Company Overview

CDL Hospitality Trusts (CDLHT) is a Singapore-listed stapled trust comprising CDL Hospitality Real Estate Investment Trust (H-REIT) and CDL Hospitality Business Trust (HBT). The group owns a diversified portfolio of hospitality and living assets across 11 cities in 8 countries, including Singapore, the UK, Japan, Australia, New Zealand, Germany, Italy and the Maldives. As at end-FY2025, CDLHT’s portfolio comprised 22 operating assets with assets under management of ~S$3.5bn. The trust is sponsored by Millennium & Copthorne Hotels Limited, part of the Hong Leong Group controlled by Singaporean businessman Kwek Leng Beng.

FY2025 Credit Performance Highlights

CDLHT’s income profile is largely lease-based, with 81.5% of FY2025 NPI derived from leased assets, which supports earnings stability during periods of operational disruption. On a full-year basis, FY2025 performance remained soft, with reported NPI declining 4.1% YoY, reflecting AEI-related disruption at W Singapore and Grand Millennium Auckland that weighed on earnings for much of the year. Excluding assets undergoing AEI, FY2025 NPI was broadly stable at +0.3% YoY, as stronger contributions from the UK, Australia and Japan were largely offset by normalisation in more volatile markets such as the Maldives, as well as declines in smaller European assets. Importantly, performance improved into 2H25, with total NPI rising 3.5% YoY, and 2H25 NPI increasing 6.3% YoY when excluding AEI assets, pointing to a better earnings run-rate as refurbishment impacts eased. With major AEIs largely completed, management guides for earnings and cash-flow improvement from 2026, supported by asset re-launch effects, higher RevPAR potential and stabilising contributions from UK living assets.

Leverage improved on a year-on-year basis, with gearing declining to 37.7% at end-FY2025 from 40.7% at end-FY2024, reflecting disciplined capital management. Interest coverage remained stable at 2.3x, despite AEI-related earnings disruption. Liquidity strengthened meaningfully, with cash and available facilities increasing to ~S$593.5mn from S$526.0mn, while a 95.7% unencumbered asset base continues to provide flexibility to manage refinancing needs and absorb near-term earnings volatility.

CDLHT has refinanced all 2025 debt maturities, extending debt tenors and lowering borrowing costs. The weighted average debt maturity stands at around 2.6 years, with borrowings skewed toward 3–5-year facilities. A growing proportion of debt is structured as sustainability-linked loans, which are typically lower-cost and more readily extendable, reducing refinancing and liquidity risk. This has smoothed the maturity profile and supports more predictable interest cash outflows as earnings recover.

Looking ahead, growth visibility is supported by the forward purchase of Moxy Singapore Clarke Quay, with TOP expected around end-2026, which does not require near-term capital outlay. Overseas assets provide additional medium-term support: Ibis Perth is seeing earnings normalisation following refurbishment, The Castings is expected to move beyond its initial gestation phase from 2026 and contribute to income ramp-up, while Benson Yard benefits from high committed occupancy under academic-year leases, providing a stable and predictable rental income stream.

Credit View: We hold a positive view on CDL Hospitality Trusts’ credit profile. Credit quality is supported by a high proportion of contracted lease-based income, which provides cash-flow visibility and helped limit earnings volatility through the AEI-impacted FY2025. While full-year FY2025 performance remained soft, leverage improved year on year, and liquidity remains strong, with a largely unencumbered asset base supporting refinancing flexibility.

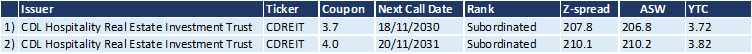

Overview of CDL Hospitality Trusts’ Outstanding SGD Bonds