.

- We maintain BUY with a higher target price of S$0.49 (prev. S$0.38). We raised our FY23e PATMI by 18% to RM209mn. The target price is pegged to 20x P/E FY23e. We expect MOBIUS and the recovery in bank IT spending after two cautious pandemic years as key growth drivers for the company.

The Positives

+ Project related revenue increased 66% YoY. Software licensing revenue increased by 110% YoY to RM84mn largely contributed by the delivery of new software licensing contracts and banking deals secured in Indonesia and Thailand. Software project services revenue increased 39% YoY to RM91mn mainly due to the ongoing implementation of two new MOBIUS contracts, which accounted for 37% of total project services revenue. Progressive revenue came from other ongoing projects.

+ Stable recurring revenue growth. Maintenance revenue grew 8% YoY while enhancement services revenue grew 2% YoY. The increase was from the commencement of new maintenance contracts upon completion and cutover of several key implementation projects as well as new enhancement contracts secured from customers. Insurance ecosystem transactions and services revenue also increased by 15% YoY as vehicle claims processing activities recovered. The addition of processing activities from new Hong Kong customers upon completion of system integration also contributed positively.

+ Record order backlog. Silverlake has a long track record and a proven client base in Southeast Asia. Three of the 5 largest Southeast Asian based financial institutions use its core banking platform, and it has largely retained all its clients since bringing them on board its platform. Silverlake’s project pipeline is healthy, at RM1.9bn, with a record-high order backlog of RM570-600mn. Silverlake is beginning to close more deals and is witnessing an uptick in inquiries about its financial services market solutions and capabilities.

The Negatives

– Lower GP margins in FY22. Gross margin was lower in FY22, at 57% compared with 60% in FY21. This was mainly due to higher provisions taken for bonus pay-outs in FY23. Management also said that there was a higher percentage of hardware sales, which usually has a lower GP margin.

About the author

Glenn Thum

Research Analyst

PSR

Glenn covers the Banking and Finance sector. He has had 3 years of experience as a Credit Analyst in a Bank, where he prepared credit proposals by conducting consistent critical analysis on the business, market, country and financial information. Glenn graduated with a Bachelor of Business Management from the University of Queensland with a double major in International Business and Human Resources.

About the author

Glenn Thum

Research Analyst

PSR

Glenn covers the Banking and Finance sector. He has had 3 years of experience as a Credit Analyst in a Bank, where he prepared credit proposals by conducting consistent critical analysis on the business, market, country and financial information. Glenn graduated with a Bachelor of Business Management from the University of Queensland with a double major in International Business and Human Resources.

Trade of the Day - iFAST Corporation Ltd (SGX: AIY)

Trade of the Day - iFAST Corporation Ltd (SGX: AIY) Trade of the Day - Singapore Airlines (SGX: C6L)

Trade of the Day - Singapore Airlines (SGX: C6L) Trade of the Day - COSCO Shipping International (Singapore) Co Ltd (SGX: F83)

Trade of the Day - COSCO Shipping International (Singapore) Co Ltd (SGX: F83) Trade of the Day - Microsoft Corp (NASDAQ: MSFT)

Trade of the Day - Microsoft Corp (NASDAQ: MSFT)