Phillip@Work

Phillip@Work

Phillip@Work is a program specifically designed for participating company partners and employees. With our wide array of products and services and dedicated team of financial professionals, we serve to enable you to make informed decision in your financial planning and investment at the convenience of your workplace.

Who is it for?

For Employers

- Complement your existing employee benefit schemes with Phillip@Work through financial knowledge and investing platforms

- Engage your employees while we organize financial seminars and events at your office premises

- Appoint our dedicated team of specialists to handle your company’s Employee Share Options Scheme (ESOS)*

For Employees

- Enjoy free financial talks and events at your office premises

- Receive ongoing support and guidance on your investments

- Enjoy special promotions or rebates when you sign up on the spot

- Access to our award-winning trading platforms and educational resources

What is in it for you?

1. Ongoing Assistance from Financial Professionals

Dedicated Relationship Manager and support teams will provide personalized guidance for your investment and planning needs through PhillipCapital. While you are busy with your work and daily life, we also have professional Portfolio Managers who can actively manage your personal securities portfolio.

2. Suite of Products & Services

With our range of quality and innovative financial products and services, we offer you a variety of options in Investments, savings, protection, financial education and financing.

- Stocks & Shares

- Regular Savings Plan

- Unit Trust Advisory

- Insurance Planning

- Bonds Advisory

- Managed Account Services

- Employee Shares Option Scheme

3. Financial Education

With an array of financial topics conducted by product specialists and market experts, you can be equipped with basic to advanced investing knowledge and trading techniques. Find any interesting seminar topic? We can bring speakers experienced and well-versed to your workplace.

In addition, you can enjoy priority invitation to our investment seminars that are regularly conducted at our Phillip Investor Centres to help you make better financial decisions.

Register for a variety of seminars conducted at Phillip Investor Centres here.

4. Privileges

Enjoy exclusive privileges such as preferential rates when you sign up for our suite of products and services. We also run thematic promotions on selected products, including Unit Trust, Insurance, and Managed Account Services that are only applicable to Phillip@Work employees.

| Brokerage | Enjoy promotional rates of 0.12% or min. S$10 when you trade in selected Markets |

|---|---|

| Share Builders Plan | Enjoy up to S$36 SBP credit rebates when you subscribe SBP/ Junior SBP |

| Unit Trusts | Entitled to 0% sales charge for all online trades |

| Managed Account Services | Receive S$15 shopping vouchers for every multiple of S$10,000 |

| Life Insurance | Receive up to S$80 shopping vouchers when you purchase any insurance plan |

5. Convenience – Just Within Your Neighborhood

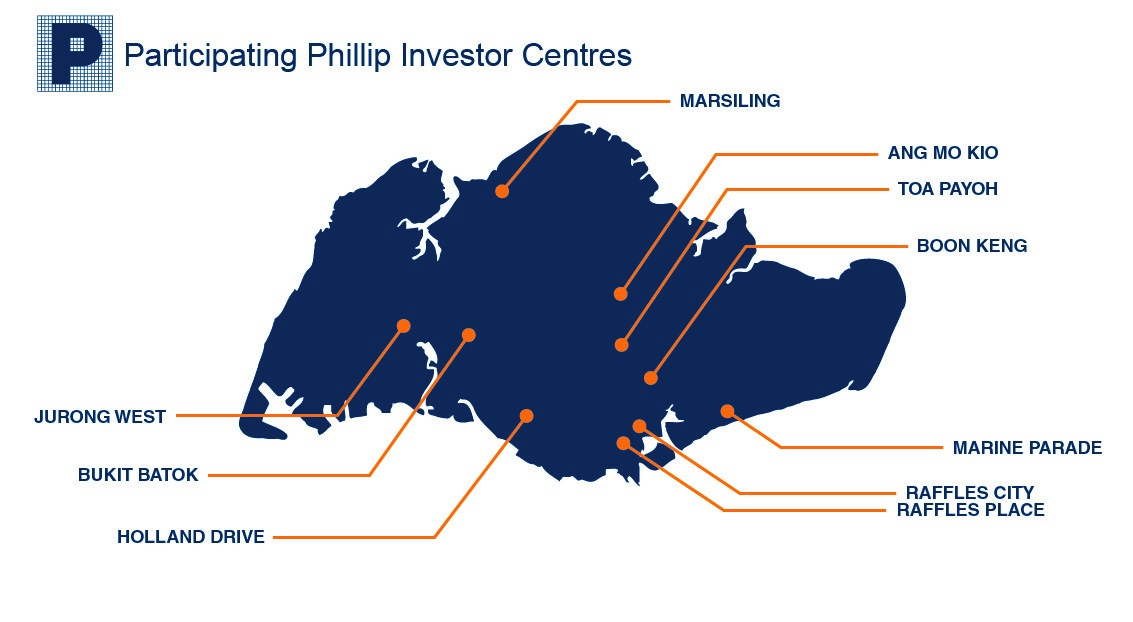

With 11 Phillip Investor Centres strategically located around Singapore, we bring financial expertise to your doorstep whether you are in the office or at home. Visit us at our Phillip Investor Centre, where we conduct monthly complimentary financial seminars for the public. Our friendly Consultants and Dealers will be happy to offer holistic advice on your financial portfolio while you are there.

Contact Us

Like what you read? Call us at 6531 1551 or email us at phillipatwork@phillip.com.sg today to partner with us through Phillip@Work.