Supplementary Retirement Scheme (SRS)

Benefit of investing SRS with POEMS:

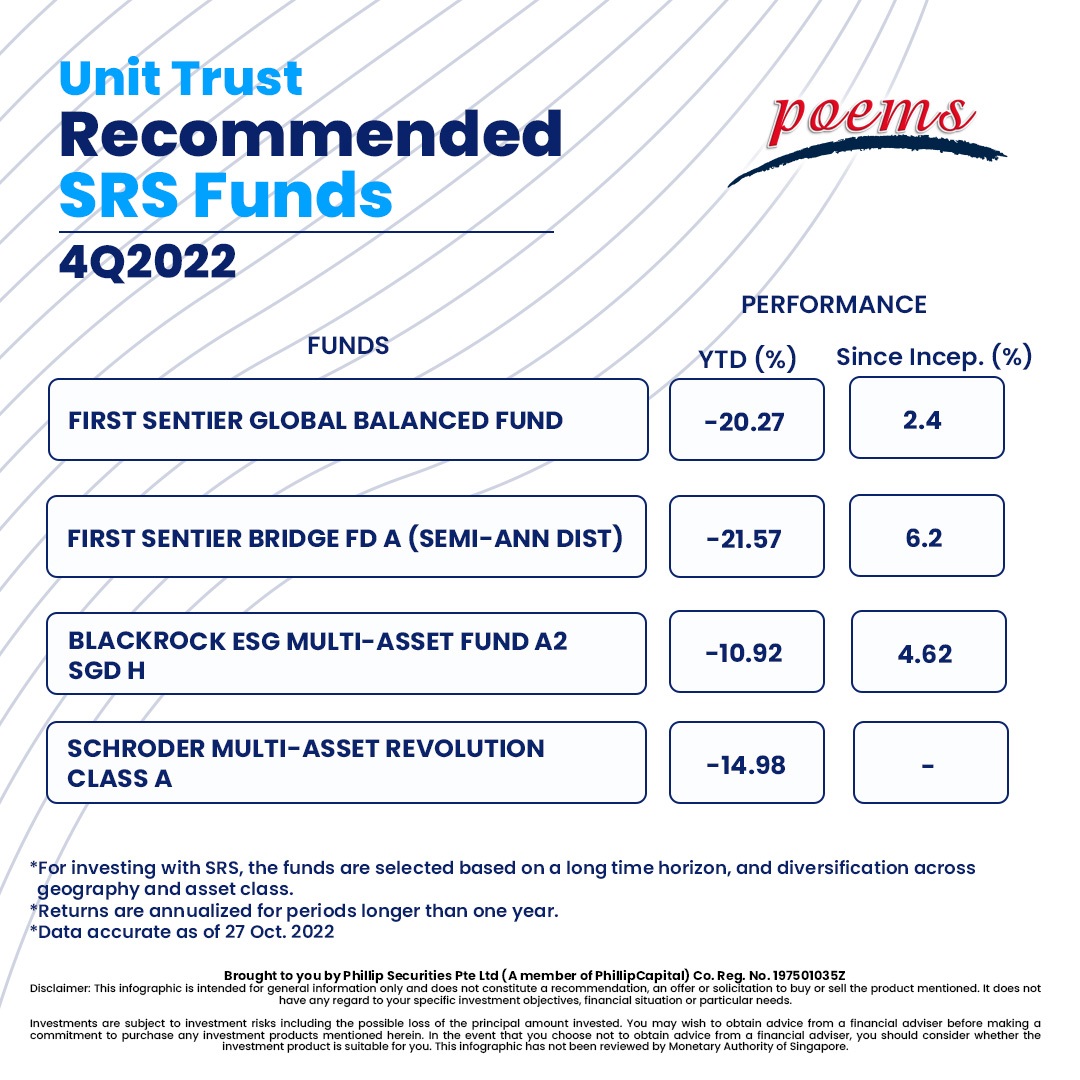

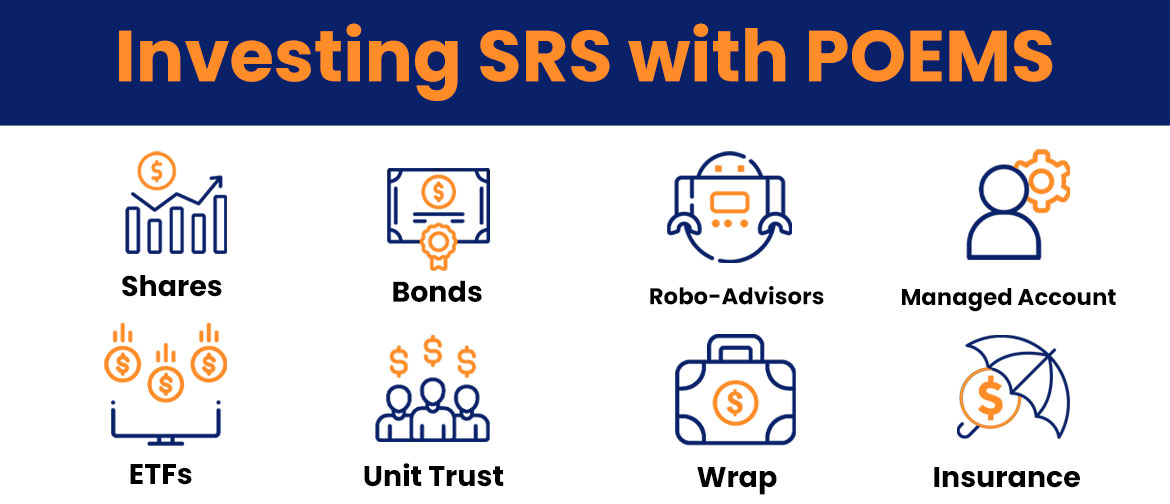

We have the widest range of financial products on SRS

What is SRS?

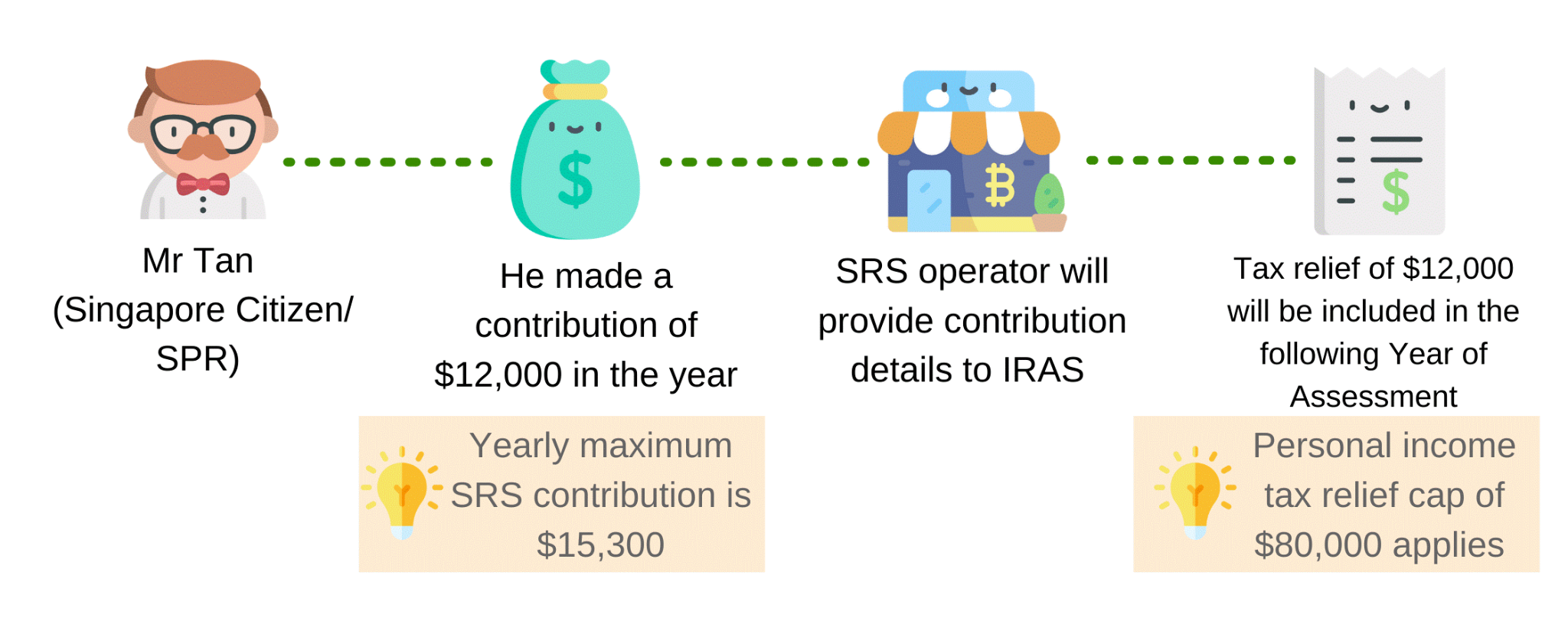

Introduced on 1 April 2001, the Supplementary Retirement Scheme (SRS) is part of the Government’s multi-pronged strategy to address the financial needs of a graying population. It is a voluntary scheme that complements the CPF. Participants can contribute S$15,300 (Singapore Citizen/Singapore Permanent Resident) or S$35,700 (foreigner) annually to SRS at their own discretion. The contributions may be used to purchase various investment instruments. The SRS offers attractive tax benefits. Contributions to SRS are eligible for tax relief, investment returns are accumulated tax-free (with the exception of Singapore dividends), and only 50% of the withdrawals from SRS are taxable upon retirement.

