Company Overview

AIMS APAC REIT (AAREIT) owns a diversified portfolio of industrial properties across Singapore (~71% of portfolio value) and Australia (~29% of portfolio value). The portfolio is primarily logistics and warehouse assets, complemented by light industrial facilities and business parks, with an essential-use tilt linked to supply chains, data infrastructure, and consumer staples. AAREIT is sponsored by AIMS Financial Group, which holds about 18.66% and is a long-established industrial real estate and fund management platform founded and controlled by George Wang.

1H FY2026 Credit Performance Highlights

AAREIT’s credit strength is anchored by stable, defensive industrial cash flows with good lease visibility. Around 82.5% of GRI is derived from essential and defensive industries, supporting steadier demand through the cycle. Portfolio occupancy is 93.3%, with a WALE of 4.2 years, providing earnings visibility. Cash-flow stability is further supported by contractual rental escalations of about ~2% per annum in Singapore and ~3% per annum in Australia, alongside master-lease exposure of about 42% of assets, which limits leasing volatility.

Operating momentum remains constructive, reinforcing income resilience. In 1H FY2026, the REIT delivered 1.1% YoY growth in NPI and DPU, supported by 7.7% positive rental reversions on renewed Singapore leases and disciplined cost control. This indicates operating cash flows are holding up and remain sufficient to meet interest servicing needs under a base-case scenario.

Balance-sheet risk is moderate with clear near-term refinancing comfort, although coverage remains the main monitoring point. Aggregate leverage is about 35%, comfortably below MAS limits, and there are no debt maturities until FY2027, which reduces near-term refinancing pressure. Liquidity is supported by around S$170mn of cash and undrawn committed facilities, preserving flexibility for capex, market volatility, or selective acquisitions without forcing leverage higher.

Interest-rate risk is partially mitigated with ~70% of debt fixed-rate and a blended cost of debt that has declined to 4.2. Reported ICR remains adequate at around 4.5x when excluding perpetual distributions, although headroom would tighten if interest rates remain elevated for an extended period or if operating income softens. Asset rejuvenation and targeted acquisitions are supportive in the longer term, with ongoing AEIs and sustainability upgrades improving competitiveness, and the proposed Framework Building acquisition, at an indicated 8.1% NPI yield, is expected to be DPU accretive and broadly neutral.

Looking forward, the main sensitivities are the direction of interest coverage if rates remain elevated for longer, and tenant concentration risk under master leases, given the relatively meaningful master-lease exposure. Refinancing execution from FY2027 onward will also be a key focus once the maturity wall comes into view, particularly if funding conditions turn less accommodating.

Credit view: We maintain a constructive view on AAREIT as an industrial REIT credit. Defensive tenant exposure, contractual escalations, and solid lease visibility support recurring cash flows, while moderate leverage and the absence of near-term maturities provide refinancing comfort. Coverage headroom is not wide, so sustained discipline on costs, leasing, and capital allocation will be important. Overall, downside protection remains adequate under a base-case scenario.

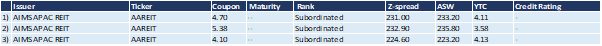

Overview of AIMS APAC REIT’s Outstanding SGD Bonds