外汇交易

低至 0.3 点的竞争性点差

外汇交易中的点差代表进入和退出交易的小额交易成本。您以货币对的卖出价买入,以买入价卖出,这两个买入价和卖出价之间的差额,称为点差或 Bid-Ask 点差。

外汇交易中的点差代表进入和退出交易的小额交易成本。您以货币对的卖出价买入,以买入价卖出,这两个买入价和卖出价之间的差额,称为点差或 Bid-Ask 点差。外汇差价合约实时价格

| Bid | Spread | Ask | High | Low | |

|---|---|---|---|---|---|

GLD/USD GLD/USD  | 5112.525 | 105 | 5112.52503 | 5143.1 | 5065.85 |

SLV/USD SLV/USD  | 84.16875 | 725 | 84.16878 | 84.5925 | 81.75 |

EUR/USD EUR/USD  | 1.161065 | 1.1 | 1.161095 | 1.16209 | 1.16015 |

USD/JPY USD/JPY  | 315.434 | 1 | 315.437 | 157.901 | 157.378 |

GBP/USD GBP/USD  | 1.336435 | 1.5 | 1.336465 | 1.33727 | 1.33372 |

USD/CHF USD/CHF  | 0.78055 | 3 | 0.78058 | 0.7812 | 0.7799 |

AUD/USD AUD/USD  | 0.7039 | 2 | 0.70393 | 0.704 | 0.7001 |

NZD/USD NZD/USD  | 0.59085 | 3 | 0.59088 | 0.5913 | 0.589 |

USD/CAD USD/CAD  | 1.3657 | 4 | 1.36573 | 1.3675 | 1.3652 |

EUR/CHF EUR/CHF  | 0.90635 | 3 | 0.90638 | 0.9066 | 0.9057 |

EUR/JPY EUR/JPY  | 366.24 | 4 | 366.243 | 183.25 | 182.7 |

EUR/GBP EUR/GBP  | 0.8688 | 4 | 0.86883 | 0.8696 | 0.8683 |

USD/SGD USD/SGD  | 1.277775 | 1.3 | 1.277805 | 1.28115 | 1.27741 |

| Last updated on 06-03-2026 | |||||

开启您的外汇差价合约之旅、

立即开设 POEMS 账户

网络研讨会

Hang on tight, more exciting events are coming up!

视频

查看全部

文章

查看全部

常见问题

合约名称或符号

外汇货币是以 3 个字母的代码报价

USD:美元

USD:美元 GBP:英镑

GBP:英镑 CHF:瑞士法郎

CHF:瑞士法郎 AUD:澳元

AUD:澳元 CAD/CAN:加拿大元

CAD/CAN:加拿大元 EUR:欧元

EUR:欧元 JPY:日元

JPY:日元 NZD:新西兰元

NZD:新西兰元

当我们买入或卖出时,我们指的是基准货币。相反的交易则以报价货币进行。例如,如果我们买入欧元/美元,就是买入欧元,卖出美元。报价货币也称为期限货币,因为交易是以该货币进行的,因为基准货币总是等于 1。因此,交易的盈亏将以报价货币计算。

“出价 “是指买方在任何特定时间以报价货币买入基准货币的最高价格。卖出价 “又称 ”报价”,指卖方以报价货币出售基准货币的最低价格。

- 流动性晴雨表

- 交易风险

- 下单类型指南

- 市场动态

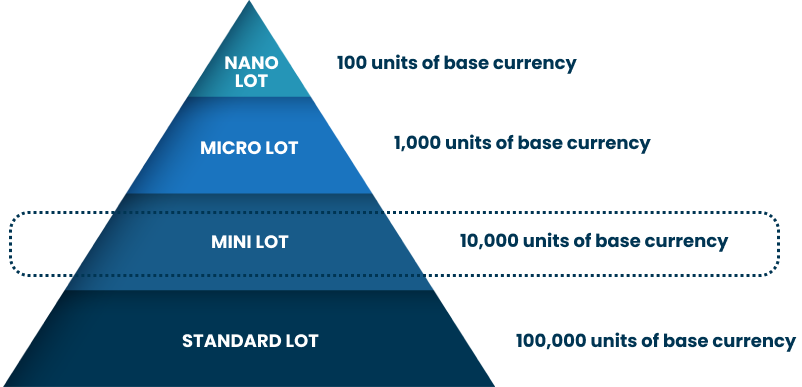

标准手数代表 100,000 单位基础货币,而迷你手数代表 10,000 单位基础货币,微型手数代表 1,000 单位基础货币。我们以迷你手提供外汇差价合约,即在 POEMS 或 MT5 上 1 手代表 10,000 单位基础货币。当您在交易平台上下单时,订单将以迷你手为单位进行报价。这是为了满足外汇差价合约新老交易者的灵活性。

词汇

Phillip CFD 是一家屡获殊荣的经纪券商,也是新加坡首家提供差价合约交易的券商。我们拥有一支敬业的交易员团队,将继续专注于产品创新,为客户提供最佳服务。

Phillip CFD 是一家屡获殊荣的经纪券商,也是新加坡首家提供差价合约交易的券商。我们拥有一支敬业的交易员团队,将继续专注于产品创新,为客户提供最佳服务。