$0 Commission and No Finance Charge

Competitive Spreads

Free Account Opening and No Maintenance Fees

Authorised and regulated by Monetary Authority of Singapore (MAS)

Round-the-clock Trade Support

Why Trade CFDs with Us

Competitive Spreads from as low as 0.3 pips

The spread in forex represents the small transactional cost to enter and exit the trade. As you would buy at the Ask price and sell at the Bid price of the currency pair, the difference between these buy and sell prices, known as spread or Bid-Ask spread.

Kickstart Your

Forex CFD Journey,

Open a POEMS

Account now

Webinars

Hang on tight, more exciting events are coming up!

Videos

View All

Articles

View All

FAQs

Forex (FX) or foreign exchange trading is the exchange of one currency for another. Investors aim to profit from changes in the relative strength of the two currencies. Forex is usually traded in pairs, when you buy one currency, you are simultaneously selling another.

You can trade Forex using CFDs on the POEMS or POEMS CFD MT5 platforms, with access up to 39 of the most traded currency pairs.

The main aim of forex trading is to predict if the value of one currency will increase or decrease relative to another. Forex trading is carried out for 2 primary reasons, for speculative or hedging purposes.

Speculation involves trying to make a profit from a price change, whereas hedging attempts to reduce the amount of risk, or volatility, associated with another underlying security’s price change.

Each of the world’s currencies has a three-letter code. These are similar to the symbols used on stock exchanges to identify a particular company. The most-traded currency worldwide is the US dollar, which has the ticker USD. The second most popular is the Euro (EUR), followed by the Japanese Yen (JPY), the British pound (GBP), the Australian dollar (AUD), Canadian (CAD), Swiss franc (CHF) and the New Zealand dollar (NZD). There are more than 170 currencies in all worldwide. In forex, currencies are always traded as ‘currency pairs’. This is because when you buy one currency, you simultaneously sell the others. The following currency pairs are known as the ‘majors’ and account for about three-quarters of all trading in the forex market: EUR / USD, USD/JPY, GBP/USD, AUD/USD, USD/CAD, USD/CHF, NZD/USD.

Contract Name or Symbol

Forex currencies are always quoted in a 3 letter code

USD:US Dollar

GBP:British Pound

CHF:Swiss Franc

AUD:Australian Dollar

CAD/CAN:Canadian Dollar

EUR:EURO

JPY:Japanese Yan

NZD:New Zealand Dollar

Each currency pair comprises of two elements. The first is the ‘base currency’. When listed in a trading quote, this part is always equal to 1. The second element is the ‘quote currency’, also known as the ‘term currency’. For example, consider the currency pair EUR/USD = 1.0750. The base currency is EURO (EUR) and the quote currency is US dollar (USD). The pairing means that €1 is worth US$ 1.0750.

When we buy or sell, we are referring to the base currency. An opposite transaction takes places in the quote currency. For example, if we buy EUR/USD, we are buying the EUR, and selling the USD. The quote currency is also known as the term currency because the transactions is done in terms of that currency, since the base currency is always equal to 1. Therefore, the profit or loss of the transaction will be in terms of the quote currency.

For the example of EUR/USD = 1.0750 this means that € 1.00 can be exchanged for US$ 1.0750. Here is another example, for USD/JPY = 140.35, this means that US$ 1.00 can be exchanged for ¥140.35. Pip (“Percentage in Point” or “Price Interest Point”) represents the smalles price variation that a particular exchange rate experiences based on typical FX market convention. For currencies like EUR/USD that have 4 decimal places, a pip refers to a 0.0001 movement. For currencies like USD/JPY that have 2 decimal places, a pip refers to a 0.01 movement. As technology advances and price quotes becomes more competitive, you would often see FX prices quoted in a fraction of 1 pip (i.e. 0.1 pip). So for example. EUR/ USD would be quoted down to the 5th decimal place

The term “bid” refers to the highest price a buyer will pay to buy the base currency in terms of the quote currency at any given time. The term “ask”, also known as “offer” price, refers to the lowest price at which a seller will sell the base currency in terms of the quote currency.

The bid-ask spread is the difference between the bid price and the ask price for a given trading instrument. The bid price represents the highest price a buyer is willing to pay for the instrument, while the ask price represents the lowest price a seller is willing to accept. There are many ways an investor can interpret what bid-ask spread represents for the instrument, including:

- Barometer of Liquidity

- Trading Risk

- Guide to Type of Order to be placed

- Momentum of the market

Bid-Ask spread primarily represents transactional cost to an investor. That is because when you enter a trade, eventually you will need to exit the trade. The turnaround costs to an investor would therefore be buying at the Ask price (where a seller is willing to sell), and selling at the Bid price (where a buyer is willing to buy), even without any changes to the asset’s price. Just on this transactional operation, the investor would have incurred a cost based on how wide the bid-ask spread is. Bid-Ask spread is therefore important as an investor would not want high trading cost eroding profits gained.

