上期我们介绍了各种影响期权价值的因素,那么,当多种因素联动,又会如何影响期权价值呢?

本期我们将会从期权的不同价值组成,内在价值(Intrinsic Value, IV)和外在价值(时间价值,Time Value, TV)来理解。

1. 内在价值(Intrinsic Value)

– 是指立即行权时,能获得的价值。通过比较正股市价/目标股票价(Stock Price)和行权价(Exercise Price)获得

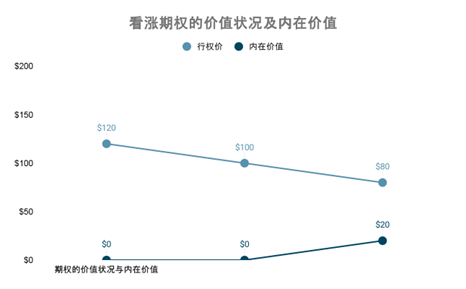

看涨期权:

- 内在价值 = 正股市价 – 行权价

- 假设:正股市价为USD100

- 价外(Out of the money)

- 市价($100) < 行权价($120),股票现价低于行权价,该看涨期权不含内在价值(IV = 0)

- 等价(At the money)

- 市价($100) = 行权价($100),该看涨期权不含内在价值(IV = 0)

- 价内(In the money)

- 市价($100) > 行权价($80),现价高于行权价,且该看涨期权含内在价值:现价 – 行权价(IV = 100 – 80 = 20)

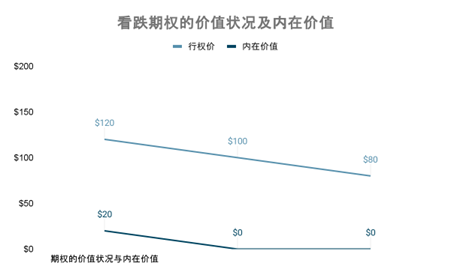

看跌期权:

- 内在价值 = 行权价 – 正股市价

- 假设:正股市价为USD100

- 价外(Out of the money)

- 市价($100) < 行权价($120),股票现价低于行权价,该看跌期权含内在价值(IV = 120 – 100 = 20)

- 等价(At the money)

- 市价($100) = 行权价($100),该看涨期权不含内在价值(IV = 0)

- 价外(Out of the money)

- 市价($100) > 行权价($80),现价高于行权价,且该看跌期权不含内在价值(IV = 0)

(操作:Poems 3.0 APP —— 点击“交易”页面 > 期权 > 搜索股票代码 Poems Web —— 点击“交易” 或 “价格”页面 > 期权 > 搜索股票代码 )

(操作:Poems 3.0 APP —— 点击“交易”页面 > 期权 > 搜索股票代码 Poems Web —— 点击“交易” 或 “价格”页面 > 期权 > 搜索股票代码 )

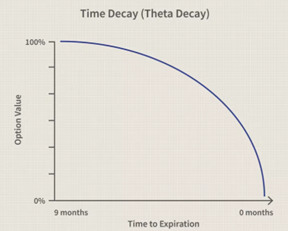

2. 时间价值(Time Value)

– 指在合约到期前,其剩余时间所占的部分

– 时间价值 = 期权金(Options Premium) – 内在价值

主要影响因素:

距离到期日时间

- 时间值耗损(Time Decay):时间价值会随着剩余时间减少而呈加速状态减少;越接近到期时,时间值耗损越快。

- 假设其他因素不变,若期权距离到期日越长,即剩余时间越长,所以其时间值越多

- 2.波幅(Volatility)

- 当波幅越大,看涨期权和看跌期权成为价内的机会越高——所以,波幅越大,时间值越高,期权金也越高

- 波幅可分为历史波幅(Historical volatility)和引伸波幅(Implied volatility)

看涨期权:

