免费SGX增强型市场深度工具,帮助您把握新加坡市场良机!

我们听到您的需求了!从2021年5月1日起至2022年3月31日止,所有POEMS客户均有资格通过POEMS交易平台的套件,享受免费使用SGX增强型市场深度工具!

什么是SGX市场深度工具?

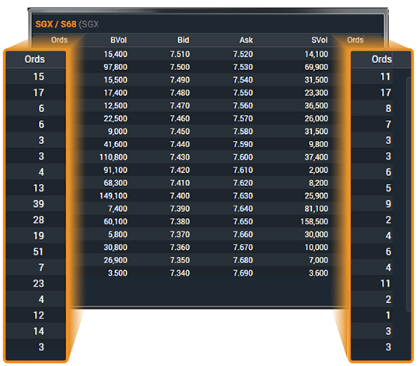

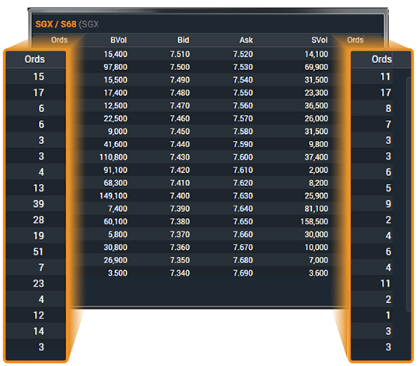

SGX市场深度,也称为二级市场数据,显示某只特定上市证券(例如股票或ETFs)在每个价位级别上的买卖盘订单数量,可显示买卖双方最多20个级别的未决订单。简单来说,这个工具在任何给定的时间内,显示出该时段内买家愿意买入,及卖家愿意卖出某上市证券的不同价格水平。

SGX市场深度显示的是实时价格,显示的订单从开盘前到收盘均在不断地变化。该工具提供的信息,使您可通过察看股票的流动性,优化买卖盘订单,及建立价格支撑/阻力位等手段,来提高您的交易决策能力。

POEMS交易平台上的SGX增强型市场深度工具

您知道辉立证券是首家提供SGX增强型市场深度服务的券商吗?

通过在POEMS 交易平台套件上增加了两栏 (买卖盘订单) 至SGX市场深度,现在,您可以从订单中确定市场的动向,是由散户投资者,还是由机构投资者所驱动的。这些订单表示出在每个价格水平上,累计总成交量的买卖盘订单的数量。

在促销期间内,您可在POEMS交易平台套件上(POEMS 2.0, POEMS Mobile 2.0 and POEMS Pro). 免费使用SGX增强型市场深度工具。无需订阅!

想知道市场深度工具如何助您获得交易优势吗?点击此处注册SGX免费网络研讨会吧,并了解如何运用该工具发挥您的交易优势。

通过OB Trader ,尝试使用市场深度的一键交易吧!

您是否知道您能通过OB Trader 在市场深度上进行直接交易吗?

OB Trader是POEMS 专业版上提供的一个免费交易工具,通过一键交易提供更快的订单提交执行。这可使您在市场深度进行直接交易。通过同一个窗口,设置交易数量,修改及撤回订单。

您可观看以下视频,了解如何使用OB Trader进行交易:

您还可以在此处了解更多关于OB Trader的信息。

开立现金加账户可享受低至0.08%的佣金优惠,交易不设最低佣金限额。现在就开启您与POEMS的投资之旅吧!适用的条款和条件。

我们听到您的需求了!从2021年5月1日起至2022年3月31日止,所有POEMS客户均有资格通过POEMS交易平台的套件,享受免费使用SGX增强型市场深度工具!

什么是SGX市场深度工具?

SGX市场深度,也称为二级市场数据,显示某只特定上市证券(例如股票或ETFs)在每个价位级别上的买卖盘订单数量,可显示买卖双方最多20个级别的未决订单。简单来说,这个工具在任何给定的时间内,显示出该时段内买家愿意买入,及卖家愿意卖出某上市证券的不同价格水平。

SGX市场深度显示的是实时价格,显示的订单从开盘前到收盘均在不断地变化。该工具提供的信息,使您可通过察看股票的流动性,优化买卖盘订单,及建立价格支撑/阻力位等手段,来提高您的交易决策能力。

POEMS交易平台上的SGX增强型市场深度工具

您知道辉立证券是首家提供SGX增强型市场深度服务的券商吗?

通过在POEMS 交易平台套件上增加了两栏 (买卖盘订单) 至SGX市场深度,现在,您可以从订单中确定市场的动向,是由散户投资者,还是由机构投资者所驱动的。这些订单表示出在每个价格水平上,累计总成交量的买卖盘订单的数量。

在促销期间内,您可在POEMS交易平台套件上(POEMS 2.0, POEMS Mobile 2.0 and POEMS Pro). 免费使用SGX增强型市场深度工具。无需订阅!

想知道市场深度工具如何助您获得交易优势吗?点击此处注册SGX免费网络研讨会吧,并了解如何运用该工具发挥您的交易优势。

通过OB Trader ,尝试使用市场深度的一键交易吧!

您是否知道您能通过OB Trader 在市场深度上进行直接交易吗?

OB Trader是POEMS 专业版上提供的一个免费交易工具,通过一键交易提供更快的订单提交执行。这可使您在市场深度进行直接交易。通过同一个窗口,设置交易数量,修改及撤回订单。

您可观看以下视频,了解如何使用OB Trader进行交易:

您还可以在此处了解更多关于OB Trader的信息。

开立现金加账户可享受低至0.08%的佣金优惠,交易不设最低佣金限额。现在就开启您与POEMS的投资之旅吧!适用的条款和条件。

“赠送使用SGX增强型市场深度”促销的条款和条件:

- 1. “推广期”为2021年5月1日至2022年3月31日(包括首尾两日在内)。

- 2. 推广期内,符合条件的客户将可通过POEMS交易平台套件(POEMS 2.0, POEMS 移动端2.0 和POEMS专业版),获得免费使用SGX市场深度工具。“合资格的客户”适用于如下的定义:

- 任何已开设POEMS交易账户的辉立证券私人有限公司(PSPL)的客户

- 任何在推广期内,在PSPL 开立账户的新客户

- 现有的已订购使用SGX市场深度工具的任何账户,其现有的订购将可获得延长3个月的使用期。例如,A客户订购了从2021年10月15日至4月14日的SGX市场深度的使用期。通过此次促销,A客户的SGX市场深度订购,将可延长3个月,使用期从2021年4月15日至2022年7月14日。

- 即使此处包含的任何规定,PSPL保留其绝对酌情权,可在任何时候,在无须事先通知的情况下,(i)作出修改,添加和/或删除此等条款和条件(包括对合资格的条件及标准),并且所有参与者在本规定生效时应受此等修改,添加和/或删除的约束,或 (ii) 更改,撤回或取消任何项目或促销活动,而无需披露其原因,且无需作出任何补偿或支付任何费用。PSPL对与促销有关的所有事宜具有最终的决定,且对所有参与者均具有约束力。

- 通过参与此促销活动,表示参与者确认,其已阅读并同意此等条款和条件。