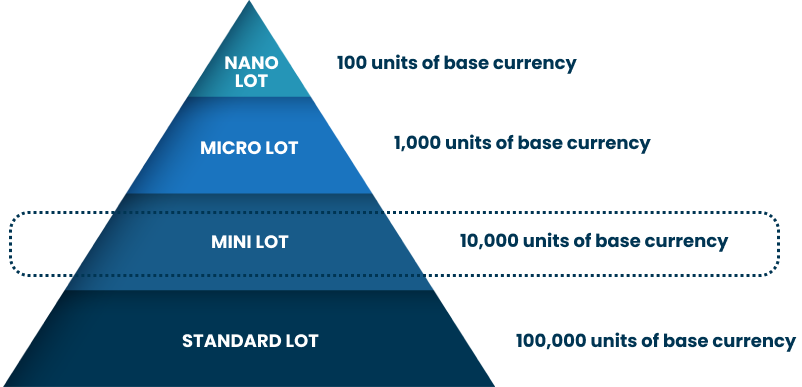

Forex is commonly traded in specific amounts called lots, or basically the number of ‘base’ currency units you will buy or sell.

A standard lot represents 100,000 units of the base currency, whereas a mini-lot represents 10,000 and micro-lot represents 1,000 units of the base currency. We offer FX CFD in mini-lots, that is, 1 lot on POEMS or MT5 represents 10,000 units of the base currency. When you place orders on your trading platform, orders are placed in sizes quoted in mini-lots. This is to cater flexibility to both experienced and new traders to FX CFDs.

The forex market is primarily driven by overarching macroeconomic factors that impact the value and strength of a nation’s currency. The economic health of a nation’s economy is a primary factor in the exchange rate of its currency. Overall economic health can change quickly based on current events and new information

Regulations do exist to protect retail forex traders. These rules help keep online forex brokers honest and protect unsuspecting traders from the risk of dealing with an unregulated broker. The Monetary Authority of Singapore (MAS) is responsible for regulating and supervising the activities of forex brokers in Singapore. The MAS has made it compulsory for forex brokers to obtain a valid MAS license to be able to operate in Singapore. MAS regulated brokers adhere to regulatory safeguards such as disclosure requirements on investment products that are offered to consumers. Regulated platforms are also subjected to conduct rules, to ensure that they deal fairly with their customers. Such safeguards protect investors’ monies and assets when they are dealing with financial institutions.

Glossary

A global market which exists for the effective movement of capital (cash/money) from one destination to another. Also referred to as Forex, FX and currency market, the foreign exchange market facilitates the trading of currencies.

The difference between the buying price selling price of a currency pair. A high spread means a big difference between the bid and ask price. The spread is measured in ‘pips‘.

A pip in forex is usually a one-digit movement in the fourth decimal place of a currency pair. So if EUR/ USD moves from 1.0730 to 1.0731, then it has moved by a single pip. A price movement at the fifth decimal place in Forex trading is known as a ’pipette’, or ‘fractional pip’. A key exception to the pip rule is when the Japanese yen is the quote currency. In this case, a pip is a calculated as a one – digit move in the second number after the decimal point. If USD/JPY alters from 140.20 to 140.21, this is a 1-pip move.

Leverage allows you to trade without paying the entire value of your position in advance. Rather, you are only required to provide a deposit known as your margin.

The deposit required to use leverage with your trades.

“One-Cancels-the-Other(OCO)” is a combination of a stop loss order and a take profit order. When one of these two orders is executed, the other order is automatically canceled.

“Good-Till-Cancelled (GTC)” order will be left in the market at a set rate until executed or cancelled by you.

Important Notice

CFDs may not be suitable for customer whose risk tolerance is low. Customers are advised to understand the nature and risks involved in margin trading. Any CFD offered is not approved or endorsed by the issuer or originator of the underlying security the issuer or originator is not privy to the CFD contract. Phillip Securities Pte Ltd reserves the right to amend the published information without prior notice. You are advised to read carefully and understand the Risk Disclosure Statement and CFD Risk Fact Sheet before undertaking transactions in CFDs. As CFD is a Specified Investment Product (SIP), retail customers are subject to the relevant assessment for trading/investing in SIPs. This advertisement has not been reviewed by the Monetary Authority of Singapore.

Copyright © 2025. Brought to you by Phillip Securities Pte Ltd (A member of PhillipCapital) Co. Reg. No. 197501035Z. All Rights Reserved.

The following are all the terms & conditions that you must read, understand and agree to when trading CFDs with us.

EUR/USD

EUR/USD

GBP/USD

GBP/USD

AUD/USD

AUD/USD  NZD/USD

NZD/USD