新手零压力!7步教你用 POEMS 轻松下单 September 3, 2025

无论你是刚开账户,还是完全没有任何投资经验,下单其实没有想象中那么复杂。当你已经下载了POEMS 3.0 App,但却无从下手,别担心,我们已经把流程拆解成7个清晰步骤。只要根据以下步骤,你就能轻松完成人生中的第一笔下单,开启属于你的投资之旅!

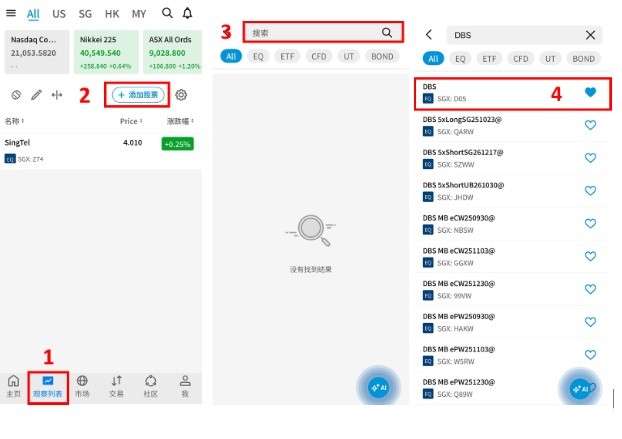

第一步:如何把股票加入观察列表

- 登录POEMS 3.0 App > 点击 [观察列表] 页面

- 点击 [添加股票]

- 搜寻 [股票代码] 或 [股票名称]

- 点击 [爱心]

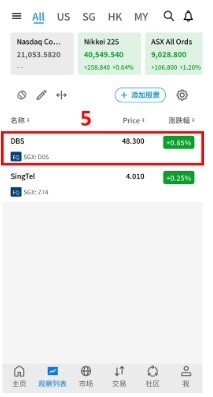

- 回到观察列表首页,即可看到已加入的股票

第二步:选择要进行交易的个股

- 进入个股页面

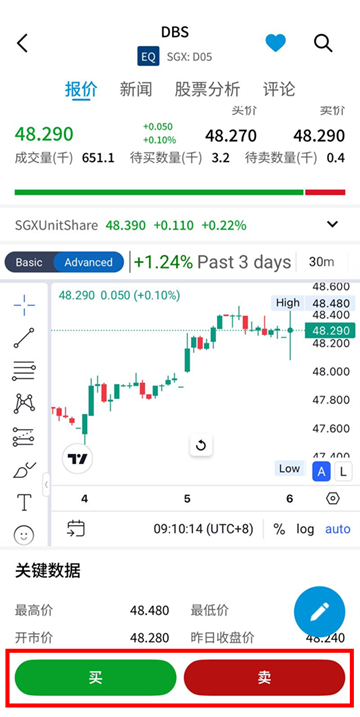

- 买: 买入股票

卖: 卖出持有的股票

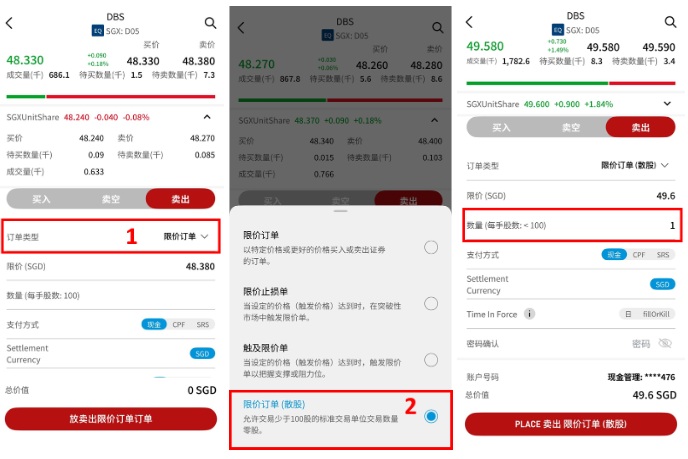

第三步:选择交易整股/散股

- 进入整股买入/卖出页面

*整股: 每手100股 - 若要买入/卖散股 > 点击 [订单类型] 往下箭头

*散股: 每手少于100股 - 点击限价订单 (散股)

