深度解密杠杆型ETF:策略、风险与投资机遇 December 18, 2024

目录

- 杠杆型ETF的历史

- MAS认证投资产品(SIP)要求概览

- 杠杆型ETF的运作原理

- 杠杆型ETF的交易策略

- 杠杆型ETF的优缺点

- 杠杆型ETF的热门资产及日均交易量

- POEMS操作指南

杠杆型ETF风险较高,可能并不适合风险规避型投资者。

杠杆型ETF的历史

杠杆型交易所交易基金(ETF)近年来备受欢迎,其交易量增长迅速。这类ETF由ProShares于2006年首次推出,旨在让交易者和投资者利用短期市场波动,并实施反向策略,以放大潜在收益。

MAS认证投资产品(SIP)要求概览

自2012年以来,新加坡金融管理局(MAS)规定,券商必须在允许投资者投资指定投资产品(SIPs)之前,评估其相关知识和经验,以保护零售投资者。因此,投资者需完成客户账户评估(CAR)资格表格后,方可投资于上市的SIPs。

杠杆型ETF的运作原理

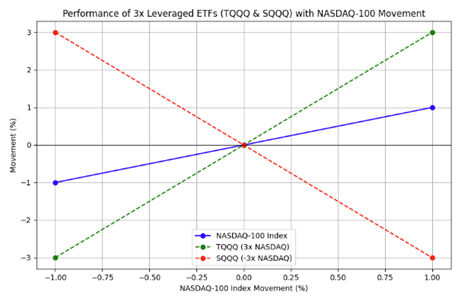

杠杆型ETF旨在放大收益与风险,通常提供其基础指数表现的两到三倍的杠杆。例如,TQQQ是一种3倍杠杆型ETF,当NASDAQ-100指数上涨1%时,TQQQ会大约上涨3%。同样,SQQQ是一种反向杠杆型ETF,其走势与NASDAQ-100指数相反,且放大三倍,提供了在指数下跌时潜在获利的机会。

图表 1.1:TQQQ/SQQQ 与 NASDAQ-100 指数的对比

图表 1.1:TQQQ/SQQQ 与 NASDAQ-100 指数的对比

使用杠杆型ETF的交易策略

下表概述了杠杆型ETF的主要特点,并简明总结了其核心功能及潜在应用:

| 特点 | 描述 |

| 短期使用 | 适合日内或短期交易,由于每日再平衡,不适合长期持有。 |

| 价值衰减 | 每日再平衡可能导致价值随时间衰减,尤其是在波动或横盘市场中。 |

| 放大回报的潜力 | 使投资者能够在短期内以较少的资本潜在地放大回报。 |

| 对冲工具 | 可用于在市场下跌时保护投资组合,作为临时对冲手段。 |

| 风险管理 | 用于对冲特定头寸或在市场波动条件下进行风险管理。 |

杠杆型ETF的优缺点

以下表格总结了杠杆型ETF的主要优点和缺点:

| 方面 | 优点 | 缺点 |

| 收益放大 | 以较少的资本投入实现显著的短期收益潜力 | 在波动市场中可能快速积累重大损失 |

| 便利性与可及性 | 与普通ETF类似的交易方式,使其比期货或期权更易获取 | – |

| 每日再平衡的衰减 | – | 每日再平衡可能导致“复利风险”,随着时间推移侵蚀价值 |

| 市场周期 | 在趋势性市场中表现最佳 | 在横盘市场中,由于每日重置机制可能减少收益并侵蚀价值 |

投资者应注意,杠杆型和反向ETF专为追踪每日市场走势设计,通常不适合持有超过几天或几周。由于每日再平衡,这些ETF可能随着时间的推移出现价值衰减,若长期持有可能侵蚀收益。

杠杆型ETF的顶级资产与日均交易量

截至2024年11月9日,根据ETFdb.com的数据显示,以下为在POEMS上可交易的具有最大资产规模及最高日均交易量的ETF。ProShares,Direxion和GraniteShares等主要ETF发行商均位列顶级杠杆型ETF提供商之列。

| 代码 | ETF名称 | 杠杆倍数 | 总资产(百万美元) | 年初至今回报率 | 日均交易量 |

| TQQQ | ProShares UltraPro QQQ | 3x | 25,139.5 | 64.95% | 49,997,796 |

| SOXL | Direxion Daily Semiconductor Bull 3x Shares | 3x | 11,299.9 | 13.37% | 89,975,304 |

| QLD | ProShares Ultra QQQ | 2x | 7,702.31 | 45.84% | 3,071,379 |

| SSO | ProShares Ultra S&P 500 | 3x | 5,554.67 | 50.19% | 2,234,171 |

| SPXL | Direxion Daily S&P 500 Bull 3X Shares | 3x | 5,512.15 | 76.40% | 3,505,306 | NVDL | GraniteShares 2x Long NVDA Daily ETF | 2x | 5,493.24 | 457.08% | 21,505,498 |

POEMS 使用指南

杠杆型及反向ETF可以通过战略性市场操作放大收益或对冲市场下跌风险,但它们固有的风险需要谨慎评估。请参考我们之前的ETF 市场期刊 了解有关杠杆型ETF的投资策略。与任何投资一样,将杠杆型ETF纳入投资组合需要深入研究并清晰理解您的财务目标与风险承受能力。

免费订阅实时美股行情!

