Company Overview

Starhill Global REIT (SGREIT) is a Singapore-listed REIT with ~S$2.8bn AUM, with revenue exposure across Singapore (63%), Australia (20%), and Malaysia (15%). The portfolio is anchored by Orchard Road retail, notably Ngee Ann City (Toshin master lease; 23.8% of GRI) and Wisma Atria, with overseas contributions from Lot 10 / The Starhill (Kuala Lumpur) and Myer Centre Adelaide. Major unitholders include YTL Corporation Berhad and Yeoh Tiong Lay family interests (~38%).

2HFY24/25 Credit Performance Highlights

Financial performance remains steady, reflecting the resilience of the core Singapore retail assets. 2H FY24/25 NPI and revenue were broadly stable, with NPI up +0.8% YoY (or +1.2% excluding divestment effects) and revenue up +1.2%, supported by Singapore retail and Perth contributions. This was partly offset by the Wisma Atria Office divestment, China rental arrears, and FX translation losses, but income available for distribution still rose +3.7% YoY on lower finance costs and tax, supporting cash-flow coverage despite higher operating expenses.

Capital management is conservative and continues to underpin the investment grade profile. Aggregate leverage stands at 36.0%, well below the MAS 50% cap, with a 100% unsecured debt structure, leaving ~85% of assets unencumbered and preserving refinancing flexibility. Funding costs improved to 3.67%, with ~76% of borrowings fixed or hedged, while weighted average debt maturity is 3.1 years and was extended by a S$600mn sustainability-linked club loan (Mar-2025), helping reduce near-term refinancing pressure.

Portfolio cash-flow visibility remains a key differentiator versus retail peers. Portfolio occupancy is 94.6%, dragged by weaker Australian assets, while the Singapore Orchard Road assets remain fully occupied (100%). Importantly, WALE is long at 7.2 years (NLA) and 7.6 years (GRI), anchored by master leases with Toshin, Lot 10, The Starhill, Myer, and David Jones, which contribute ~53% of GRI, providing strong income visibility even when spot market conditions soften. Liquidity is adequate with ~S$84mn in cash and ~S$200mn in undrawn RCF, while the ICR of 2.9x is a modest but workable buffer; net debt/EBITDA is elevated at ~7.5x, but is partially mitigated by the stability of Orchard Road cash flows and the master-lease structure.

Looking ahead, the main watchpoints are coverage and operating leverage rather than balance-sheet leverage. ICR is only modest at 2.9x, so any renewed pressure from funding costs, vacancies (particularly in Australia), or negative reversions could tighten buffers faster than those of larger peers. Separately, the portfolio’s stability is concentrated in a handful of large master leases, so renewal terms and tenant health at key master-lessees (and the ability to sustain performance at non-core overseas assets) will matter for preserving cash-flow visibility.

Credit View: SGREIT retains a stable, defensive BBB profile, anchored by Orchard Road dominance, long WALE, and conservative leverage. The fully unsecured debt structure and meaningful unencumbered asset pool support funding flexibility, keeping refinancing risk manageable. While ICR and net debt/EBITDA are the key constraints, they are currently consistent with an IG REIT profile given the portfolio’s income visibility; maintaining coverage and sustaining performance outside Singapore will be the key to preserving buffers and keeping spreads supported.

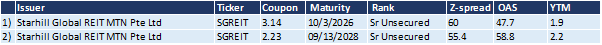

Overview of Starhill Global REIT’s Outstanding SGD Bonds