引言

在当今瞬息万变的经济环境中,市场波动加剧,投资者往往错失获利良机。事实上,即便是选择较为稳健的股票,也可能需要长时间才能看到回报;而节奏更快的短期期权交易又潜藏着较高风险。此时,期权轮盘策略(The Wheel Strategy)便应运而生——这是一种以耐心为核心、结构化的投资方法,能在市场波动中持续创造稳定收益,同时避免追逐短线暴涨所带来的压力。

什么是期权轮盘策略?

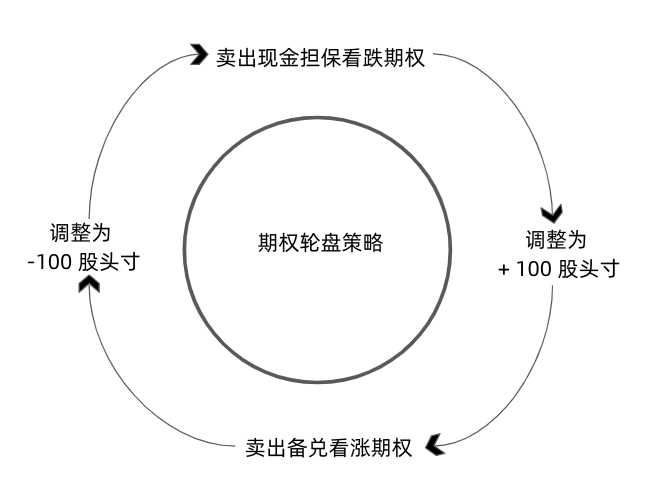

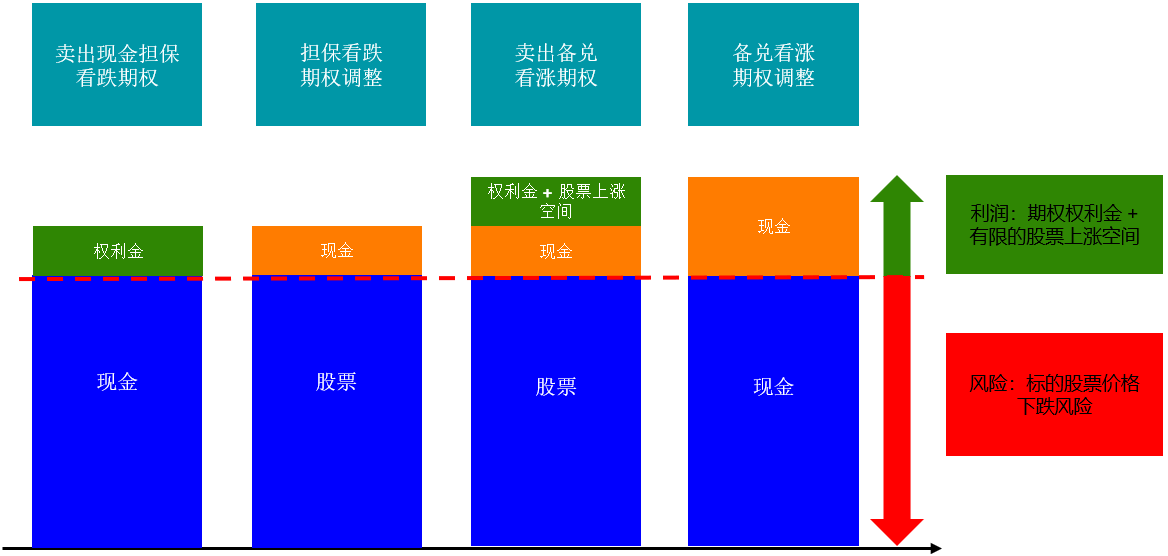

期权轮盘策略(The Wheel Strategy)结合了两种常见的期权操作方式:现金担保看跌期权(cash-secured put)与备兑看涨期权(covered call),并以循环的方式持续运作。具体流程如下:

- 卖出备兑现金认沽期权:在等待以理想价格买入股票的同时,先收取权利金作为收益

- 若认沽期权被执行,你将以预设价格买入该股票。此时转为卖出备兑认购期权,在持有股票期间继续收取额外的权利金

- 若股票被行使卖出(即被“call走”),则重新回到第一步,继续重复这一循环

这种策略常被形容为“稳中求进”——不追求高风险的暴利,而是通过持续收取期权权利金实现稳定现金流。

因此,它特别适合希望:

