期权 vs 股票:哪个更适合您?选择适合的投资方式,让财富增值更快 April 8, 2025

期权是一种衍生性金融产品,是一种合约,允许投资者通过判断其价格趋势,在特定的时间内,以约定价格购买/卖出标的资产。当市场波动时,期权是一种非常实用的交易工具,可以小博大、对冲持股,和增强潜在收益等。

期权投资虽然提供了更大的灵活性,但也伴随着一定的风险;而且与股票相比,期权投资相对更复杂。因此,我们将一系列地介绍投资期权的相关必备重点知识,揭示期权的机制、风险和潜在益处。本篇文章的最后,也将总结概括其与股票投资的区别,有助于投资者更好地了解两者投资的优劣势。

1. 期权交易

期权是什么?

期权是一种合约,赋予交易者在特定日期,即到期日(Expiration date) 前,以约定价格,即行使价格 (Strike Price/Exercise Price) 买入或卖出标的资产 (Underlying Asset) 的权利,但并不要求必须执行。这意味着当您买入期权时,实质上是购买了买入或卖出标的资产的权利,可选择是否执行;而卖方则有义务按约定条件履行。

5个关键组成因素

期权是一种衍生性金融工具,其价值由标的资产决定,并具有特定的交易规则。理解期权交易,首先要掌握以下 5 个关键组成因素:

- 合约标的资产(Underlying Asset):行使期权时,买卖双方约定交易的相关标的资产,包括股票、外汇、大宗商品等,我们主要关注的是股票期权。

- 期权类型:

- 看涨期权(Call Option):赋予买方在未来某个时间以行使价格买入标的资产的权利。

- 看跌期权(Put Option):赋予买方在未来某个时间以行使价格卖出标的资产的权利。

- 行权价(Exercise Price):期权合约中,约定的交易价格

- 期权金:期权买方向期权卖方支付的成本,例如期权溢价(Option Premium),包括内在价值(Intrinsic Value)和时间值(Time Value)。

- 到期日(Expiration Date):期权合约到期的日期

- 美式期权(American Option):交易者可以在到期日或到期日前的任意一天行权

- 欧式期权(European Option):只能在到期日当天行权

4种基本策略(单边策略)

在期权交易中,投资者可以运用以下 4 种基本单边策略,根据市场预期调整交易方向:

| 看涨期权(Call Option) | 看跌期权(Put Option) | |

| 买入 (Long) |

买入看涨期权(Long Call)

-认为股价会上涨 |

买入看跌期权(Long Put)

-认为股价会跌 |

| 卖出 (Short) |

卖出看涨期权(Short Call)

-认为股价不会上涨 |

卖出看跌期权(Short Put)

-认为股价不会跌 |

期权交易中的风险指标

期权交易的风险指标主要通过Greeks来衡量不同因素对期权价格的影响。

- Greeks

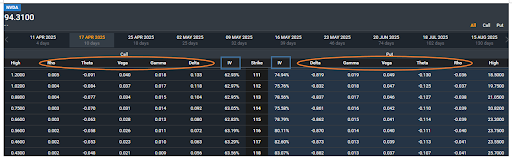

交易期权涉及风险指标,而Geeks一系列的希腊值用于衡量可能影响期权合约价格的不同因素的变量,最常用的有Delta、Gamma、Vega、Theta、Rho等。

Delta- 衡量期权价格对标的资产价格每变化$1而变化的敏感度

- 看涨期权:Delta值在0~1之间,看跌期权:Delta值在 -1~0之间

Gamma

- 有助于确保期权数据的稳定性,衡量标的资产价格变动$1时,Delta的变化大小

- 若Gamma值为1,表示若标的资产价格上涨$1,Delta相应上涨10%

Vega

- 衡量期权对标的资产波动变化的价格敏感度

- 若Vega值为0.2,表示若期权的隐含波动率(Implied Volatility)增加1%,期权价格将相应增加$0.2

Theta

- 在其他因素保持不变的条件下,衡量期权价格对时间(到期日)变化的敏感度

- 若Theta值为0.9,则意味着期权价格每天会下降$0.9,直至到期

Rho

- 衡量期权价格相对于无风险利率()变化的比率

- 若Rho值为0.2,表示若无风险利率每上升1%,则期权价格将上升$0.2

- 隐含波动率/引伸波幅(Implied Volatility,IV)

- 反映了交易者对未来价格波动的预期:较高的隐含波动率通常表示预期标的资产价格波动较大,从而导致期权价格更高。

2. 期权与股票投资的对比

- 股票

股票投资主要通过购买公司股票 (Company Stock) 来获得部分所有权。投资者购买股票后,可享有投票权和分红等福利。股价的波动受供求关系、公司业绩和市场预期等因素的影响。 - 与期权的比较

| 股票 | 期权 | |

| 投资者类型 | 初学者,长期投资者 | 寻求灵活性,和风险管理的活跃交易者 |

| 投资 (资金投入) |

购买股票的初始支出(包括佣金、交易所费用等)

可选择交易碎股,或者整股 |

与等值股票相比,资本投入更少 |

| 潜在风险 | 损失风险:无法保证获得正回报,且有可能会损失全部投资 | 复杂性:涉及各种策略,不仅需要理解市场,还有与标的资产的关系、动态等

损失风险:短期期权可能只能获得短期收益,且由于到期时间有限,执行策略的时间也有限 时间衰减:期权价值对时间非常敏感,越接近到期日,价值将会减少 |

| 优点 | 可获得分红派息

持有期不确定,可长期持有作为长期投资 |

买入时的下跌风险有限

更多投资策略 |

无论是股票投资还是期权交易,各有其独特的优势。股票投资适合追求稳定回报的长期投资者,而期权则为那些希望在市场波动中灵活操作、增加收益或对冲风险的投资者提供了更多机会。通过了解两者的区别和特点,您可以根据自身的风险承受能力和投资目标,选择最符合个人需求的投资决策,开启属于自己的投资之旅!

点击了解更多关于美股期权

📩 有任何问题,欢迎联络我们!

微信|PSPLSG

WhatsApp | (65) 8800 7686

电话 | (65) 6531 1264

电邮 | GMD_China@phillip.com.sg

微信公众号:辉立环球SG

开户无国界,无开户费用,无最低押金

💡 辉立证券优势

- 专业中文交易团队

- 一个账户,交易全球 -交易26个国家及地区股票。包括美国,加拿大,英国,韩国,台湾,越南,澳大利亚,比利时,法国,葡萄牙,土耳其,香港,新加坡,英国, 日本,马来西亚,泰国等等。

- 多元投资商品– 超过40,000种产品任您选择。包括ETF、差价合约(CFD)、美国期权(Options),单位信托基金(Unit Trust)、定期定额储蓄计划等等。

- 中文界面友好,适合华人投资者

- 交易成本低,开户便捷

- 多种联络方式,提供全中文服务

关于作者

关于作者

环球交易部(中文团队)

特别设立的环球交易部中文团队,不仅协助执行客户订单,还通过市场期刊和线上研讨会,为全球华人投资者提供全面的教育支持,包括宏观经济见解、股票选择及技术分析等内容。