资讯 | 基建投资加速,中国中铁(601390)等基建股走强

道指创历史上最大单日上涨点数,以及2009年以来的最大单日最大百分比涨幅。此前道指的历史最大单日上涨点数是2018年12月创造的1290点。

道指30成分股悉数收高。苹果(298.81, 25.45, 9.31%)公司收高9.31%,成为涨幅最大的道指成分股。其他成分股中,沃尔玛(115.88, 8.20, 7.62%)收高7.61%,美国联合健康(273.11, 18.15, 7.12%)集团收高7.03%,微软(172.79, 10.78, 6.65%)收高6.65%,旅行者财产险(127.68, 7.87, 6.57%)集团收高6.58%,默沙东(81.37, 4.81, 6.28%)集团收高6.30%。

疫情持续蔓延令市场担忧

市场仍在评估新冠病毒疫情发展及其对全球经济的潜在影响。数据显示,新冠肺炎疫情近日持续在多国蔓延。韩国、伊朗、意大利等国确诊病例仍在增加。同时,法国、德国、美国等国感染人数也在上升。

焦点个股

特斯拉(743.62, 75.63, 11.32%)股价攀升。据报道称Model Y即将开始交付。

苹果申请触摸检测专利。这将改变苹果硬件对“手指靠在屏幕上”这种直接触摸输入模式的高度依赖。

京东(43.3, 4.79, 12.44%)宣布2019年第四季度营收、净利润均优于市场预期,且预计今年第一季度营收至少涨10%。

优信(1.62, -0.05, -2.99%)二手车官微针对近期媒体所报道的情况发布官方公告。公告称目前优信各项工作都在正常开展,没有停工更没有休克。

热点板块

建材水泥股上涨。中国建材(9.93, 0.00, 0.00%)涨10.21%;金隅集团(2.38, 0.00, 0.00%)涨8.68%;亚洲水泥涨6.03%。

华为概念股走高,中兴通讯(34.8, 0.00, 0.00%)涨7.91%,长飞光纤光缆(16.48, 0.00, 0.00%)涨6.87%;舜宇光学科技(127.4, 0.00, 0.00%)涨5.12%。

石油股上涨。中海油(11.14, 0.00, 0.00%)田服务涨5.2%;中国海洋石油涨4.31%;中国石油(3.1, 0.00, 0.00%)股份涨2.65%。

内房股上涨。融创中国(44.9, 0.00, 0.00%)涨5.65%;绿城中国(10.9, 0.00, 0.00%)涨6.24%;碧桂园(10.72, 0.00, 0.00%)涨3.88%。

中资券商股上涨。中金公司(15.22, 0.00, 0.00%)涨5.84%;光大证券(5.92, 0.00, 0.00%)涨3.86%;中州证券(1.63, 0.00, 0.00%)涨5.16%。

海航系集体走强,海航创新涨2.11%,海航控股涨2.25%。海航科技投资(0.54, 0.00, 0.00%)涨20%。消息面上,海航系上市公司公告称收到海航集团告知函:近日,海南省政府牵头会同相关部门派出专业人员共同成立了“海南省海航集团联合工作组”。联合工作组是全面协助、全力推进海航集团风险处置工作,并非接管海航集团。陈峰继续担任董事长,原经营团队保持不变。本次海航集团管理层结构调整,不涉及海航集团实际控制权的变化。

从盘面上看,水泥、建筑装饰、医疗废物处理板块居板块涨幅榜前列,暂无板块表现弱势。

消息面上,海航系上市公司公告称收到海航集团告知函:近日,海南省政府牵头会同相关部门派出专业人员共同成立了“海南省海航集团联合工作组”。联合工作组是全面协助、全力推进海航集团风险处置工作,并非接管海航集团。陈峰继续担任董事长,原经营团队保持不变。本次海航集团管理层结构调整,不涉及海航集团实际控制权的变化。

动物保健概念走强,蔚蓝生物(26.770, 0.66, 2.53%)一字涨停,普莱柯(18.480, 0.37, 2.04%)、中牧股份(13.280, 0.42, 3.27%)等集体高开。

消息面上,非洲猪瘟疫苗创制成功。

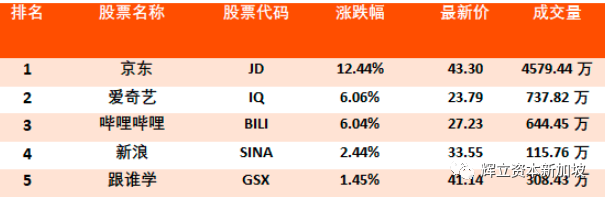

全天涨幅最大的5支沪港通