SMART Park是一个余额资金管理工具,可酌情自动投资和管理您的闲置现金。

不要让您的钱闲着,利用它为您赚取更多!

7天年化回报率#

SGD

SGD USD

USD收益率更新截至 2022年10月31日

#基于过去一周的平均年化回报率。

过往表现并不一定预示未来的表现。请查看免责声明。

为什么选择SMART Park

真实的回报,

并非预期回报

收益率显示的是真实的回报!

受托资金超过10亿新元

最大的^零售货币市场新元基金之一,由优质的短期工具组成,包括:

- 优质的政府债券和公司债券

- 商业票据和定期存款

值得信赖的金融机构

为机构客户和散户投资者服务超过45年

^根据FundSingapore.com,显示的总资产净值 (TNA)数据

可在这里阅读更多有关SMART Park如何让您的资金增值的信息

如何选择加入SMART Park?

在线转账和提款更快、更便捷

购买其他投资产品

如果您打算购买股票、ETFs、单位信托基金和债券,您SMART Park账户中的现金将会自动清算并用于您的投资。

货币市场基金有什么优势?

与债券基金等非货币市场基金(Money Market Funds)相比,SMART Park所投资的货币市场基金(MMF),具有更严格的投资准则,包括投资等级、集中度限制和流动性等。