- 散股买入/卖出显示页面

*注:每个市场的每手交易数量不同

第四步: 设定买入/卖出价格和股数

- 在限价输入价格

- 数量

买入订单: 输入要购买的股数

卖出订单: 输入卖出股数前,查看是否持有该股/足够的股数

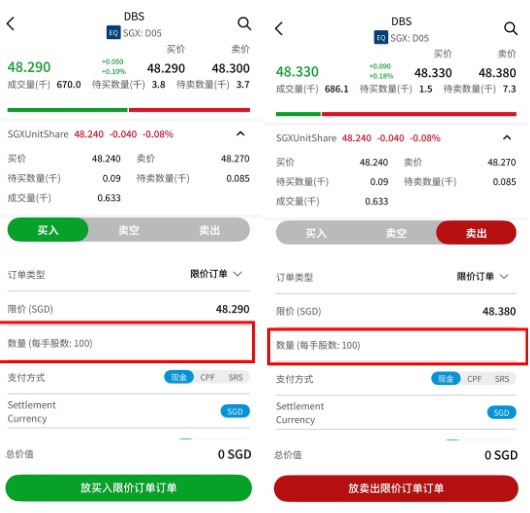

第五步: 订单类型

- 选择订单类型

- 限价订单: 限价单是指以特定价格或低于/高于的价格买入或卖出股票的订单

- 选择 [现金] 或 [CPF] 或 [SRS] 支付

- 当日单 (Day Order): 订单仅在输入当天有效。若未成交,订单将在交易日结束时自动失效。

- 到期前有效单(Good-till-Date, GTD): 可指定订单的有效期,最长可保留 28 天。

- 全部成交否则取消 (Fill or Kill, FOK): 只允许订单全部成交,否则将全部取消

- 无锁定期

- 真实回报, 并非预期回报

- 最大的^零售货币市场新元基金之一

- 值得信赖的金融机构

限价止损单:当股票的价格达到指定价格,即所谓的触发价格,才执行买入或卖出指令的订单。

一旦达到触发价格,止损限价单就变成将以指定价格 (或更好的价格) 来执行的限价单。

触及限价单: 指以低于(或高于)市场的指定价格或更好的价格买入(或卖出)合约的订单。

此订单将保存在系统中,直至达到触发价位。触及限价订单与止损限价单相似,区别在于触及

限价卖单高于当前市场价格,而卖出止损限价单则低于当前的市价。

第六步: 支付方式

*环球账户/投资保证金账户/现金预付账户需要先入金至交易账户后,才能通过CPF或SRS方式支付。关于入金方式,可以点击查看: https://www.poems.com.sg/zh-hans/payment/

通过CPF 或SRS 支付可以交易哪些股票?点击下方链接了解更多:

CPF: https://www.sgx.com/securities/stocks-under-cpf-investment-scheme

第七步: 订单有效期类型

整股页面

散股页面

在您已经掌握了以上的下单步骤之后,还需要进一步了解并特别留意与交易紧密相关的时间安排和规则,例如新交所的常规交易时段以及证券交易的结算日,这些都是确保交易顺利进行的重要环节。

(1) 新交所常规交易时段

| 开盘时段 | |||

| 预开盘 | 上午8.30 至 上午8.58/59* | ||

| 不可撤单时段 | 上午8.58/59 至上午9.00 | ||

| 交易 | 上午9.00至中午12.00 | ||

| 午休时段 | 预开盘 | 中午12.00至12.58/59 | |

| 不可撤单时段</td> | 中午12.58/59至下午1.00 | ||

| 交易 | 下午1.00 至下午5.00 | ||

| 收市时段 | 预收盘 | 下午5.00 至下午5.04/05* | |

| 不可撤单时段 | 下午5.04/05至下午5.06 | ||

| 收盘时交易 | 下午5.06至下午5.16 | ||

| 收盘 | 下午5.16 | ||

* 预开盘/预收盘交易时段在此一分钟内随时随机结束,立马跟进的就是不可撤单时段.

