UOB - Stock Analyst Research

| Target Price* | SGD 34.9 |

| Recommendation | BUY› BUY |

| Market Cap* | - |

| Publication Date | 26 Feb 2024 |

*At the time of publication

United Overseas Bank Limited – NII hurt by NIM decline and flat loan growth

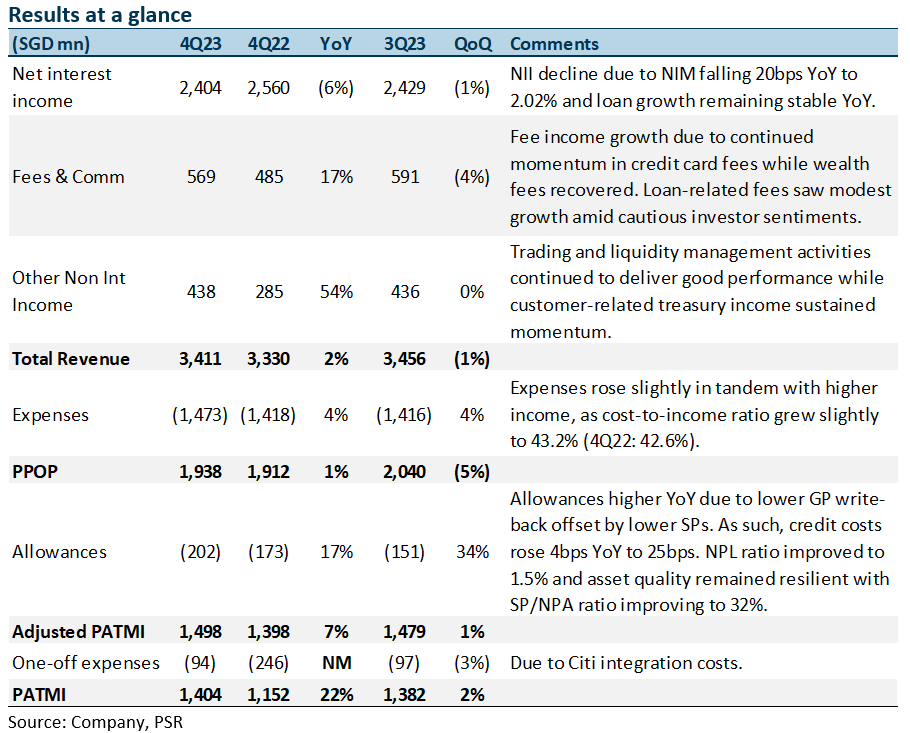

- 4Q23 adjusted earnings of S$1,498mn were slightly above our estimates due to higher fee income and other non-interest income, but offset by lower-than-expected NII and higher allowances. FY23 adjusted PATMI was 102% of our FY23e forecast. 4Q22 DPS was up 13% YoY to 85 cents; the full-year FY23 dividend rose 26% YoY to 170 cents, with the dividend payout ratio stable at 50%.

- Positives include fee income growth of 17% YoY and other non-interest income rising by 54% YoY, while negatives were NII declining by 6% YoY as NIMs fell 20bps and allowances increasing 17% YoY. Management has provided FY24e guidance of low-single-digit loan growth, NIM to sustain at the current level of ~2% as funding costs have stabilised and expectations for rates to maintain till 2H24, double-digit fee income growth from the Citi acquisition, stable cost-to-income ratio of around 41-42% and credit cost to come in at the lower end of 25-30bps.

- Maintain BUY with a lower target price of S$34.90 (prev. S$35.90). We lower FY24e earnings by 9%. Our NII is reduced as we assume softer NIMs and increased allowances, offset by higher fees and other non-interest income. We assume 1.41x FY24e P/BV and ROE estimate of 13.9% in our GGM valuation. FY24 will be another year of growth from stable NIMs, loan recovery, and double-digit fee income growth will boost earnings.

The Positives

+ Fee income continues the strong recovery. Fees grew 17% YoY, largely due to higher credit card fees, which hit a new record of S$125mn (+69% YoY), boosted by higher card spending on an enlarged regional franchise due to the Citi integration. Wealth management fees recovered modestly by 21% YoY, while loan-related fees grew 5% YoY amid cautious investor sentiment. Fee income now makes up 17% of total income (4Q22: 15%). On a full-year basis, fee income rose 4%, driven by record-high credit card fees, underscored by higher customer spending, expanded regional franchise, and higher wealth fees. This was partly offset by softer loan-related fees amid cautious corporate sentiment.

