“股”有所“值”:关注二季度港股价值股 May 24, 2024

经过长时间的低迷,香港市场开始回暖。恒生指数突破了约17200点的关键阻力位,暗示着投资者情绪可能出现转变。这一出色表现可能受到多种因素的推动,从战略投资决策到经济预期的改善。

我们将探讨可能导致市场复苏的具体事件,并简要分析支持性政策和外国资本流入的作用。随后,我们将审视影响投资者决策的更广泛经济环境。除此之外,许多投资者也渴望抓住潜在的投资机会;因此,我们还将深入探索香港市场中的具体股票选择,重点关注那些可能从这一乐观情绪中受益的公司。

自2021年以来,香港股市一直处于熊市,投资者信心减弱,拖累恒生指数下跌。这与中国的不确定时期相吻合,而中国是香港股市的主要驱动力。然而,最近中国市场监管机构的支持承诺带来了乐观情绪,暗示香港市场可能出现转折点。自2024年2月以来,通过香港股票连接进入中国市场的外国资金稳步增加,这也表明外国对中国市场的兴趣有所回升。

随着美国市场相对于全球市场显得越来越昂贵,许多投资机构正在战略性地调整配置,寻找价值。这一转向优先考虑被低估的市场,特别是亚洲市场。同样,越南和泰国等新兴亚洲市场也因其长期增长前景和较高的回报潜力而受到关注。

在国内,香港的宏观经济数据显示出微弱的改善,预计国内经济将继续适度复苏。在国际上,市场普遍预期美联储将在六月加息。这一潜在的举措可能会创造一个更有利的环境,使投资者撤出美国市场,转而寻找被低估的市场,从而对香港股票有利。

截至2024年4月29日,恒生指数在2024年4月转正,年初至今上涨近4%,突破了17200点的重要阻力位。下一个阻力位在18200点左右。

Figure 1: Hang Seng Index, Source: TradingView, As of 2 May 2024

Figure 1: Hang Seng Index, Source: TradingView, As of 2 May 2024

对于新进入香港市场的投资者来说,价值导向的方法可以是一个良好的起点。价值股往往比成长股波动性小,这有助于不熟悉特定市场动态的投资者降低风险。

经验丰富的香港投资者也可以利用这一点,顺势而为。

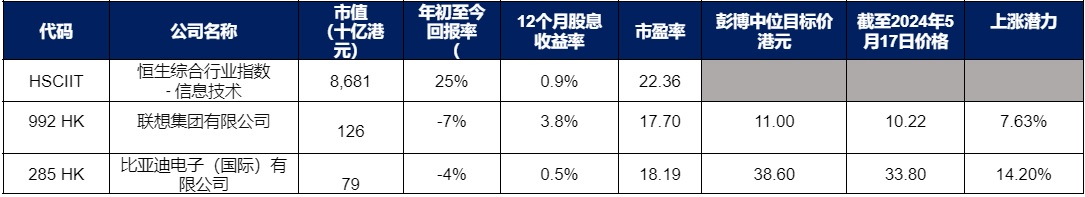

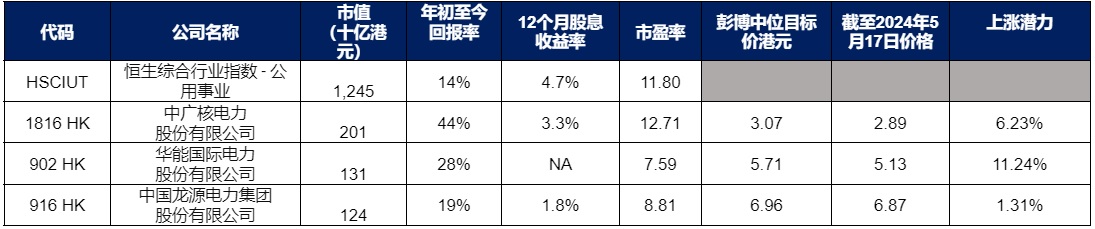

为了降低投资于看似被低估但可能无法实现预期回报的公司(即价值陷阱)的风险,我们在香港市场的各个行业中挑选了具体股票。这些选择基于正向收益、较低的市盈率(P/E)和较高的股息收益率等标准,提供了资本增值的潜力,同时保持适度的风险水平。