- -假设股价为USD100,执行价为USD100,且波动率不变

- 假设股价、执行价、波动率均不变,其看涨期权价值会随到期天数减少而减少

- 对于期权买方来说,时间就是敌人,若股价不变或上涨不够快,随着到期日的接近,对买方来讲,可能会出现亏损

- 而对期权卖方来讲,时间就是朋友,能从股价不涨时获利,每天赚取时间价值

看跌期权:

- -假设执行价为USD100

- 对于期权买方来说,时间价值的减少对他们是不利的,即使标的价格不变,随着时间值耗损增加,其期权价值也会出现亏损;若想获得最佳市场走势,是当股价大幅下跌,快速进入价内状态时,其期权价值增加

- 而对期权卖方来说,时间价值每天流入,对他们是有利的,当股价维持不变或上涨时,可以通过时间价值获利

总结

通过了解影响期权价值的不同因素,能帮助我们更好地了解其影响。但是,面对实际行情,这些因素都不是单一影响期权价值的,所以我们需要一个更综合的分析。

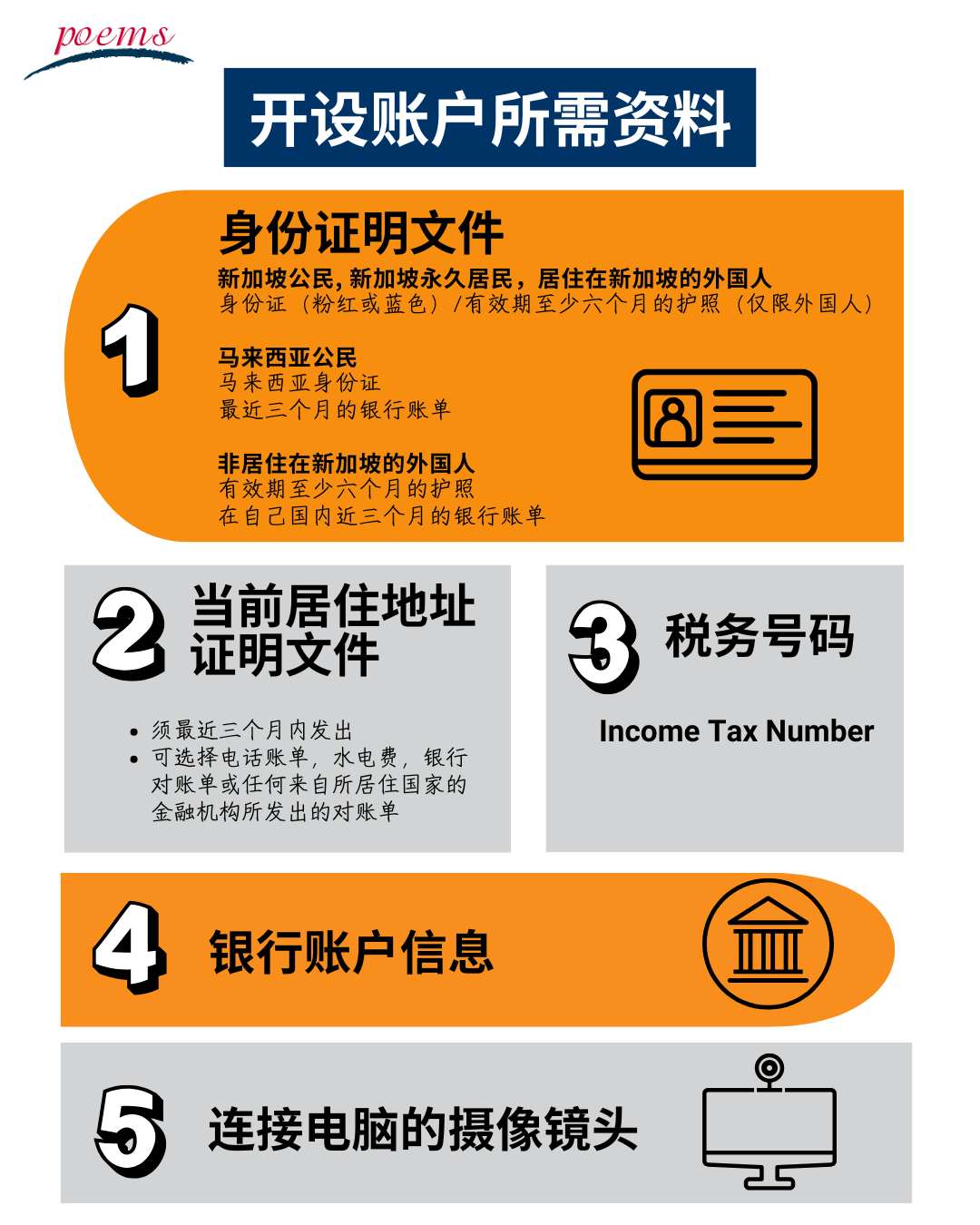

在辉立开设账户,轻松交易全球市场。

辉立证券优势

- 专业中文交易团队

- 一个账户,交易全球 -交易26个国家及地区股票。包括美国,加拿大,英国,韩国,台湾,越南,澳大利亚,比利时,法国,葡萄牙,土耳其,香港,新加坡,英国, 日本,马来西亚,泰国等等。

- 多元投资商品– 超过40,000种产品任您选择。包括ETF、差价合约(CFD)、美国期权(Options),单位信托基金(Unit Trust)、定期定额储蓄计划等等。

- 中文界面友好,适合华人投资者

- 交易成本低,开户便捷

- 多种联络方式,提供全中文服务

微信 | PSPLSG

WhatsApp | (65) 8800 7686

电话 | (65) 6531 1264

邮件 | GMD_China@phillip.com.sg

微信公众号:辉立环球SG

免责声明

