UG Healthcare - Stock Analyst Research

| Target Price* | 0.200 |

| Recommendation | NEUTRAL› NEUTRAL |

| Market Cap* | - |

| Publication Date | 30 Aug 2022 |

*At the time of publication

UG Healthcare Corporation Ltd - Downcycle extended, but valuations attractive

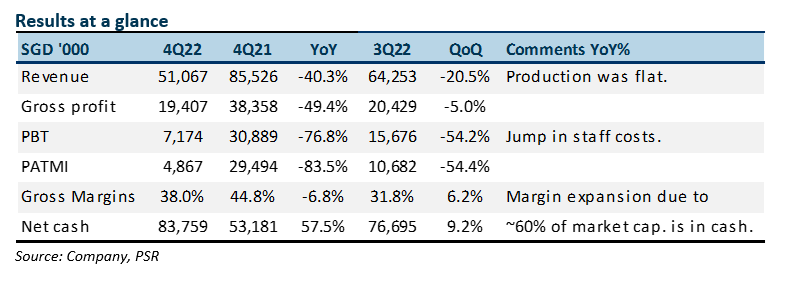

- 4Q22 PATMI was below expectations. FY22 Revenue and PATMI were 103%/93% of our FY22e forecasts. Glove selling prices remain sluggish, still inching lower on a QoQ basis.

- The largest drag in 4Q22 was the higher operating expenses. UG is building up a new sales team in Europe to focus on reusable heavy duty gloves. We expect higher costs in the coming quarters as the company builds a new distribution and brand in the region.

- We cut our FY23e PATMI by 39%. Our expectations are that stable glove prices are unlikely. Competition from China continues to depress nitrile glove prices globally. Demand is also affected by overstocking and slower demand post-pandemic. UG’s strength is the ability to source low-priced gloves from other manufacturers for its trading business. We downgrade our recommendation from BUY to NEUTRAL and lower our target price from S$0.32 to S$0.20. The target price is pegged to a discount to the Big 4 glove makers or 5x FY22e PE. The company is still trading below book value with net cash of S$84mn.

The Positive

+ Expansion in gross margins QoQ. Gross margins in 4Q22 improved on a QoQ basis to 38%. We believe the trading business drove the bounce in margins. The offset was a doubling in minority interest.

The Negative

– Higher operating expenses. There was an estimated 64% YoY (or S$4.8mn) jump rise in operating expenses in 4Q22. We believe that it was due to the additional headcount in Europe to build the reusable non-glove trading operations.

Outlook

Production in 4Q22 was lower due to existing foreign workers returning home after the border reopened in Malaysia. Recruitment of new foreign workers has also turned slower due to additional social and ethical due diligence. The lack of workers has delayed the commencement of the new 1.2bn piece factory. Other challenges include new competition in key market Brazil as registration and market surveillance of gloves was relaxed. UG is looking to build a new business in reusable industrial gloves for the auto, construction and manufacturing industries. There will be an upfront cost to build the distribution and branding of these gloves.

About the author

Paul Chew

Head of Research

Phillip Securities Research Pte Ltd

Paul has 20 years of experience as a fund manager and sell-side analyst. During his time as fund manager, he has managed multiple funds and mandates including capital guaranteed, dividend income, renewable energy, single country and regionally focused funds.

He graduated from Monash University and had completed both his Chartered Financial Analyst and Australian CPA programme.

About the author

Paul Chew

Head of Research

Phillip Securities Research Pte Ltd

Paul has 20 years of experience as a fund manager and sell-side analyst. During his time as fund manager, he has managed multiple funds and mandates including capital guaranteed, dividend income, renewable energy, single country and regionally focused funds.

He graduated from Monash University and had completed both his Chartered Financial Analyst and Australian CPA programme.

Netflix Inc. - Pricing power on display

Netflix Inc. - Pricing power on display Keppel DC REIT - DXC settlement offers partial relief from uncollected rents

Keppel DC REIT - DXC settlement offers partial relief from uncollected rents Apr 19th - Things to Know Before the Opening Bell

Apr 19th - Things to Know Before the Opening Bell Trade of the Day - iFAST Corporation Ltd (SGX: AIY)

Trade of the Day - iFAST Corporation Ltd (SGX: AIY)