美股研报 |Facebook (脸书)

Facebook (脸书)

Facebook Inc. (纳斯达克股票代码:FB)致力于打造使大众通过移动设备、个人计算机和其他平板电脑进行互联分享的产品。公司产品包括Facebook、Instagram、Messenger、WhatsApp 和Oculus。公司还从事向营销人员出售广告位。其广告投放可使营销人员根据年龄、性能、位置、兴趣和行为等一系列因素接触大众。营销人员购买的广告位可出现在多个平台,如Facebook、Instagram 和第三方应用程序及网站。

资料来源:汤森路透

公司要闻

98%以上的FB 营收来自广告。

FB 营收增长速度连续5 年超过50%。

在全球互联网广告营收中, Facebook 占有25.7%的市场份额, 仅次于Google。

Facebook 拥有14 亿的每日活跃用户和21.3 亿的每月活跃用户

投资策略

FB 的股价继Cambridge Analytica 丑闻后急剧下跌,该丑闻揭露这家政治分析公司能够在未经Facebook 用户允许的情况下访问5 千多万份Facebook 的个人档案。该新闻发布后,FB 的股价从高峰跌落了近20%。我们认为,虽然这则新闻看起来很糟糕,但对FB 内在价值的影响和损害被夸大了,当前情况是买入这家社交媒体巨头的机会。

买入FB 的理由

近期股价走势:发布最新盈利公告后,FB 股价上升到近193 美元的高峰。虽然该公司发布的结果好于预期,但其发布的一组数据显示平台上的用户使用时间有所下跌。该公司正从Cambridge Analytica 丑闻中恢复过来,这次事件造成公司股价下跌到151 美元的低点,但最近回升到159.79 美元左右。

大规模用户基础:FB 在最新盈利公告中报告,上个季度的每日活跃用户总计约14 亿,每月活跃用户21.3 亿。更重要的是,FB 显示其完全有能力利用这一用户群获取盈利。FB 能够通过对其用户群投放广告产生399.4 亿美元的营收。

根据FB 的数据,其美国和加拿大用户达1.84 亿,欧洲用户2.77 亿,亚太地区用户4.99 亿,其他地区4.41 亿。营收方面,来自美国用户的人均营收为26.26 美元,欧洲用户、亚太地区用户和其他地区用户的人均营收分别为8.71 美元、2.52美元和1.85 美元。

随着其余新兴市场变得更加富裕,各公司也开始花费更多成本对这些市场投放广告,我们认为FB 拥有巨大潜力从全球其他市场的用户处进一步获益。

数字广告增长:2017 年数字广告最终超过了传统电视广告费用,全球数据广告费达2090 亿美元(占所有媒体广告费的41%),而电视广告费仅为1780 亿美元(占所有媒体广告费的35%)。FB 在过去几年继续扩大其市场占有率,从2015年的17%,到2016 年的20%,再到2017 年的25.70%。数字广告费预计将持续高水平增长,估计2021 年达到3758 亿美元左右。假设FB 能够维持25.7%的市场占有率,则其2021 年的营收将达到965.8 亿美元,4 年复合年增长率约为24%。这虽然低于FB 过去5 年的复合年增长率52%,但依然是较高的增长速度,而且随着营收基础的扩大,这种高复合年增长率很难长时间维持。

估价:FB 以159.79 美元收盘,市盈率为18.95。FB 的4 年平均市盈率为53.64。FB 在2017 年的总营收为406.5 亿美

元,近5 年间,其营收增长率约为每年50.75%。FB 在2017 财年产生的自由现金流为174.83 亿美元,并保证自由现金

流的持续增长,其2016 财年为116.2 美元,2015 财年为78 亿美元。FB 能够保持较低的运营支出,因此2017 财年的毛

利率达到惊人的87.58%,而2016 财年为86.29%,2015 财年为84.01%。其净利率也很惊人,2017 财年为39.20%,而2016 财年为36.97%,2015 财年为20.57%。鉴于FB 的增长前景和可观的财务状况,我们认为FB 的当前股价被低估。