我们选择货币市场基金,是因为基础资产的流动性和质量对于资本保值和稳定回报是至关重要的,这样可满足客户的长期需求。

常见问题

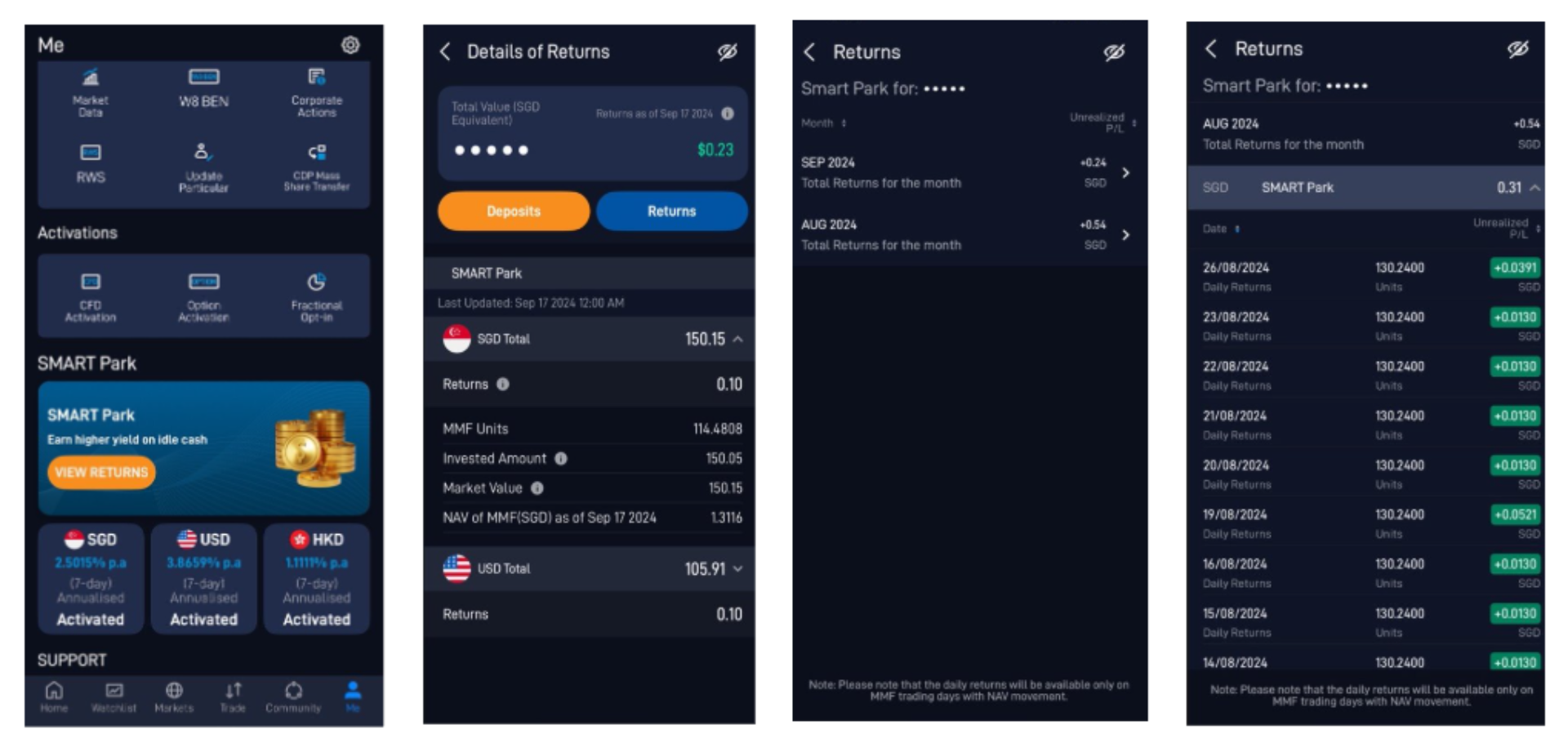

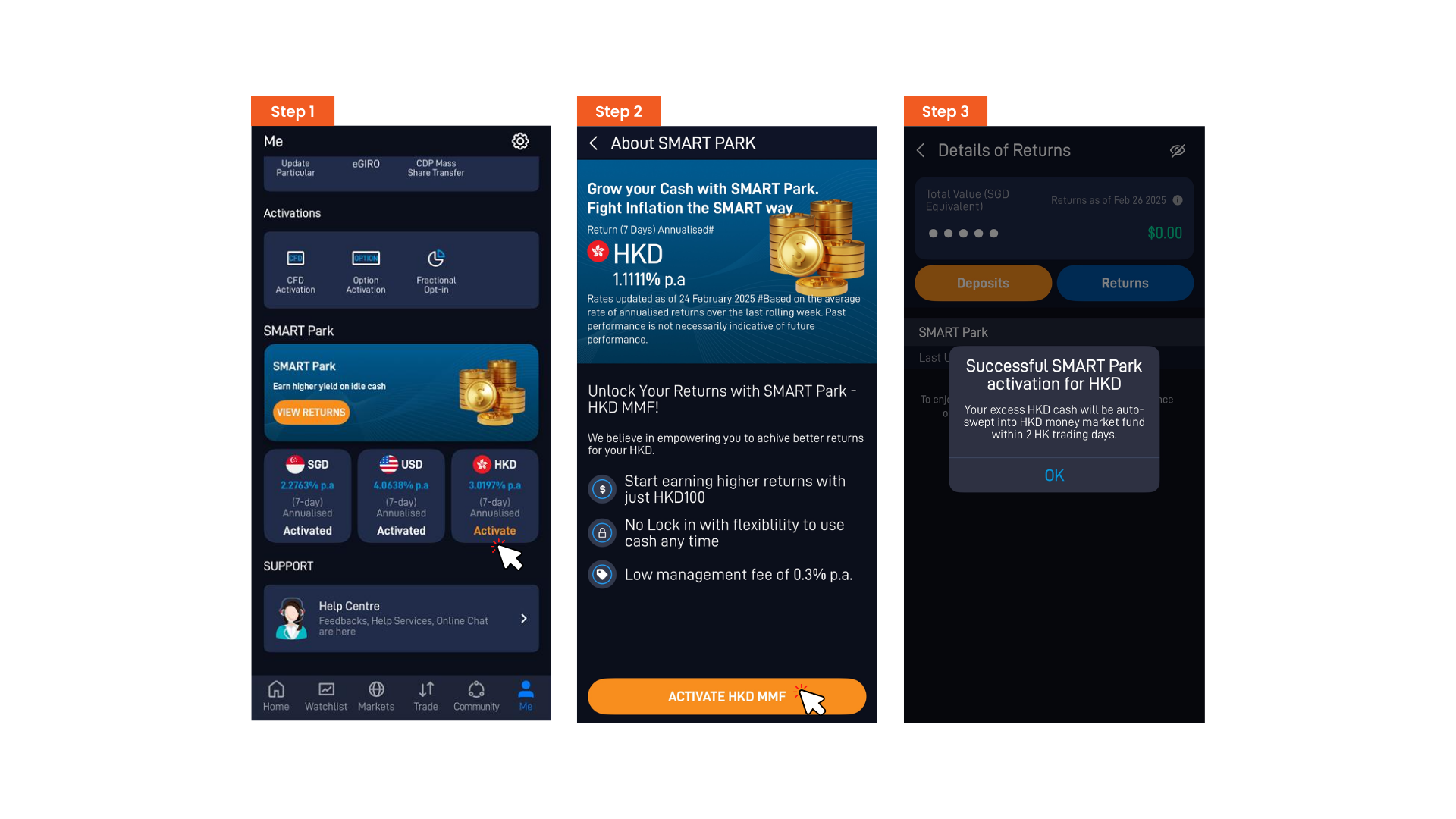

在 POEMS 3 手机客户端中 > “我” 页面 > 点击 SMART Park 横幅上的 “VIEW RETURNS”

