Sea Ltd - Stock Analyst Research

| Target Price* | 70.00 |

| Recommendation | ACCUMULATE› ACCUMULATE |

| Market Cap* | - |

| Publication Date | 8 Mar 2024 |

*At the time of publication

Sea Ltd. - More E-Commerce Growth Ahead

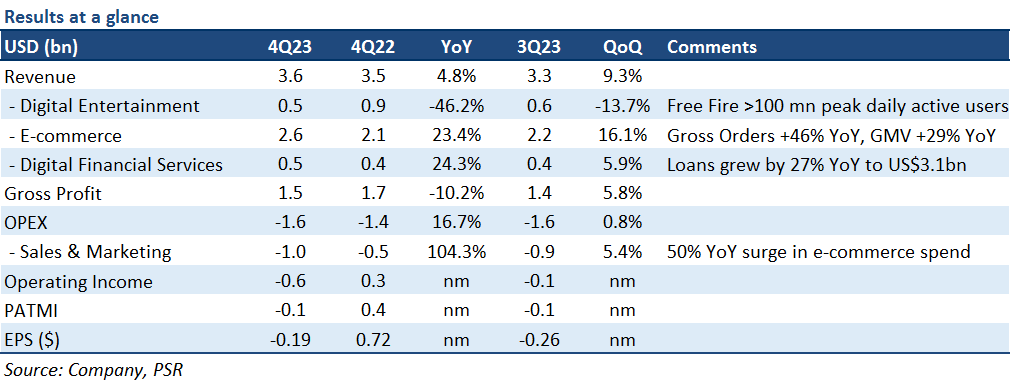

- Both 4Q23 revenue and PATMI were in line with expectations. FY23 revenue was at 98% of our FY23e forecasts, while PATMI was ~US$0.7bn below. Sea has hit its first profitable year since its IPO in 2017.

- Shopee is gaining market share against its competitors, with both GMV and gross orders growing strong (29%/46% YoY), driven by increased investments in the business since 3Q23. Garena is guided to increase by double digits after two years of decline.

- We raised our FY24 revenue growth rate/PATMI by 2%/0.28bn driven by higher e-commerce and gaming growth. We expect FY24 to be profitable given profitability contribution from Garena and Shopee. We roll over an additional year of valuations and downgraded our recommendation from Buy to Accumulate due to a recent share price change. Our DCF target price is raised to US$70 (prev. US$61), with an unchanged WACC/growth rate of 7.6%/3%.

The Positive

+ Investments in Shopee are paying off; gaining market share. Shopee’s strategic pivot to reinvigorate its topline growth through ramped up investment to competed aggressively for market share since July last year has paid off, helping Shopee gain more market share: there was a renewed surge in its GMV and gross orders (29%/46% YoY). Revenue grew 23% YoY in 4Q23. Shopee focuses on the expansion of last-mile delivery facilities and optimising routing, which cuts costs and improves delivery speed. Both market gain and improved logistics signal long-term growth for Shopee.

+ Shopee expected to see high-teens GMV growth in FY24e. Shopee has guided high-teens GMV growth YoY in FY24e as its investment in gaining market share starts to bear fruit. Its new initiative live-streaming e-commerce business continues to gain traction due to its leadership position and economics of scale. It now accounts for 15% of order volume by the end of FY23. SE claims to be making adjustments in take-rates, especially in ads, which has a sizable room to grow compared to global peers. SE has disclosed their confidence of returning Shopee to positive EBITDA in 2H24 even as competition picks up.

+ Gaming guidance is a pleasant surprise. Despite gaming continuing to show a 52% YoY revenue decline, SE has surprisingly guided a positive outlook for Free Fire. Both user base and bookings of SE’s largest and most profitable game are expected to increase by double digits in FY2024, indicating a rebound in gaming earnings after two years of decline.

The Negatives

– Nil.

About the author

Helena Wang

Research Analyst

PSR

Helena covers Hardware/Marketplaces/ETF. Helena graduated with a master degree in Financial Technology from Nanyang Technological University

About the author

Helena Wang

Research Analyst

PSR

Helena covers Hardware/Marketplaces/ETF. Helena graduated with a master degree in Financial Technology from Nanyang Technological University

Apr 19th - Things to Know Before the Opening Bell

Apr 19th - Things to Know Before the Opening Bell Trade of the Day - iFAST Corporation Ltd (SGX: AIY)

Trade of the Day - iFAST Corporation Ltd (SGX: AIY) Trade of the Day - Singapore Airlines (SGX: C6L)

Trade of the Day - Singapore Airlines (SGX: C6L) Trade of the Day - COSCO Shipping International (Singapore) Co Ltd (SGX: F83)

Trade of the Day - COSCO Shipping International (Singapore) Co Ltd (SGX: F83)