Company Overview

Perennial Holdings is an integrated real estate and healthcare company headquartered in Singapore, with operations spanning China, Singapore, Malaysia, and Ghana. China remains its core market, supported by healthcare and eldercare platforms concentrated in key cities such as Kunming, Chengdu, Guangzhou, and Xi’an. The group operates under a hybrid model that combines property ownership, development, and healthcare operations. Its shareholder base includes Kuok Khoon Hong (29%), Wilmar International (16%), Hopu Investments (14%), Perpetual Capital (11%), Ron Sim (13%), Bangkok Bank (9%), and Pua Seck Guan (8%).

1H2025 Performance

Perennial’s operating momentum continues to strengthen as its healthcare and eldercare platforms gain scale. Portfolio occupancy has risen to 65% as of YTD 2025 (from 51% in 2022), while mature assets have reached a robust 86% occupancy, underscoring strong utilisation once stabilised. Earnings reflect this ramp-up, with adjusted EBITDA at S$223.6 million in FY2024 and S$13.5 million in 1H2025, marking a solid 65% YoY growth. Importantly, the business has shifted structurally toward recurring income, with over 55% of revenue now driven by healthcare operations. Further scalability is supported by a 4,500-bed brownfield pipeline across Guangzhou, Chengdu, Shanghai, and Hainan (launching 4Q2026–4Q2027) and the upcoming Kunming Medical City in 1Q2026, which will anchor recurring EBITDA growth over the medium term.

Despite improving operations, the credit profile remains constrained by elevated leverage and tight interest coverage. Debt/Total Assets has risen to 0.41× (from 0.38×), while Net Debt/Equity has increased to 0.83× (from 0.71×), reflecting ongoing project investment and slower capital recycling. Though the adjusted ICR of ~1.0× better captures cash-servicing ability compared to the reported 0.15×, both measures highlight thin headroom amid funding- cost volatility. Refinancing execution has been constructive—with ~86% of unsecured facilities rolled over and all secured loans under renewal—but the schedule remains front-loaded, keeping liquidity dependent on timely renewals and selective asset monetisation. A diverse lending syndicate (DBS, UOB, OCBC, Maybank, BBL, SMBC, ICBC, BoC) helps mitigate concentration risk.

Looking ahead, several milestones will be key to shaping Perennial’s credit trajectory. The ramp-up in occupancy and EBITDA following the launch of Kunming Medical City in 1Q2026 will be crucial in lifting the adjusted ICR toward a more sustainable level above 1.5×. Liquidity conditions also hinge on the timely completion of remaining unsecured renewals and the ability to secure longer tenors beyond the typical three-year cycle. In addition, refinancing spreads will need close monitoring, as Perennial’s thin coverage base leaves the credit profile sensitive to funding-cost volatility.

Credit View: Perennial’s credit profile has shown gradual improvement, underpinned by better operating momentum and clearer visibility on recurring healthcare earnings. However, leverage remains high and ICR tight amid a front-loaded refinancing schedule. We stay cautiously constructive, recognising improving fundamentals but noting continued reliance on refinancing and capital recycling.

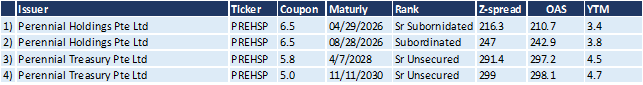

Overview of Perennial Holdings’ Outstanding SGD Bonds