+ Other non-interest income surges YoY. Other NII surged 54% YoY as customer-related treasury income sustained momentum while trading and liquidity management activities continued to deliver good performance. On a full-year basis, other NII spiked 85% to S$2bn from all-time high customer-related treasury income and strong performance from trading and liquidity management activities.

+ New NPAs dipped 2% YoY. New NPA formation fell by 2% YoY to S$389mn as asset quality stabilised during the quarter. The NPL ratio improved by 10bps YoY and QoQ to 1.5%. Asset quality remained resilient, with SP/NPA improving slightly to 32%. 4Q23 NPA coverage is at 101%, and unsecured NPA coverage is at 209%.

The Negatives

– NII declines YoY as NIMs soften. NII dipped 6% YoY from NIM, falling 20bps YoY and 7bps QoQ to 2.02% mainly from loan margin compression due to competition for high-quality credits and loans remaining flat YoY. The decline in loan growth from Singapore was offset by growth in North Asia and the rest of the world. UOB is guiding for a low-single-digit loan growth for FY24e.

– Credit costs increase due to lower GP write-back. Total allowances rose by 17% YoY to S$202mn mainly due to a lower general allowance write-back of S$9mn (4Q22: write-back of S$80mn) despite specific allowance falling by 16% YoY to S$212mn. Credit costs rose by 4bps YoY to 25bps, with full-year FY23 credit costs coming in at UOB’s guidance of 25bps (+5bps YoY). Nonetheless, the total general allowance for loans, including RLARs, was prudently maintained at 0.9% of performing loans. UOB has guided for credit costs to come in at the lower end of 25-30bps for FY24e.

– Expenses up 4% YoY. Excluding one-offs, expenses rose 4% YoY to S$1,473mn. The increase was across the board, including staff costs, revenue-related and IT-related expenses. Nonetheless, the cost-to-income ratio (CIR) was relatively stable and rose 0.6% points YoY to 43.2% on the back of strong income growth, with full-year CIR improving by 1.8% points to 41.5%. UOB has guided CIR to remain stable at around 41% to 42% for FY24e and for the one-time costs from the Citigroup acquisition to roll off substantially.

Outlook

PATMI: We expect UOB’s profits to grow 8% in 2024e on the back of stable margins, loan growth recovery, stronger fees and stable provisions. We expect credit costs to come in around the guidance of 25bps. UOB has guided for loan growth of low single digits and NIM of around 2% for FY24e.

Fee income: UOB expects fee income to continue its recovery and for the growth to be led by credit card fees and wealth and fund management fees as the market sentiment recovers. Wealth management AUM has grown 14% YoY to S$176bn. UOB has successfully integrated their Citi portfolios in Malaysia and Indonesia, with Thailand and Vietnam to be completed by FY24, which could further expand their regional franchise. As such, they have guided for double-digit fee income growth in FY24e, which could add ~S$220mn to revenue.

Loan growth: UOB expects to see demand for loans pick back up with rate cuts expected in 2H24 and is guiding for loans to grow 1-3% in Singapore and 4-5% in the region. However, we expect a slowdown in the first few quarters of FY24 as rates remain high with the recovery to come in 2H24. Management have guided low-single-digit loan growth for FY24e.

About the author

Glenn Thum

Research Analyst

PSR

Glenn covers the Banking and Finance sector. He has had 3 years of experience as a Credit Analyst in a Bank, where he prepared credit proposals by conducting consistent critical analysis on the business, market, country and financial information. Glenn graduated with a Bachelor of Business Management from the University of Queensland with a double major in International Business and Human Resources.

About the author

Glenn Thum

Research Analyst

PSR

Glenn covers the Banking and Finance sector. He has had 3 years of experience as a Credit Analyst in a Bank, where he prepared credit proposals by conducting consistent critical analysis on the business, market, country and financial information. Glenn graduated with a Bachelor of Business Management from the University of Queensland with a double major in International Business and Human Resources.

Trade of the Day - iFAST Corporation Ltd (SGX: AIY)

Trade of the Day - iFAST Corporation Ltd (SGX: AIY) Trade of the Day - Singapore Airlines (SGX: C6L)

Trade of the Day - Singapore Airlines (SGX: C6L) Trade of the Day - COSCO Shipping International (Singapore) Co Ltd (SGX: F83)

Trade of the Day - COSCO Shipping International (Singapore) Co Ltd (SGX: F83) Trade of the Day - Microsoft Corp (NASDAQ: MSFT)

Trade of the Day - Microsoft Corp (NASDAQ: MSFT)