行业内被低估的公司与行业指数的比较

上涨潜力是用彭博目标价中位数除以截至 2024 年 5 月 17 日的最后成交价得出的。

金融业

能源业

信息技术

材料

工业

非必需性消费

必需性消费

医疗保健

电信业

公用事业

在未来几周,我们将提供行业细分和具体公司评估,帮助您把握香港市场的这一潜在机遇。

如果您想了解更多有关香港市场价值股的信息,欢迎点击链接报名由香港辉立证券董事兼知名大咖“黄师傅”黄玮杰先生带来的线上英文讲座!

此外,我们还有一个好消息与您分享!为了庆祝香港市场的复苏潜力,我们很高兴地宣布,POEMS 将举办港股特别抽奖活动!点击此处了解更多活动详情!在投资港股把握上升潜力的同时,千万不要错过这个赢取大奖的机会!

免责声明:

这些评论仅供一般传阅,并不考虑任何人的具体投资目标、财务状况和特殊需要。因此,对于任何人根据这些信息直接或间接造成的任何损失,本网站不作任何保证,也不承担任何责任。在承诺投资于本文提及的任何投资产品之前,您应考虑您的具体投资目标、财务状况或特定需求,就该产品是否适合您寻求财务顾问的意见。

这些评论中表达的观点如有变更,恕不另行通知。投资须承受投资风险,包括可能损失投资本金。任何基金单位的价值及其收益均可升可跌。本评论中使用的过往业绩数字以及任何预测或预报并不一定代表未来或可能的业绩。

Phillip Securities Pte Ltd (PSPL)、其董事、关连人士或雇员可能不时在本评论提及的金融工具中拥有权益。

这些评论中包含的信息是从公开来源获得的,PSPL 没有理由认为这些来源是不可靠的,这些评论中包含的任何分析、预测、推测、预期和意见(统称为 “研究”)都是基于这些信息,并且仅表达信念。PSPL 未对这些信息进行核实,也未对这些信息或研究的准确性、完整性或核实性做出任何明示或暗示的陈述或保证,或应依赖于这些信息或研究。这些评论中包含的任何此类信息或研究可能会发生变化,PSPL不承担任何责任来维护所提供的信息或研究,或提供任何与之相关的更正、更新或发布。在任何情况下,PSPL均不对因使用所提供的信息或研究而可能产生的任何特殊的、间接的、附带的或后果性的损害承担责任,即使PSPL已被告知可能会产生此类损害。这些评论中提及的公司及其雇员对任何错误、不准确和/或遗漏概不负责,无论这些错误、不准确和/或遗漏是如何造成的。本文中的任何意见或建议均为一般性意见或建议,如有更改,恕不另行通知。这些评论中提供的信息可能包含对未来事件或国家、市场或公司未来财务表现的乐观陈述。您必须自行对这些评论中提供的信息的相关性、准确性和充分性进行财务评估。

这些评论中描述的观点和任何策略可能并不适合所有投资者。 本评论所表达的意见可能与PSPL其他单位或其关连人士及联系人所表达的意见不同。 此等评论对投资产品或商品的任何提述或讨论纯粹作说明用途,不得诠释为认购、购买或出售所述投资产品或商品的建议、要约或招揽。

本广告未经新加坡金融管理局审核

关于作者

环球交易部门(亚洲市场)

环球交易部亚洲市场交易团队专注于管理亚洲市场,涵盖大中华地区、马来西亚、日本、泰国等关键地区。除了执行客户订单外,他们还通过市场期刊和在线讲座提供教育内容,为亚洲市场格局提供宏观经济、股票选择和技术分析等方面的见解。

2026 ETF 市场开局展望:原油与恒生指数有望在一月走强

2026 ETF 市场开局展望:原油与恒生指数有望在一月走强  金价节节高,如何“点石成金”?——黄金ETF投资全解析

金价节节高,如何“点石成金”?——黄金ETF投资全解析  稳中求进:缓冲型ETF的运作原理与投资价值

稳中求进:缓冲型ETF的运作原理与投资价值  积微成著:如何利用ETF降低投资成本

积微成著:如何利用ETF降低投资成本