Contributions to SRS accounts only earn 0.05% when kept in banks. Investing is an effective way to put your money to work and potentially build wealth. Why not invest to plan well for your retirement?

At a Glance

- Enjoy tax savings for every dollar saved into the account

- Accumulate tax-free gains from investing SRS funds

- Freedom to invest SRS to boost retirement savings

- Flexibility to withdraw funds anytime

- 50% tax concession on withdrawals

How SRS gives you tax savings

Who is eligible to open an SRS account

Singapore Citizens, Singapore Permanent Residents (SPRs) and foreigners who derive any form of income in Singapore may make SRS contributions in the current year. You must:

- be at least 18 years of age

- Singaporean, Permanent Resident (PR) or foreigner

- not an undischarged bankrupt

How to set up SRS account

Step 1: open a SRS account with one of 3 bank operators:

- DBS Group Holdings Ltd

- Overseas-Chinese Banking Corporation (OCBC) Ltd

- United Overseas Bank (UOB) Ltd

Step 2: Update SRS information with POEMS. Click here for steps.

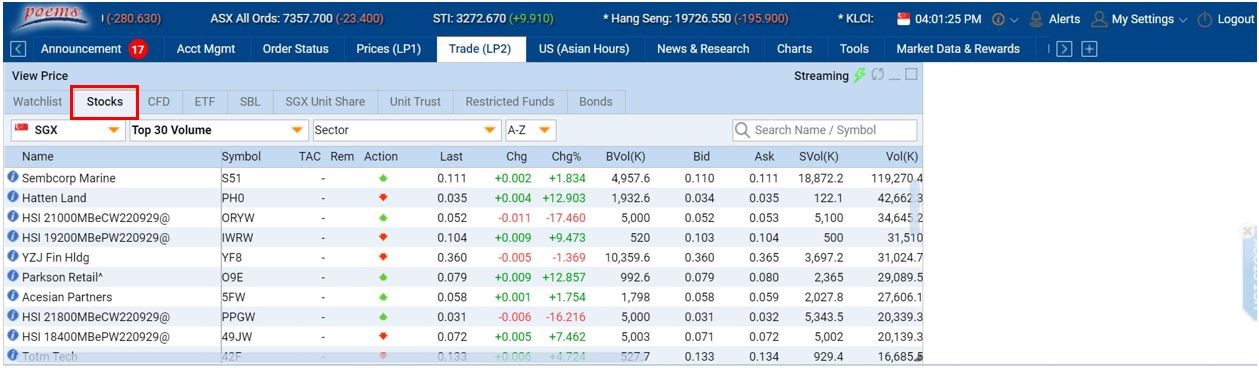

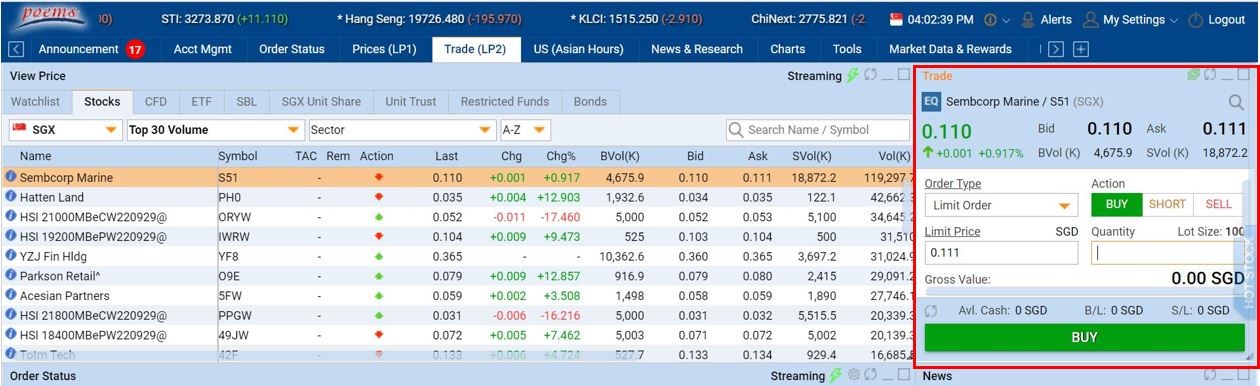

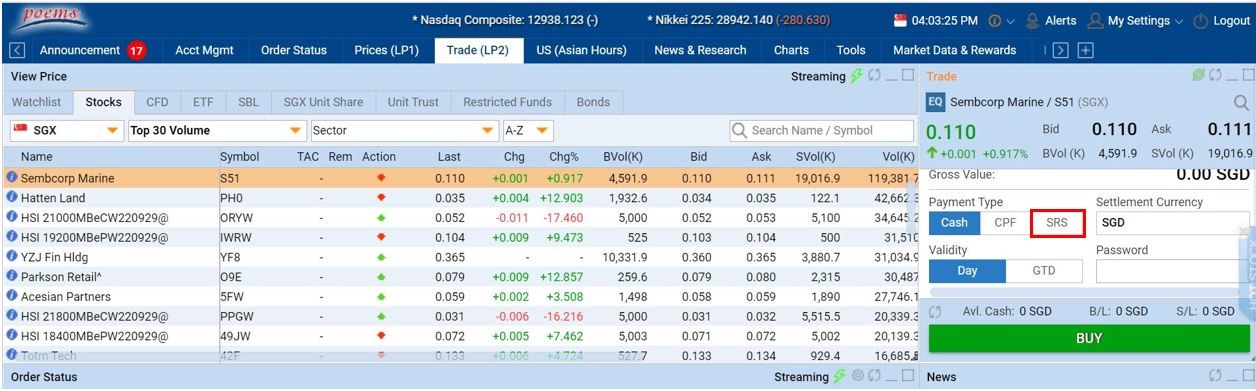

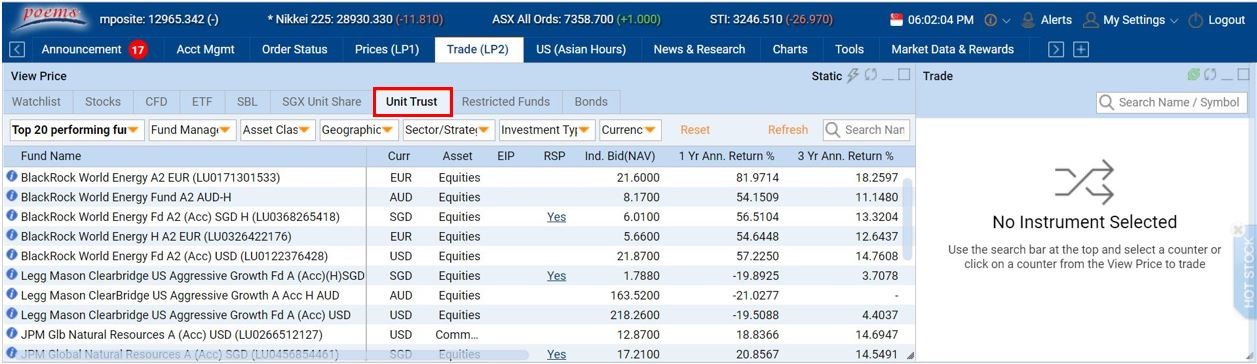

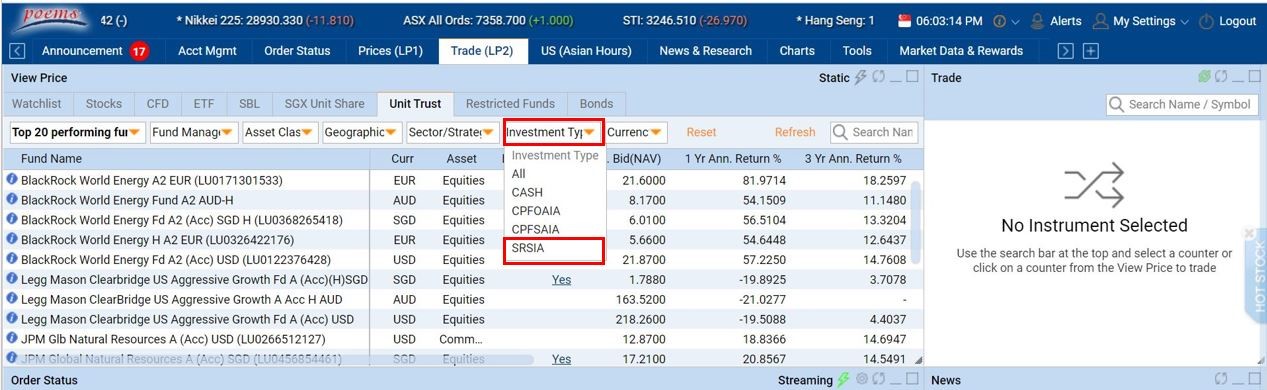

Step 3: log into POEMS to invest Stocks, bonds, unit trusts