Company Overview

MoneyMax is a leading pawnbroking and retail-financing group with operations in Singapore (~20% market share) and Malaysia (<10%). Its core segments are pawnbroking, retail & trading (pre-owned jewellery, watches, and luxury goods), and secured lending. The group is majority-owned by Money Farm Pte. Ltd. (~61.2%), which is controlled by the Lim family and holds combined voting control of >70%.

1H25 Credit Performance Highlights

Earnings momentum has been strong, supported by firm gold prices and healthy loan demand. 1H25 revenue rose to S$243.0mn (+31.2% YoY), with PBT at S$40.1mn (+77.6% YoY) and net margin expanding to 13.1% (+3.4ppts YoY). The operating backdrop remains supportive as elevated gold valuations lift collateral pledge values and trading margins, while loan demand stays healthy, together driving both top-line growth and operating leverage.

Balance-sheet metrics and debt service capacity are also improving. Net debt/equity eased to ~2.97x (from ~3.04x in 1H24), while interest coverage improved to 3.39x (from 2.55x). Liquidity is improved with a 1.19x current ratio, and ~14.3% ROE indicates better capital efficiency and profitability, which is important for a secured-lending business where maintaining confidence in funding lines and rollover access matters.

The pawnbook remains a predictable, self-liquidating engine central to the credit story. Management indicates ~90% redemption, keeping collateral loss risk limited and cash conversion relatively stable, given the short duration of pawn loans. Typical pawn yields of ~1.5–2.0%/month in Malaysia and ~1.5%/month in Singapore imply attractive spreads over funding costs, supporting margins even if funding conditions tighten. Inventory growth (+11.6% YoY to S$94.5mn) largely reflects pawnbook expansion and higher transaction volume rather than poorer quality, with unredemption still in the single digits. While working-capital intensity can temporarily tie up cash, liquidity risk of MoneyMax is contained by stable redemption behaviour and diversified funding access. The integrated model also provides “dual-cycle” resilience: pawn and secured lending tend to be countercyclical, while retail trading performs better in upcycles, helping stabilise earnings across economic conditions.

Looking ahead, the main sensitivities are gold-price volatility, which can influence pledge values and resale margins. A sharp rise in funding costs or tightening of liquidity could compress spreads and slow pawnbook growth. Separately, working-capital intensity bears watching; continued inventory build could weigh on near-term cash flow if redemption or turnover slows, even if underlying credit quality remains sound.

Credit view: We maintain a positive stance on MoneyMax credit. The combination of strong earnings momentum, improving coverage, and a high-redemption, secured and self-liquidating loan book supports a resilient profile versus peers. While the business remains exposed to gold-price swings and funding market conditions, current buffers appear adequate, and the operating model should continue to generate stable carry for creditors as long as redemption discipline and funding access are maintained.

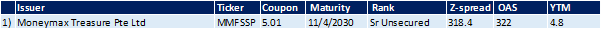

Overview of MoneyMax’s Outstanding SGD Bonds