*对于新交所的隔夜订单,您可以从下午 5.26 开始提交。

(2)结算日

新加坡证券交易的结算日是交易日(T)后的第二个工作日(T+2)。

点击 链接了解更多!

在辉立开设账户,轻松交易全球市场。

辉立货币市场基金(PMMF)

货币市场基金是一种开放式共同基金,投资于短期(少于 1 年)、低风险的债务证券,以获得流动性。这是一种低风险的现金投资方式。

辉立货币市场基金(PMMF)旨在保全本金价值并保持高度流动性,同时获得与新币储蓄存款相当的回报。该基金将主要投资于短期、高质量的货币市场工具和债务证券。此类投资可能包括政府和公司债券、商业票据和金融机构存款。

如何投资于辉立货币市场基金?

您可以通过 “余额增值服务”(SMART Park)投资辉立货币市场基金。交易账户中的最低余额若超过100 美元,则该资金将自动投资于辉立货币市场基金。

使用SMART Park 获取超额收益,让你的钱生钱!

微信 | PSPLSG

WhatsApp | (65) 8800 7686

电话 | (65) 6531 1264

邮件 | GMD_China@phillip.com.sg

微信公众号:辉立环球SG

免责声明

这些评论旨在供一般传播使用,并未考虑任何接收该文件的个人的具体投资目标、财务状况和特别需求。因此,对任何因基于此信息而采取行动的个人所造成的任何直接或间接损失,均不作任何保证和不承担任何责任。评论中表达的观点可随时更改,恕不另行通知。投资涉及投资风险,包括可能损失所投资的本金金额。单位的价值及其收入可能会上升也可能会下降。过去的业绩数据以及这些评论中使用的任何预测或预期并不一定能指示未来或可能的表现。Phillip Securities Pte Ltd(PSPL)、其董事、关联人士或员工可能不时对评论中提到的金融工具持有利益。投资者在投资前可能希望咨询财务顾问。如果投资者选择不寻求财务顾问的建议,他们应考虑该投资是否适合自己。

这些评论中包含的信息来源于公共来源,PSPL对此信息的可靠性没有理由怀疑,评论中包含的任何分析、预测、预期和意见(统称为“研究”)均基于此类信息,并仅为信念的表达。PSPL并未验证该信息,且对该信息或研究的准确性、完整性或应被依赖性不作任何明示或暗示的声明或保证。评论中包含的任何此类信息或研究均可能会发生变化,PSPL不承担任何责任以维护所提供的信息或研究,或提供与此相关的任何更正、更新或发布。在任何情况下,PSPL均不对因使用所提供的信息或研究而可能产生的任何特殊、间接、附带或后果性损害承担责任,即使其已被告知可能存在此类损害。评论中提到的公司及其员工对任何因各种原因导致的错误、不准确和/或遗漏不承担责任。此处的任何意见或建议均为一般性意见,且可随时更改,恕不另行通知。评论中提供的信息可能包含有关国家、市场或公司的未来事件或未来财务表现的乐观声明。您必须自行评估所提供信息的相关性、准确性和充分性。

这些评论中描述的观点和任何策略可能不适合所有投资者。此处表达的意见可能与PSPL或其关联人士和合作伙伴表达的意见不同。评论中对投资产品或商品的任何提及或讨论纯粹是为了举例说明,不应被解读为推荐、要约或对提到的投资产品或商品的认购、购买或销售的邀请。

关于作者

Mee Yi Ting

辉立证券环球交易部资深中文交易员

Mee Yi 是辉立证券环球交易部中文团队的资深交易员。她主要负责分析股市信息和执行交易。她毕业于澳洲斯威本理工大学,拥有市场营销学学士学位。她曾在马来西亚辉立资本工作,作为持牌衍生品交易员和营销专员。