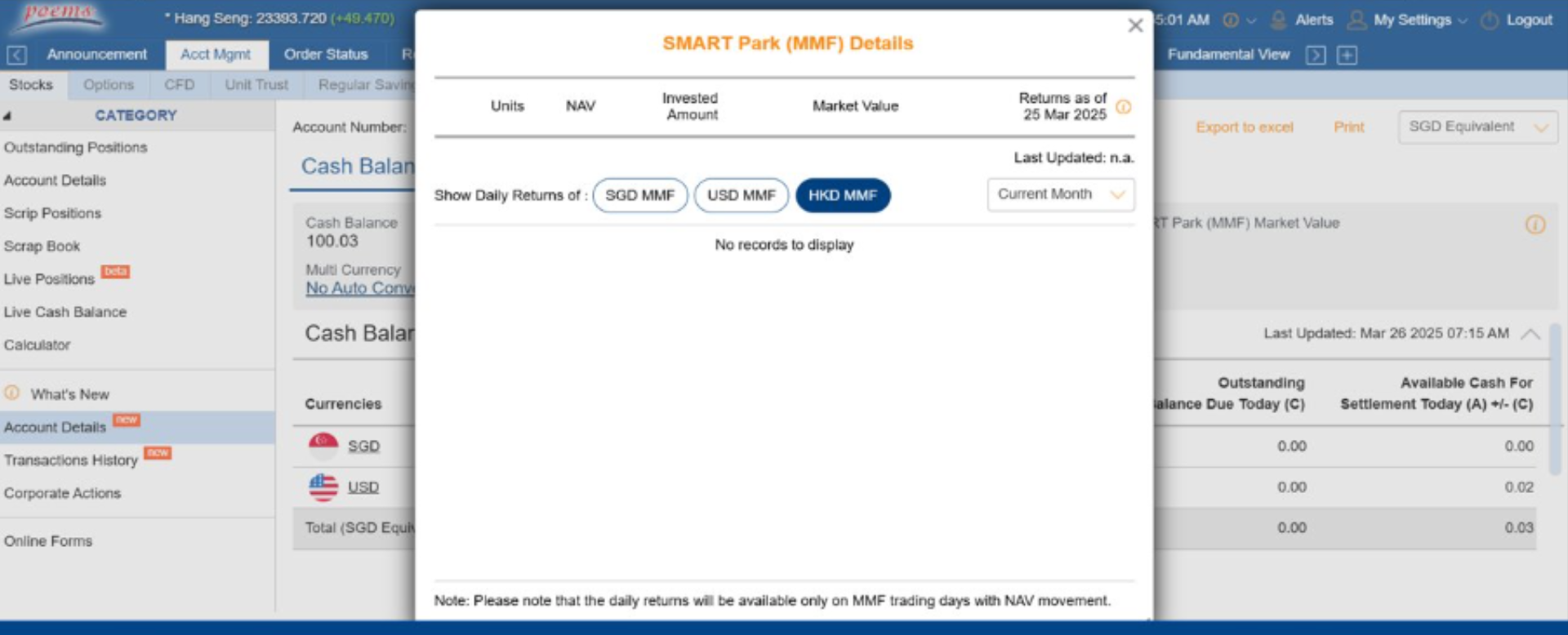

在 POEMS 2 网页版 > 账户管理 > 股票 > 账户详情更新 > SMART Park(货币市场基金)市值

首先,选择启用 SMART Park。

在成功启用 SMART Park 后,您可按以下步骤启用港币货币市场基金(HKD MMF):

