研报 | 华侨银行有限公司: 受保险和津贴拖累

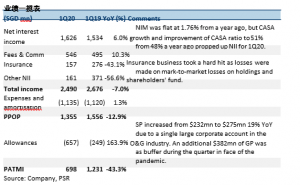

- 2020年一季度收益低于我们预期的45%,原因是保险以市值计价的损失暴跌了94%,以及津贴较一年前的49亿新元,提高到6.57亿新元。

- 同比3%的贷款增长支撑了6%的NII(净利息收入)增长,因为NIM从一年前开始就企稳在76%。

- 我们维持增持评级,并下调目标价至14新元 (先前目标价为12.10新元)。在未来两年里,信贷成本指引被修订为每年50-60个基点,并在此期间追加了额外的3亿新元的津贴。由于准备金的提高和保险的损失,我们将2020财年的收益削减了20%。

积极方面

+ 手续费和佣金收入同比增长了10%。财富管理费用同比增长32%,而经纪业务和基金管理费用同比增长18%,抵御了来自贷款相关费用的下行压力。 (同比下降18%)。

消极方面

– 对油气的风险敞口继续推动信贷成本上升。2020年一季度,被收取了2.75亿的SP(专项准备金),其中大部分是由于对当地的一家油气交易商的较大敞口造成的。一位新的油气交易商正浮出水面,可能会在随后几个季度给OCBC的SP带来压力。银行认为,欺诈活动只是孤立事件,而不是普遍现象。

前景

投资行动

我们维持增持评级,并下调目标价至9.14新元 (先前目标价为12.10新元)。考虑到较低的利率环境后,我们修订了目标价。NIM的预测被压缩了10个基点,而未来两年将在每个季度增加3亿新元的信贷成本,以反映不断恶化的经济状况。

如果有想了解更多全球股市资讯,请关注微信公众号 “辉立资本新加坡” (SGPSPL)。同时提供在线免费开设股票账户,一个账户轻松交易全球股票和ETF美股,港股,新加坡股,中国A股,越南股票,韩国股票,德国股票,马来西亚股票,泰国股票,印尼股票,菲律宾股票,日本股票,澳大利亚股票,台湾股票,加拿大股票,英国股票,法国股票,荷兰股票,葡萄牙股票,比利时股票,土耳其股票如果本文是英文翻译版本,一切请以英文为准