港股研报 | 吉利汽车 (175.HK) – 毛利水准有望随着月销过万车型增多更上台阶

投资概要

我们认为吉利汽车将继续受益于成功的战略带来的红利,未来公司在外延跨越式发展、出口市场方面看点多多,管理层几次大笔增持显示强烈信心。估值上,我们上调盈利预测,并调整目标价至36港元,对应2018/2019年18/13倍预计市盈率,上调至买入评级。(现价截至5月16日)

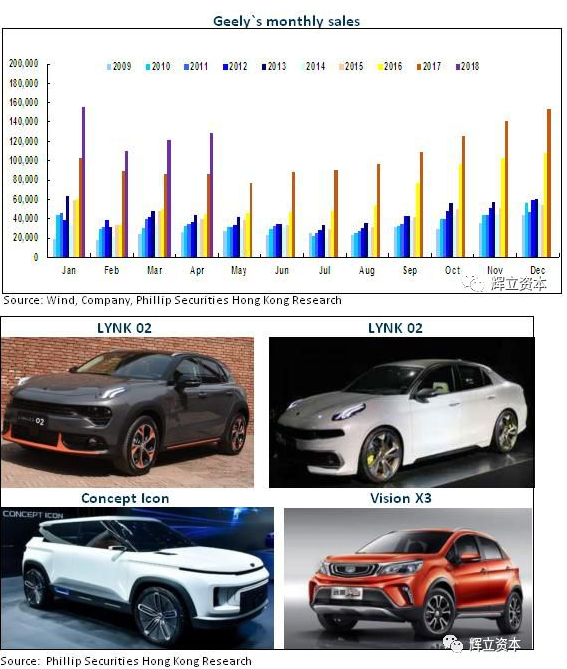

四月销量强势依旧

吉利汽车4 月份总销量为128,817辆,同比劲升+49%,环比增长+6%,远高于行业平均的+9.6%。其中中国市场销量与出口量分别增47%与187%。2018 年首4月累计总销量为51.5 万辆,同比增长41%,达致全年销量目标(158万辆)的33%。

毛利水准有望随着月销过万车型增加更上台阶

2017年吉利共有四款车月均销量过万,两款车月均销量过两万,进入2018年以来,原有强势车型热度不减,新推车型稳步爬坡,预计今年月销过万车型将增加到5-6款,过两万车型有望增加到3款。帝豪月均销量2.2万左右,博越月均销量接近2.4万,GS和GL均录得强劲增幅,远景X3推出后迅速上量,目前月销已经过万,唯一欠缺之处在于高端轿车博瑞有所下滑。我们预计,由于销售增量基本由新车型贡献,吉利汽车的平均单价将保持稳中小升,但毛利率水准有望随着热卖车型增多而更上台阶。

2017年净利翻番

2017年公司的财务成果好于市场一致及我们的预期,净利润连续第二年实现翻番(+108%),达到106亿元人民币,每股摊薄收益1.16元,派股息0.29港元,派息率20%。总收入增长73%,达到929.6亿元,总销量录得1247116辆,同比增长63%。

净利增速高于收入增速反映公司盈利能力得到加强,收入增速高于销量增速显现公司平均单车售价提高。毛利率升1.1个百分点至19.4%,净利率上升2个百分点至11.5%,单车售价7.35万元,提高了7%。三项费用率分别降低0.3,1.6,0.9个百分点,规模效益明显。公司提前赎回3亿美元5.25%的优先票据,发行3亿美元3.625%的债券,有望为公司节省6千多万利息支出。

新车上市力度不减

公司的新车上市力度不减,2018/2019年仍将是吉利的产品大年。除了现有车型的升级版将依次陆续推出,全新车型计画中,2018年吉利将推出不少于8款全新车型,包括领克02和03,2款新能源车,2款轿车,2款SUV,和一款MPV车型。2019年也将推出不少于5-6款的全新车型,进一步丰富其产品组合。

2017年底,公司经销商数目达到962家,其中领克品牌82家,2018年领克品牌的网路将扩充到200-300家左右。公司第二发动机厂年底投产,与爱信合资成立变速箱工厂将确保供应,领克产能将逐步释放,为未来销量突破提供弹性空间。

投资建议

估值上,我们上调盈利预测,并调整目标价至36港元,对应2018/2019年18/13倍预计市盈率,上调至买入评级。(现价截至5月16日)

风险

经济弱于预期影响购车需求,

所推新车受市场欢迎程度低于预期,

车市价格战,

海外市场风险。

关键字:新加坡股票研报,新加坡股,新加坡研报,宇通客车 (600066.CH),新加坡账户,交易新加坡股票,新加坡股票开户,免费开户,在线开设新加坡股票开户,新加坡证券,新加坡券商,投资组合,吉利汽车 (175.HK)