End of Singapore Swap Offer Rate (SOR)

With the Singapore Dollar Swap Offer Rate (SOR) cessation as of 30 June 2023, a significant shift is underway. All new Singapore dollar bond issuances with reset rates will no longer rely on SOR as a benchmark rate. Instead, they will now be tagged to the Singapore Overnight Rate Average (SORA). This transition is crucial and requires your attention.

Typically, perpetual bonds carry reset dates, reset rates (a benchmark rate and a spread that was determined during the issuance date), and a recallable date. This is, on one hand, to incentivize investors to hold the bond as it becomes more attractive compared to new perpetual issued with higher initial interest rates, while on the other is also an option that is provided for the issuer to adjust its coupon rate based on market condition (attractive for issuer during lower rates period)

Example of a perpetual bond:

Paragon 4.1% Perpetual (aka. SPH 4.1% perpetual previously)

Bond type: Perpetual

Coupon: 4.1%

Reset Rate: 30 Aug 2024 and every 5 years thereafter

Reset Rate: Prevailing SGD 5Y SOR + the Initial Spread (2.517%)

Perpetual bonds may be early redeemed on their reset date. However, if the issuer does not choose to redeem at reset date, the coupon rate for the perpetual bond will be reset based on the pre-determined reset formulas during issuance. This is the usual perpetual bond reset structure, which leads us to the question: What will happen to those perpetual issuances that were previously based on SOR as the benchmark reset rate during the callable period?

The transition for SOR to SORA was overseen by a committee established by the Monetary Authority of Singapore (MAS) called the Steering Committee for SOR & SIBOR Transition to SORA (SC-STS). For past issuances that were previously issued using the legacy SOR rate as a benchmark, issuers can decide not to redeem these bonds during the callable date, but they will have to conduct a consent solicitation with their bondholders to replace the legacy SOR rate with the latest SORA benchmark rate (including a small spread markup = approx. 0.1%). Alternatively, issuers could redeem these outstanding notes and refinance them with newer notes that use SORA as the new benchmark for the replacement.

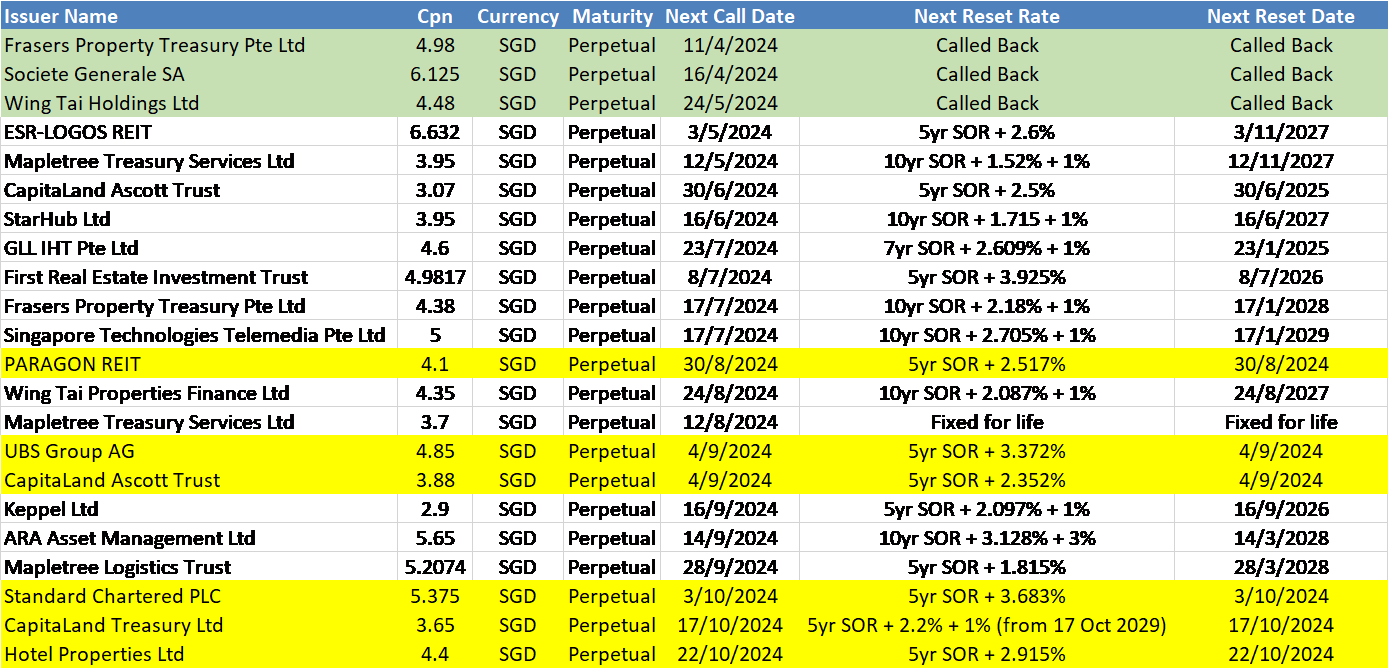

The Association of Banks in Singapore (ABS), who played a key role by working alongside MAS on this transition, noted that during their stakeholder engagement, a handful of issuers in the market have shared that the latter approach would be much preferred than to go through with the consent solicitation approach. There is no explicit mention early redemption will be a guaranteed option taken by the issuers. Given the current high-interest rate environment, it would be an expensive option for issuers to go through with the consent solicitation approach and reset these perpetual bonds with a higher coupon rate. Herewith is a list of perpetual bonds that were using the legacy SOR reset rate as the benchmark. Those that are highlighted in yellow have callable dates in 2024. With the above considerations, there may be a possibility of early redemption for bond holders who are holding these legacy SOR benchmarked perpetual instruments and start planning for reinvestment opportunities ahead.