- 主页

- US Fractional Changes

为什么通过 POEMS 进行美股碎股交易?

- 每笔碎股订单的交易佣金低至 0.88 美元*。

- 专业交易员为您服务

- 无平台费

*仅适用于订单少于1股的情况,否则适用现行经纪费用。

为什么通过 POEMS 进行美股碎股交易?

- 每笔碎股订单的交易佣金低至 0.88 美元*。

- 专业交易员为您服务

- 无平台费

*Only for less than 1 share order quantity, else existing brokerage will apply.

美股碎股订单详情

符合条件的订单类型

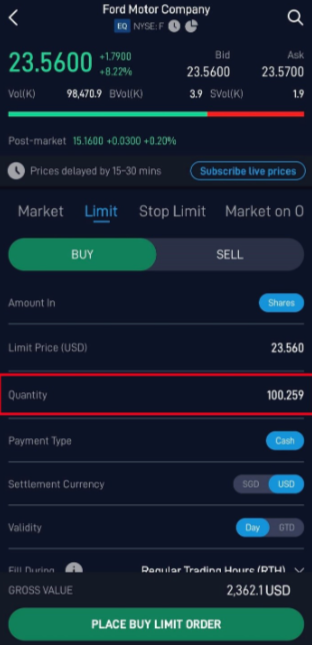

- 只有正常交易时间 (RTH) 限价订单和市价订单才符合条件。

- 美股碎股交易不适用延长时间和 GTD 订单。

最低下单量

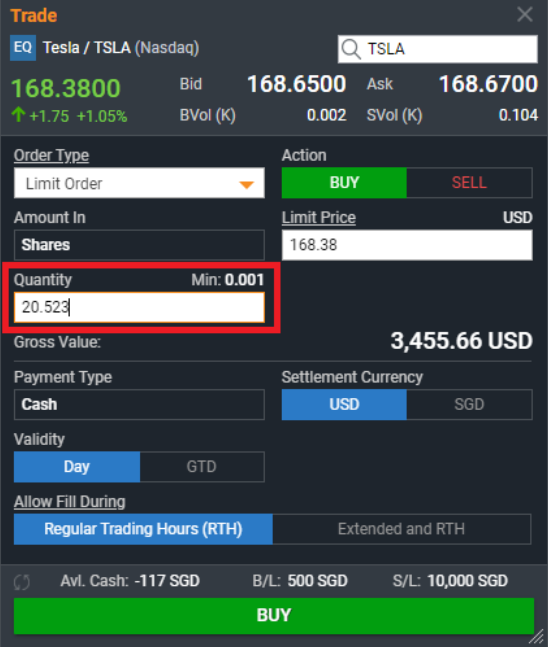

- 美股碎股订单的最小下单量为 0.001。

- 每笔美股碎股订单的合约价值必须超过 1 美元。

企业行动

- 美股碎股仍受企业行动(如股票分割、股息分配等)的影响

- 美股碎股不可转让,投资者无表决权。

美股碎股订单详情

符合条件的订单类型

- 只有正常交易时间 (RTH) 限价订单和市价订单才符合条件。

- 美股碎股交易不适用延长时间和 GTD 订单。

最低下单量

- 美股碎股订单的最小下单量为 0.001。

- 每笔美股碎股订单的合约价值必须超过 1 美元。

企业行动

- 美股碎股仍受企业行动(如股票分割、股息分配等)的影响

- 美股碎股不可转让,投资者无表决权。

常见问题

美股碎股要求每笔订单的最低合约价值为 1 美元,且支持到小数点后三位(如 0.001)。

美股碎股只能支持市价订单和限价订单。

美股碎股可在正常交易票据下进行交易。

美股碎股可用于现金管理账户(cash management)、保证金账户(margin)、辉立环球账户(cash plus)、投资托管账户(custodian)或预付投资托管账(prepaid custodian accounts)。