Cambridge Analytica:我们认为Cambridge Analytica 调查的影响被夸大了,该丑闻的潜在影响似乎有限。历史上,发生严重数据泄露的公司并不会遭受永久损害。2017 年,Equifax 有1.45 亿人的资料被窃,其股价受到重挫,从142 美元跌落到92 美元的低点。此后,其股价回升到117.81 美元左右。

我们认为

政府不可能通过永久损害FB 开展业务能力的法案,因为任何这类法案不仅会影响FB,还可能影响所有以数据为基础的公司。从声誉上说,FB 可能从近期抵制Facebook 的运动中受到一定损害。但我们不认为FB 会在声誉上受到很大的永久损害,因为无论从规模还是功能上说,用户难以找到可以替代Facebook 的社交平台。

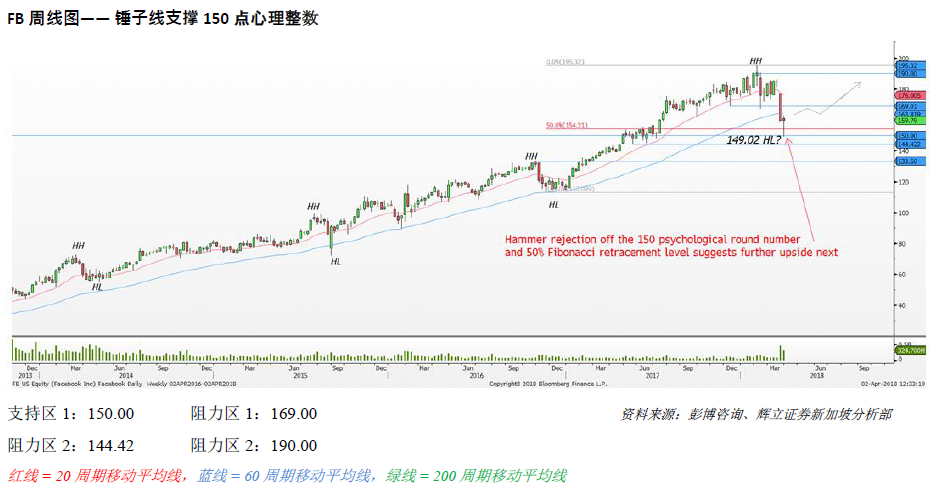

技术:股价自2018 年1 月最后一周冲击记录新高的195.00 美元心理整数后,已进入大幅修正。从峰值到低谷,FB 股价下跌高达23%。

但是,从最近的价格走势上看,我们可能在8 周修正后很快看到一定的近期反弹。三月份最后一周短期跌破150.00 美元心理整数后,买家轻易地守住了这一整数,因为每日收盘均未跌破150.00 美元的心理整数。

因此,2018 年3 月30 日前的一周形成的看涨反转烛图(锤子线)表明接下来会形成一个反转高点。另外,150.00 美元心理整数与50%斐波那契回撤水平吻合,使得这一支持区更加可靠。

预计锤子线低点149.02 美元将成为这一波上涨趋势的下一个高低点(HL),买家重新瞄准169.00 美元的阻力区,准备冲击190.00 美元。

结论

我们认为目前的Cambridge Analytica 丑闻向投资者提供了低价买入FB 的机会。我们认为该丑闻的潜在影响有限,不

可能对FB 的业务模式造成永久损害。出于1)其大规模用户基础,2)数字广告增长,以及3)对FB 增长前景的估值,我们看好FB。因此,我们认为股价被低估,最近出现的丑闻为买入机会

科技 行业

代码:FB

货币:美元

最后价:159.79

时限:3-6个月

止蚀价:139.00

目标价:220.00

买入价:159.79

彭博综合目标价:220.00

关键字:新加坡股票研报,美股,美股研报,FACEBOOK, 脸书,美股账户,交易美股,新加坡股票开户,免费开户,在线开设新加坡股票开户,新加坡证券,新加坡券商