作为非专业投资者,您可以通过POEMS 2.0或POEMS Mobile 3 App免费订阅 美股实时行情 每次订阅有效期为12个月。请注意,未订阅时显示的期权价格将有15-30分钟的延迟。

为什么选择POEMS?

通过战略性市场操作,利用杠杆型ETF放大回报。了解其工作原理、交易策略,并探索表现卓越的资产,以有效应对这些工具的独特风险与回报。使用POEMS,您将获得通向全球26个股票交易所的权限,提供多样化和探索全球市场的无限机会。无论是区域性增长还是国际性投资,我们的综合平台都能无缝支持您的交易需求。

今天开始您的全球投资旅程!

立即开设 POEMS账户 迈向多元化的全球投资组合!

欲了解更多关于通过POEMS交易的信息,您可以访问我们的网站,或拨打6531 1225联系我们的夜间交易团队。

参考:

- 1.ProShares. (n.d.). Leveraged and inverse strategies, 9 November 2024

- 2.Singapore Exchange (SGX) Academy. (n.d.). Specified Investment Products (SIP), 15 November 2024

- 3.ETF Database. (n.d.). Leveraged equity ETFs, 9 November 2024

此内容为英文翻译版本,若有任何不一致之处,皆以英文版本为准。

免责声明

这些评论旨在供一般传播使用,并未考虑任何接收该文件的个人的具体投资目标、财务状况和特别需求。因此,对任何因基于此信息而采取行动的个人所造成的任何直接或间接损失,均不作任何保证和不承担任何责任。评论中表达的观点可随时更改,恕不另行通知。投资涉及投资风险,包括可能损失所投资的本金金额。单位的价值及其收入可能会上升也可能会下降。过去的业绩数据以及这些评论中使用的任何预测或预期并不一定能指示未来或可能的表现。Phillip Securities Pte Ltd(PSPL)、其董事、关联人士或员工可能不时对评论中提到的金融工具持有利益。投资者在投资前可能希望咨询财务顾问。如果投资者选择不寻求财务顾问的建议,他们应考虑该投资是否适合自己。

这些评论中包含的信息来源于公共来源,PSPL对此信息的可靠性没有理由怀疑,评论中包含的任何分析、预测、预期和意见(统称为“研究”)均基于此类信息,并仅为信念的表达。PSPL并未验证该信息,且对该信息或研究的准确性、完整性或应被依赖性不作任何明示或暗示的声明或保证。评论中包含的任何此类信息或研究均可能会发生变化,PSPL不承担任何责任以维护所提供的信息或研究,或提供与此相关的任何更正、更新或发布。在任何情况下,PSPL均不对因使用所提供的信息或研究而可能产生的任何特殊、间接、附带或后果性损害承担责任,即使其已被告知可能存在此类损害。评论中提到的公司及其员工对任何因各种原因导致的错误、不准确和/或遗漏不承担责任。此处的任何意见或建议均为一般性意见,且可随时更改,恕不另行通知。评论中提供的信息可能包含有关国家、市场或公司的未来事件或未来财务表现的乐观声明。您必须自行评估所提供信息的相关性、准确性和充分性。

这些评论中描述的观点和任何策略可能不适合所有投资者。此处表达的意见可能与PSPL或其关联人士和合作伙伴表达的意见不同。评论中对投资产品或商品的任何提及或讨论纯粹是为了举例说明,不应被解读为推荐、要约或对提到的投资产品或商品的认购、购买或销售的邀请。

关于作者

Thng Xiao Xiong

Xiao Xiong是辉立环球交易部夜间交易团队的副经理,专门负责英国市场。他毕业于新加坡理工学院,获得飞机系统工程学士学位。他对宏观经济和期权策略有着浓厚的兴趣。

2026 ETF 市场开局展望:原油与恒生指数有望在一月走强

2026 ETF 市场开局展望:原油与恒生指数有望在一月走强  金价节节高,如何“点石成金”?——黄金ETF投资全解析

金价节节高,如何“点石成金”?——黄金ETF投资全解析  稳中求进:缓冲型ETF的运作原理与投资价值

稳中求进:缓冲型ETF的运作原理与投资价值  积微成著:如何利用ETF降低投资成本

积微成著:如何利用ETF降低投资成本