打开 POEMS 3 手机客户端 > “我的”标签页 > 点击 SMART Park 横幅中的“ACTIVATE HKD MMF” > 启用 HKD MMF。

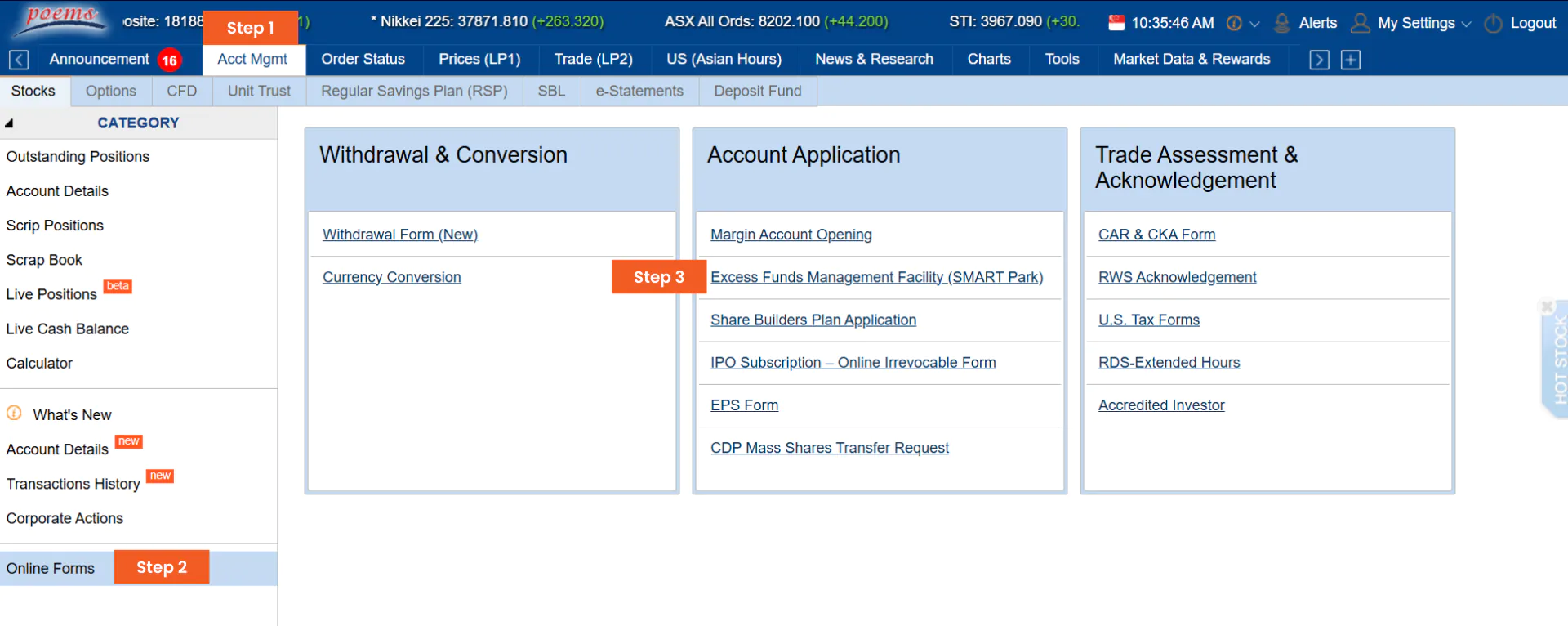

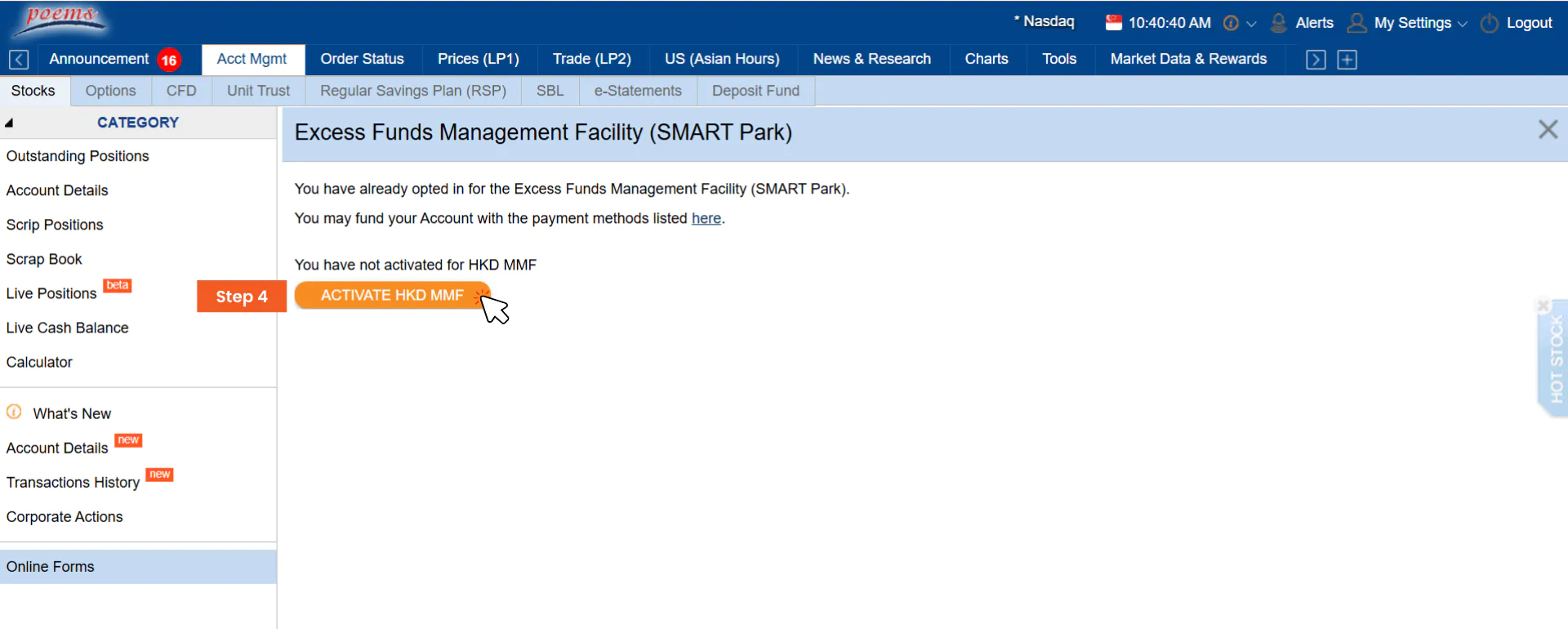

在 POEMS 2 网页版中:

前往【账户管理】>【线上表格】>【账户申请】>【货币市场基金管理服务(SMART Park)】> 启用港币 MMF(HKD MMF)。

已启用港币 MMF(HKD MMF)的账户:

任何账户中现有满 100 港币或以上的港币余额将会自动转入 SMART Park 港币基金。此外,您也可以先入金并兑换为港币,系统随后将自动把港币余额转入 SMART Park 港币基金。

对于新币(SGD)和美元(USD)SMART Park,不收取任何销售费用或管理费用。

对于港币(HKD)SMART Park,将会从您的港币余额中按年利率 0.3% 收取少量管理费,每月月底扣除。

以下为计算示例说明:

- 港币每日余额:HKD 100,000

- 每日管理费:HKD 100,000 × 0.3% / 365 = HKD 0.82

- 每月费用:HKD 0.82 × 30 天 = HKD 24.6(约新币 S$4.42)

此管理费用将显示在交易记录与月结单中。

若您的账户启用了自动货币转换功能,系统将使用其他货币(有余额)来自动抵销港币的借项(如 HKD MMF 管理费)。自动转换时间为每日晚上 7:15,按系统设定的汇率与币种优先顺序执行。币种使用顺序如下(从优先到次):SGD > USD > HKD > CNY > JPY > AUD > GBP > EUR > CAD > MYR。

若您希望开启或关闭该功能,请联系您的交易代表。

若未启用自动货币转换功能,客户需手动入金或提交货币兑换指示,以结清欠款,避免产生利息费用。

- 新币(SGD) 与 美金(USD) MMF 的截单时间为工作日下午 2:00

- 港币(HKD)MMF 的截单时间为工作日上午 10:00

HKD

HKD