这些评论旨在供一般传播使用,并未考虑任何接收该文件的个人的具体投资目标、财务状况和特别需求。因此,对任何因基于此信息而采取行动的个人所造成的任何直接或间接损失,均不作任何保证和不承担任何责任。评论中表达的观点可随时更改,恕不另行通知。投资涉及投资风险,包括可能损失所投资的本金金额。单位的价值及其收入可能会上升也可能会下降。过去的业绩数据以及这些评论中使用的任何预测或预期并不一定能指示未来或可能的表现。Phillip Securities Pte Ltd(PSPL)、其董事、关联人士或员工可能不时对评论中提到的金融工具持有利益。投资者在投资前可能希望咨询财务顾问。如果投资者选择不寻求财务顾问的建议,他们应考虑该投资是否适合自己。

这些评论中包含的信息来源于公共来源,PSPL对此信息的可靠性没有理由怀疑,评论中包含的任何分析、预测、预期和意见(统称为“研究”)均基于此类信息,并仅为信念的表达。PSPL并未验证该信息,且对该信息或研究的准确性、完整性或应被依赖性不作任何明示或暗示的声明或保证。评论中包含的任何此类信息或研究均可能会发生变化,PSPL不承担任何责任以维护所提供的信息或研究,或提供与此相关的任何更正、更新或发布。在任何情况下,PSPL均不对因使用所提供的信息或研究而可能产生的任何特殊、间接、附带或后果性损害承担责任,即使其已被告知可能存在此类损害。评论中提到的公司及其员工对任何因各种原因导致的错误、不准确和/或遗漏不承担责任。此处的任何意见或建议均为一般性意见,且可随时更改,恕不另行通知。评论中提供的信息可能包含有关国家、市场或公司的未来事件或未来财务表现的乐观声明。您必须自行评估所提供信息的相关性、准确性和充分性。

这些评论中描述的观点和任何策略可能不适合所有投资者。此处表达的意见可能与PSPL或其关联人士和合作伙伴表达的意见不同。评论中对投资产品或商品的任何提及或讨论纯粹是为了举例说明,不应被解读为推荐、要约或对提到的投资产品或商品的认购、购买或销售的邀请。