Company Overview

Aspial Lifestyle is a consumer lifestyle group operating across Singapore, Malaysia, and Hong Kong, with businesses in jewellery retail, pawnbroking, and secured lending. Key brands include Maxi-Cash, Lee Hwa Jewellery, Goldheart, and Niessing, which was acquired in 2H24 to deepen premium exposure. The group also operates BigFundr, a wholly owned digital secured-lending platform providing short-term collateralised loans. Aspial Lifestyle is about 71% owned by Aspial Corporation, which is controlled by MLHS Holdings, the Koh family’s investment vehicle.

Credit highlights

Aspial Lifestyle benefits from an established brand franchise and a diversified earnings base, though this comes with high capital intensity. The group operates an integrated retail–pawn–lending ecosystem that helps anchor earnings across cycles. Jewellery retail remains the dominant revenue contributor, accounting for approximately 87% of total revenue, while pawnbroking and secured lending provide recurring income backed by pledged collateral. Gold-linked lending offers some counter-cyclical support during weaker consumer periods. That said, significant amounts of cash are tied up in inventory and pawn receivables, limiting cash conversion and increasing reliance on ongoing funding access. This structural dependence heightens refinancing risk, particularly in tighter liquidity environments.

Operating momentum has strengthened materially, improving near-term debt servicing capacity. For 1H 2025, revenue rose 46% YoY to S$367.2mn from S$251.4mn, driven by robust jewellery demand, elevated gold prices and the consolidation of Niessing. Profit before tax more than doubled to S$37.3mn from S$8.0mn in the prior year, reflecting improved operating leverage. The stronger earnings trajectory and brand scale support a more resilient earnings base heading into FY2025.

Funding costs remain manageable. In 1H2025, finance costs declined to S$23.3mn, with interest coverage at around 1.3x. However, leverage remains elevated, with interest-bearing borrowings of approximately S$771mn against cash of S$51mn, constraining financial flexibility despite improved earnings momentum.

Looking ahead, the main watchpoints are the sustainability of consumer-driven demand and continued access to funding. Jewellery demand and pawn activity are sensitive to retail sentiment and gold price dynamics, which can affect both volumes and margins. Separately, the group’s reliance on bank lines and capital markets makes it sensitive to rollover conditions and any tightening in funding availability, especially given the working-capital nature of the business model and modest interest coverage.

Credit view: We maintain a cautious view on Aspial Lifestyle. Profitability has improved, and collateral-backed pawn and secured-lending income provides a stabilising cash base that supports near-term servicing. However, high structural leverage, thin coverage buffers, and constrained free cash flow keep the credit dependent on ongoing funding access, limiting upside until there is clearer evidence of sustained cash conversion and balance-sheet improvement.

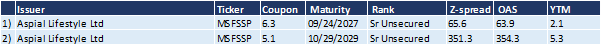

Overview of Aspial Lifestyle’s Outstanding SGD Bonds