Company Overview

Wee Hur is a Singapore-based diversified property and construction group with five key pillars: building construction, property development, worker-dormitory operations, Australian PBSA, and fund management/alternative investments. Major shareholders are Goh Yeow Lian & Family (~38%) and GSC Holdings (~6.5%).

1H25 Performance

Wee Hur’s 1H25 results show a credit profile that’s gradually becoming steadier and less reliant on “one big completion” to carry the year. Revenue rose 43% YoY to S$156mn, helped by Bartley Vue progress billings and a S$38mn performance fee from the Fund I sale. The dormitory and fund-management income are making up a larger share of EBITDA, which smooths the earnings base versus a development-heavy model.

That improving earnings mix is now backed by a much more comfortable balance sheet. The S$299.6mn Fund I divestment proceeds lifted cash to ~S$277mn and brought net gearing down to 13%, giving the group room to fund growth without stretching leverage. On top of that, the S$500mn MTN programme provides a ready term-funding channel, enabling co-investments such as PBSA Fund III (Adelaide) and domestic projects to be financed in a more orderly way while maintaining liquidity.

Also, recurring cash flow visibility and near-term earnings coverage are improving. Tuas View remains ~93% occupied, and the ~10.5k-bed Pioneer Lodge, scheduled for a 2H25 launch, lifts total dormitory capacity by ~66% to ~26k beds, supporting more stable EBITDA and interest-service capacity to cushion volatility from construction and development. On the contracting side, construction margins remain structurally thin, but the record ~S$629mn order book as at 1H25, boosted by ~S$439mn of new HDB BTO wins, provides ~2–3 years of revenue runway. Against this backdrop, liquidity looks like a genuine buffer rather than a headline figure: ~S$302mn in working capital and ~S$277mn in cash, alongside ~12.7x interest coverage and diversified banking lines, preserve downside protection and maintain reinvestment flexibility without pressuring key credit ratios.

Looking ahead, the key risks to monitor centre on the durability and quality of Wee Hur’s cash-flow base. First, dormitory lease-renewal risk remains a core sensitivity: renewal terms (tenor, rental step-ups, and operating conditions) and any occupancy slippage would directly affect the stability of recurring EBITDA. Second, property-development earnings are inherently cyclical and timing-driven, given profit contribution can swing meaningfully with project completion schedules, take-up rates, and margin outcomes, keeping cash-flow conversion uneven across cycles. Finally, Australian PBSA exposure introduces valuation and funding risk, as softer cap-rate conditions or tighter financing markets could pressure asset values and reduce flexibility around monetisation, refinancing, or new fund formation, raising the probability of earnings volatility and more cautious capital deployment.

Credit View: We are positive on Wee Hur’s credit, supported by an asset-backed balance sheet, low leverage, and a strengthening mix of recurring income. The group’s deleveraged position and growing rental/fee income anchor resilience, while construction and development earnings remain cyclical but are moderated by strong liquidity, prudent leverage management, and an evolving shift toward a more capital-efficient, fund-management-led model.

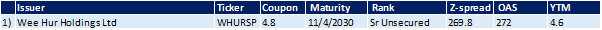

Overview of Wee Hur’s Outstanding SGD Bonds