- 获得持续的被动收入

- 降低交易压力

- 并采用纪律性强、规则化操作的投资者。

你可以把它视为一种让市场为你工作的耐心策略——随着时间推移,在市场波动中稳步前行,既能积累股票部位,也能灵活锁定获利,实现成长与收益的双赢。若想进一步了解“备兑现金认沽”与“备兑认购”的原理,可参考我们过往的市场期刊,我们已对这两种策略进行了深入讲解。

为何耐心至关重要

期权轮盘策略的每一个循环都需要一定时间来完成。换句话说,你是在让资金或持股“帮你收租”。通过持续收取期权权利金,投资者能够建立起一条稳定的现金流,同时根据当下市场状况灵活调整策略,从而在长期中获得稳健回报。这种策略在应用于价格波动较小、流动性高、基本面稳健的个股时效果最佳,因为此类标的价格剧烈下跌的风险较低,权利金收入也更具可预测性。

风险提示

1. 标的股票风险

当标的股票价格下跌时,投资者将面临潜在亏损风险,其下行风险与直接持有股票相同。在最极端的情况下,若股价归零,投资者可能面临全部本金损失。不过,这一风险可通过选择稳健且基本面良好的公司来降低。特别是蓝筹股,由于股价波动较小,相对能减少价格急跌带来的风险。

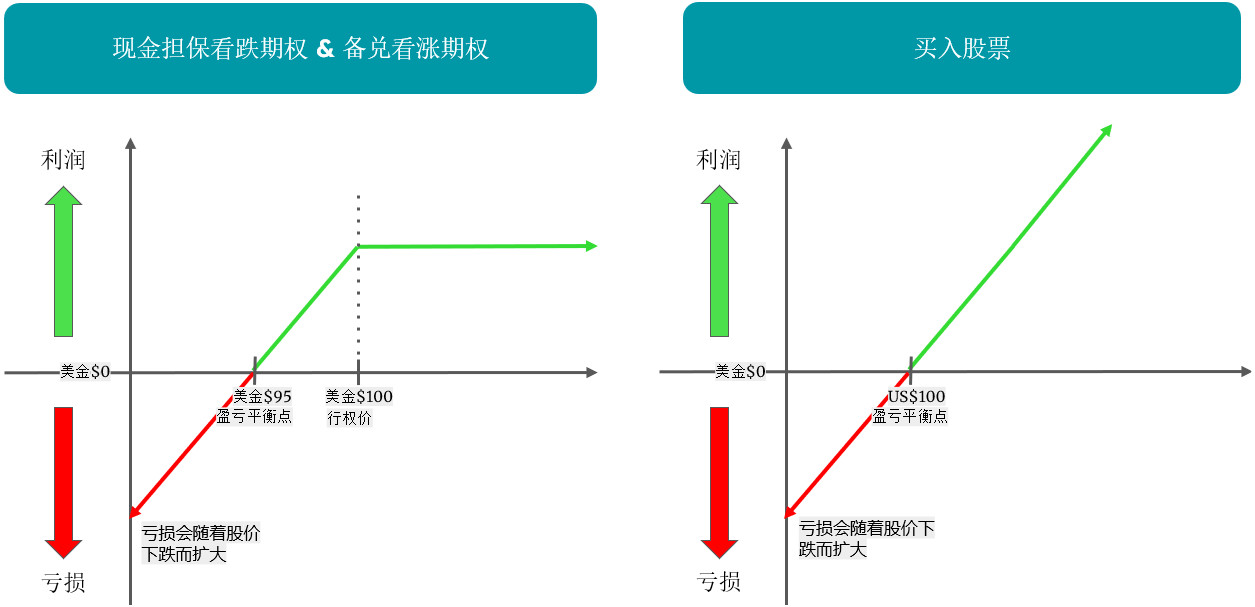

2. 机会成本

期权轮盘策略也存在机会成本。当股价大幅上涨、超过执行价时,投资者的利润将受到限制。对于备兑现金认沽与备兑认购而言,最大收益分别为所收取的期权权利金,以及(在备兑认购情形下)从买入价至执行价之间的股价升值。这与单纯的“买入并持有”策略不同——若股价持续上涨,后者的潜在收益理论上是无限的。也就是说,虽然期权轮盘策略能带来稳定的收入与一定的下行保护,但代价是牺牲了无限的上涨空间。

关于收益上限的说明

在备兑现金认沽与备兑认购策略中,投资者的最大收益是有限的——前者的利润来自所收取的期权权利金,后者则是权利金加上股价上涨至执行价之间的差额。这与单纯“买入并持有”股票的策略不同——若股价持续上涨,后者的潜在收益理论上是无限的。

换句话说,虽然期权策略能提供稳定的收入来源与一定的下行保护,但其代价是放弃了长期无限的上涨潜力。

谁适合采用期权轮盘策略?

