您想知道的中国A股ETF一览

7月大翻身,中国A股市场火爆非常,A股上市ETF交易额涨超80%

7月以来A股市场火爆非常,转融通取消保证金提取比例限制等利好消息刺激A股市场交易量连续9个交易日超万亿,A股大涨。截至7月21日,上证指数累计上涨超11%,深证成指累计上涨超12%。

同期ETF市场同样火热,7月首周A股ETF无一下跌,总成交额为2575.39亿元,较此前一周增加了1183.2亿元,增幅达到85%。

整体来看,A股ETF份额增加120.59亿份,以区间成交均价估算,资金净流入约308.09亿元,扭转了4月以来的整体净流出态势。

国际投资者投资中国A股热情高涨:

7月首周,国际投资者在A股涨势吸引下涌入投资中国的交易所交易基金(ETF)。

截至7月10日当周,在美国上市、投资中国股票和债券的ETF获得6.81亿美元资金流入,占流入新兴市场的11亿美元的大部分。根据彭博汇总数据,这扭转了前一周新兴市场ETF资金流出8.058亿美元的局面。今年迄今资金累计流出172亿美元。

来源:Bloomberg

其中,3.65亿美元的Xtrackers Harvest沪深300中国A股ETF(ASHR)流入19亿美元,领先其它中国ETF,并在上周上涨10.6%,为2015年以来最大涨幅。iShares安硕MSCI中国ETF和iShares安硕中国大盘ETF也吸引到新的资金流入。

新加坡投资者如何选择,投资中国A股ETF:

尽管新加坡投资者无法直接投资在沪深两市上市的A股ETF,但是可以选择在香港或美国上市的ETF,目前投资者可以选择跟踪A股相关指数的ETF,或者相关产业的主题ETF。

这里我们将为您介绍相关A股的指数:

富时A50指数: 最能代表中国A股市场的指数

指数包含了中国A股市场市值最大的50家公司,其总市值占A股总市值的33%,是最能代表中国A股市场的指数,许多国际投资者把这一指数看作是衡量中国市场的精确指标。包括了中国联通、招商银行、中石化、宝钢、深圳发展银行、长江电力、上海汽车等大盘股。

沪深300指数:300只优质中国A股组合

指数是由上海和深圳证券市场中选取300支市值大,流通性好的A股以自由流通股本市值加权的方式,由中证指数有限公司编制并发布的成份股指数。权重前3名的股票分别是浦发银行,首创股份,和上海机场。

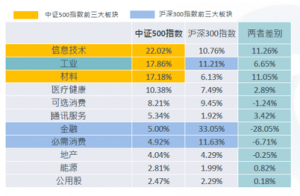

中证500指数:反映中小市值股票的整体表现,侧重在科技板块

指数的样本空间内股票是由全部A股中剔除沪深300指数成份股及总市值排名前300名的股票后,总市值排名靠前的500只股票组成,综合反映中国A股市场中一批中小市值公司的股票价格表现。

中证500指数相比于沪深 300 指数板块分比更加均匀,沪深300指数有 1/3 的权重在金融板块,中证 500 则更偏向于以私企为主的信息技术行业(占比超22%)。

以下是在香港上市的追踪中国A股相关指数的ETF:

近期,A股走势反复,同期香港市场与中国A股高度联动,尤其是以在港上市的中国企业为代表的中国企业指数指数走势。

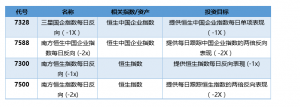

这里为大家总结了相关的杠杆及反向产品,希望能助大家在投资A股和港股的过程中乘风破浪。港交所上市的A股相关的反向及杠杆产品,通常追踪恒生中国企业指数的日表现。

恒生中国企业指数:指数反映了在香港交易所上市的中国企业中较大型股的表现,与恒生指数不同,国企指数成份股的数目并没有限制,但必须为市值最大,且在恒生综合指数成份股内的H股。

另外需要提醒广大投资者的是,杠杆和反向ETFS更复杂,风险更大。主要是为满足短期交易需求而设计的,并非旨在用于购买和持有。适合那些有市场观点要表达的资深战术交易者。 若您想要了解更对关于杠杆以及反向ETF的相关知识,请参看我们之前的文章《杠杆以及反向ETF 101》:https://www.poems.com.sg/market-journal/leveraged-and-inverse-etfs-101/

来源:CSOP

上证指数改制完成,预测A股流量将显著增加

修订后的上证综合指数编制方案于7月22日正式实施,上证综指迎来“新生”。改制内容包括纳入科创板股和中概股,剔除特别处理(ST)股票等。随着上证指数改制加入科创板和中概股,上证指数更加能反映中国的基本面以及新经济走向。随着科创板加入上证指数,相关科创板基金通过审核,未来将会有更稳定,多元的资金流入A股市场。

如果想要交易暗盘,请随时联系我们

邮箱地址:gmd_china@phillip.com.sg

官方微信公众号:SGPSPL

(1)www.view.jin10.com/news20200614192237031100.html

如果有想了解更多全球股市资讯,请关注微信公众号 “辉立资本新加坡” (SGPSPL)。同时提供在线免费开设股票账户,一个账户轻松交易全球股票和ETF

美股,港股,新加坡股,中国A股,越南股票,韩国股票,德国股票,马来西亚股票,泰国股票,印尼股票,菲律宾股票,日本股票,澳大利亚股票,台湾股票,加拿大股票,英国股票,法国股票,荷兰股票,葡萄牙股票,比利时股票,土耳其股票

如果本文是英文翻译版本,一切请以英文为准