To aid in your investment journey, we are giving you complimentary LIVE price quotes for the following markets:

Complimentary LIVE price quotes

Hong Kong

HKEX

United States

NASDAQ1

NYSE1

AMEX1

US Options1

US Asian Hours

Singapore

SGX2

Thailand

SET1

Malaysia

BURSA1

1. Complimentary live price is available exclusively to Non-professionals, with a subscription required.

2. Access to Free SGX Market Depth requires a one-time opt-in. More information can be found here.

How to subscribe?

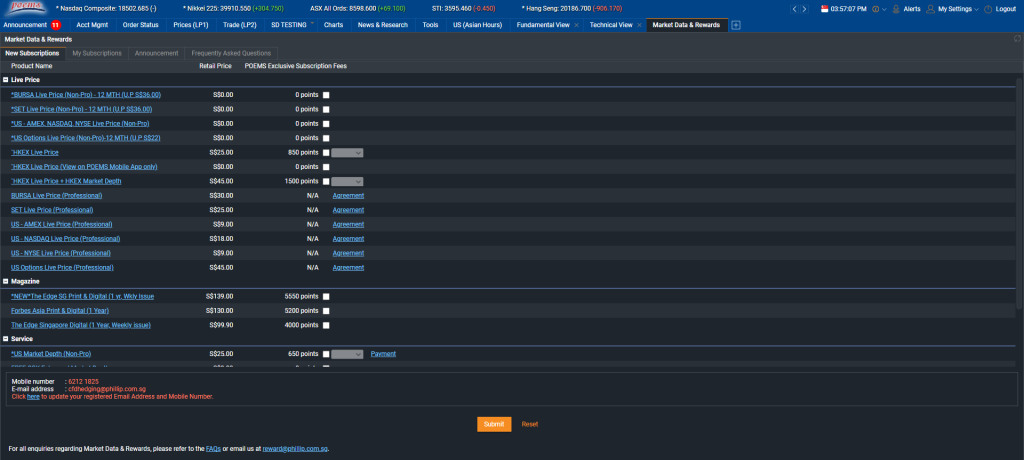

For POEMS 2.0

- Log in to POEMS 2.0 by clicking the below “Subscribe Now” button

- Tick the box of the Live Price that you wish to subscribe to

- Complete the subscriber agreement and submit

- Select the number of months from the drop down list (if applicable)

- Click ‘Submit’

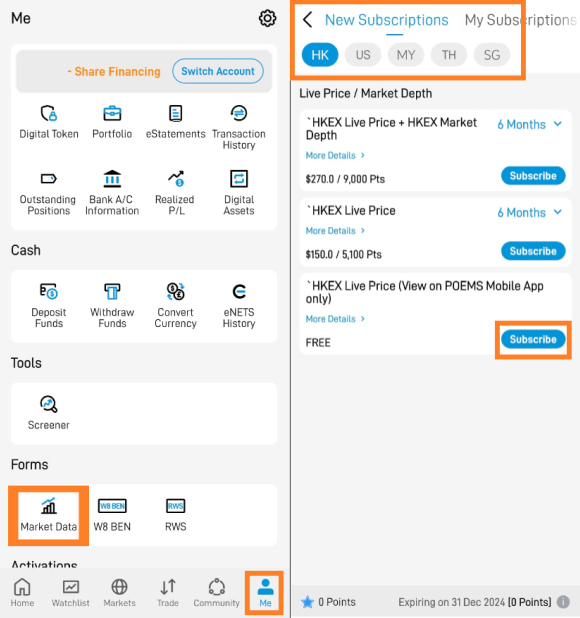

- Login to POEMS Mobile 3 App > “Me” tab > “Market Data” > “New Subscription”

- Click on “Subscribe” to submit the request

- Live Price is applicable to new and existing Customers of Phillip Securities Pte Ltd (PSPL).

- Live Price is open to individuals who qualify as non-professional. Individuals have to meet all the following criteria to be considered non-professional:

- An individual who is registered and paying in his personal name or capacity

- An individual who uses the Subscriber’s Service for the purpose of managing his personal funds; and

- Does not distribute or provide Market Information from the Subscriber’s Service to any third party in any manner

- Individuals who meet any one of the following criteria are deemed as professional investors and do not qualify for this promotion:

- Registered and paying under a corporate name, association or any legal entity registered with the Registrar of Companies; or

- A individual who uses the Subscriber’s Service in his capacity as an investment advisor or fund manager of funds which do not belong to him.

- Subscribers must subscribe on POEMS 2.0 or POEMS Mobile 3 App and agree to the agreements set out in the subscription page to enjoy this promotion.

- A subscriber, who falsely declares to be Non-Professional but is a Professional, will be held accountable for all applicable penalties and/or Exchange fees.

- The promotion is valid from now on till 30 June 2026. Customers who wish to renew or extend the subscription after 30 June 2026 may subscribe for the chargeable subscription and pay accordingly prior to activation of the service.

- PSPL staff and agents, and PSPL cross-border clients are not eligible for this promotion

- PSPL account application Terms & Conditions apply.

- The management reserves the right to make changes to the Terms and Conditions of this promotion without prior notice.