正如其名,期权轮盘策略是一场关于耐心的游戏。在执行过程中,投资者最终往往会持有标的股票——可能是在期权到期时,也可能更早(若买方提前行权)。因此,这一策略尤其适合那些愿意长期持股、并能接受被指派风险的投资者。期权轮盘策略的目标是创造稳定现金流,同时有助于降低股票的平均持仓成本。

在宏观经济不确定性增强、市场方向难以预测的时期,这种策略提供了一种有纪律的操作框架:它让投资者既能留在市场中、持续收取权利金,又有机会以更理想的价格买入优质股票,并在可控风险下稳步增值。

结语

期权轮盘策略提醒我们:耐心终会带来回报。与其追逐瞬息万变的交易机会或寄望于暴涨暴富,不如通过持续收取小额权利金,在时间的积累中稳步获益。这并非要你精准掌握市场节奏或预测每一次波动,而是要以纪律执行策略,安心持有优质资产,让时间成为你的盟友。

立即与 POEMS 一起聪明投资——马上开户,畅享美股交易!

辉立货币市场基金(PMMF)

货币市场基金是一种开放式共同基金,投资于短期(少于 1 年)、低风险的债务证券,以获得流动性。这是一种低风险的现金投资方式。

辉立货币市场基金(PMMF)旨在保全本金价值并保持高度流动性,同时获得与新币储蓄存款相当的回报。该基金将主要投资于短期、高质量的货币市场工具和债务证券。此类投资可能包括政府和公司债券、商业票据和金融机构存款。

如何投资于辉立货币市场基金?

你可以通过 “余额增值服务”(SMART Park)投资辉立货币市场基金。交易账户中的最低余额若超过100 美元,则该资金将自动投资于辉立货币市场基金。

使用SMART Park 获取超额收益,让你的钱生钱!

- 无锁定期

- 真实回报, 并非预期回报

- 最大的^零售货币市场新元基金之一

- 值得信赖的金融机构

此内容为英文翻译版本,若有任何不一致之处,皆以英文版本为准。

免责声明

这些评论旨在供一般传播使用,并未考虑任何接收该文件的个人的具体投资目标、财务状况和特别需求。因此,对任何因基于此信息而采取行动的个人所造成的任何直接或间接损失,均不作任何保证和不承担任何责任。评论中表达的观点可随时更改,恕不另行通知。投资涉及投资风险,包括可能损失所投资的本金金额。单位的价值及其收入可能会上升也可能会下降。过去的业绩数据以及这些评论中使用的任何预测或预期并不一定能指示未来或可能的表现。Phillip Securities Pte Ltd(PSPL)、其董事、关联人士或员工可能不时对评论中提到的金融工具持有利益。投资者在投资前可能希望咨询财务顾问。如果投资者选择不寻求财务顾问的建议,他们应考虑该投资是否适合自己。

这些评论中包含的信息来源于公共来源,PSPL对此信息的可靠性没有理由怀疑,评论中包含的任何分析、预测、预期和意见(统称为“研究”)均基于此类信息,并仅为信念的表达。PSPL并未验证该信息,且对该信息或研究的准确性、完整性或应被依赖性不作任何明示或暗示的声明或保证。评论中包含的任何此类信息或研究均可能会发生变化,PSPL不承担任何责任以维护所提供的信息或研究,或提供与此相关的任何更正、更新或发布。在任何情况下,PSPL均不对因使用所提供的信息或研究而可能产生的任何特殊、间接、附带或后果性损害承担责任,即使其已被告知可能存在此类损害。评论中提到的公司及其员工对任何因各种原因导致的错误、不准确和/或遗漏不承担责任。此处的任何意见或建议均为一般性意见,且可随时更改,恕不另行通知。评论中提供的信息可能包含有关国家、市场或公司的未来事件或未来财务表现的乐观声明。您必须自行评估所提供信息的相关性、准确性和充分性。

这些评论中描述的观点和任何策略可能不适合所有投资者。此处表达的意见可能与PSPL或其关联人士和合作伙伴表达的意见不同。评论中对投资产品或商品的任何提及或讨论纯粹是为了举例说明,不应被解读为推荐、要约或对提到的投资产品或商品的认购、购买或销售的邀请。