在进行碎股交易之前,客户需要确认与了解《碎股风险披露声明》。

可在 POEMS 2.0 Web 和 POEMS Mobile 3 App 上进行美股碎股交易。

美股碎股(即少于 1 股)的佣金为每笔订单 0.88 美元。

如果超过 1 股(如 1 股、1.5 股、100 股等),佣金将按照客户现行佣金率收取。

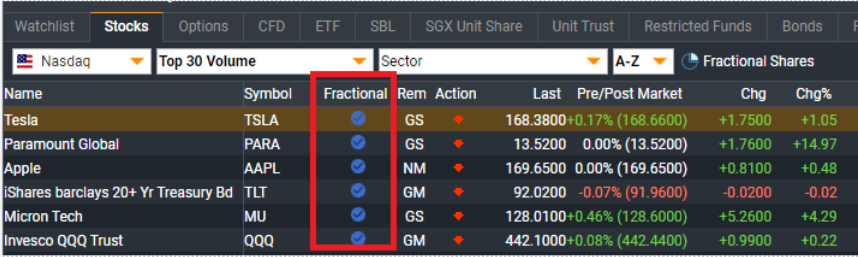

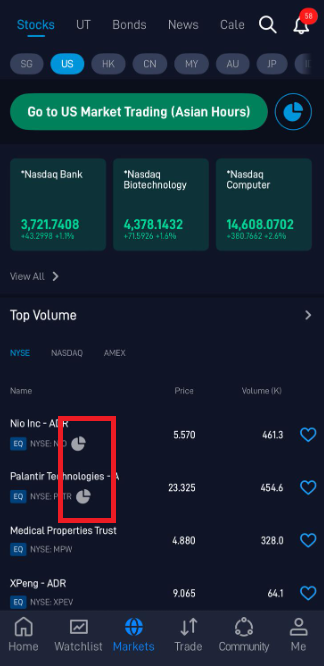

美股碎股的股票代码旁会显示一个美股碎股标签。

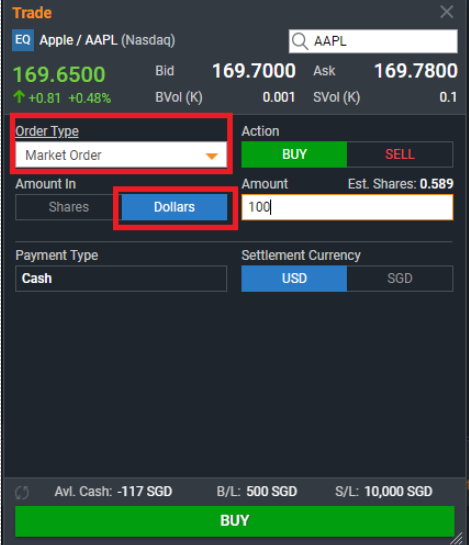

在POEMS 2.0下美元订单:前往至心仪的美股碎股 > 选择市价订单 > 选择美元 > 买入

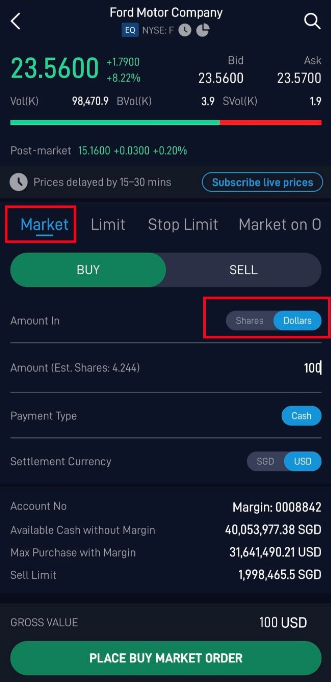

在 POEMS Mobile 3 应用程序下美元订单:前往至心仪的美股碎股 > 选择市价订单 > 切换至美元 > 买入市价订单

您可以联系您的交易代表。您可通过以下方法获取交易代表的联系信息:

1) 登录 POEMS 2.0 > 我的设置 > 联系我们

2) 在 POEMS 2.0 主页,点击 Phillip Chatbot(右侧屏幕上的橙色标志),输入 “股票经纪人详细信息(Remisier details)”,获取交易代表的联系方式。

3) 登录 POEMS Mobile 2.0 应用程序 > 点击菜单 > 帮助 > 致电经纪人。

4) 登录 POEMS Mobile 3 应用程序 > 我标签 > 支持 > 帮助服务 > 呼叫经纪人。

或者,您也可以致电 6531 1555 向我们寻求帮助,以获取您的交易代表的详细联系信息。

Now you can own a Portion of a Stock with US Fractional Shares!

T&Cs Apply.

免责声明

本广告仅提供一般信息,并不构成购买或出售此处提及的任何投资产品的建议、要约或招揽。本广告不考虑您的具体投资目标、财务状况或您的任何特定需求。

投资有投资风险,包括可能损失投资本金。任何投资的价值及其收益都可能下跌或上涨。杠杆交易的损失风险可能很大,您的损失可能超过您的初始资金。

在投资此处提及的任何投资产品之前,您可能希望获得财务顾问的建议。如果您选择不听取财务顾问的建议,则应考虑投资产品是否适合您。建议您在交易投资产品前阅读交易账户条款及条件和风险披露声明(可在此页查阅)。

此内容为英文翻译版本,若有任何不一致之处,皆以英文版本为准。