货币市场基金

为什么要选择辉立货币市场基金(PMMF)?

*基于 FundSingapore.com 中反映的净资产总额 (TNA) 数字 (http://www.fundsingapore.com/screener/basic_search)

回报率(7 日)年化#

0.1633% p.a.

0.2661% p.a.

汇率更新至 12 Apr 2021

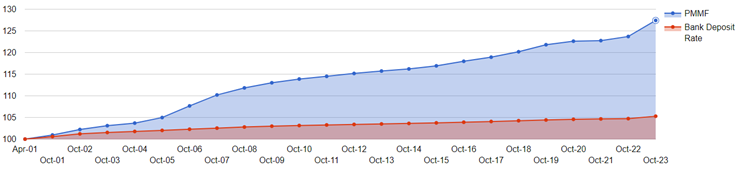

*基于 1 年滚动回报率,净资产/净现值价格。

#基于过去一个月滚动年化回报率的平均值。

过往表现不一定代表未来表现。查看免责声明

有关辉立新币货币市场基金的更多信息,请点击 此处

什么是货币市场基金(MMF)?

货币市场基金是一种开放式共同基金,投资于短期(少于 1 年)、低风险的债务证券,以获得流动性。这是一种低风险的现金投资方式。

辉立货币市场基金(PMMF)旨在保全本金价值并保持高度流动性,同时获得与新币储蓄存款相当的回报。该基金将主要投资于短期、高质量的货币市场工具和债务证券。此类投资可能包括政府和公司债券、商业票据和金融机构存款。

辉立货币市场基金对不同期限的存款进行分散投资,以提高收益。有关当前投资组合的详细分类,请阅读概况介绍。

本基金只适合以下投资者

- 寻求本金保值

- 寻求保持高度流动性,同时获得与新币储蓄存款相当的回报,尽管本基金并非储蓄存款

如何投资于辉立货币市场基金?

您可以通过 “余额增值服务”(SMART Park)投资辉立货币市场基金。您交易账户中的最低余额若超过100 美元,则该资金将自动投资于辉立货币市场基金。

这项服务适用于现金管理账户、预付账户、保证金账户、辉立投资托管账户和辉立环球账户。

您也可以在 POEMS 上购买辉立货币市场基金。

常见问题

货币市场基金将投资者的资金集中起来,投资于货币市场工具(MMI),这些工具是由政府(国库券)、金融机构(存款单)和公司(商业票据)发行的风险相对较低、流动性强且评级较高的短期债务工具。根据定义,MMI 的到期日从 1 天到 1 年不等,但通常少于 90 天。例如,截至 2023 年 9 月,辉立货币市场基金的加权平均到期日仅为 53 天。

这没有一个放之四海而皆准的答案,因为这取决于投资者的风险状况和投资目标。不过,在等待市场出现更好的机会时,货币市场基金是存放多余现金的理想而安全的地方,尤其是在目前前端利率高达 3% 的情况下。

货币市场基金有分不同货币类型,例如新币、美元甚至港币。也有在交易所交易的 ETF 版货币市场基金。

大多数货币市场基金利息都计入资产净值,除非有一个分配类别,货币市场基金可以定期支付利息。

这取决于您如何定义 “好”。对于时间跨度较短,希望保本并获得比银行活期存款更高利率的投资者来说,货币市场基金是现金投资的好去处。由于新币和美元的前端利率分别高达 3% 和 5%,投资者能够以更低的风险获得与股票相当的回报。

Smart Park 又称 “余额增值服务”,是为 POEMS 账户提供的功能之一。在 POEMS 账户中持有货币市场基金的好处之一是每天都能从您的银行账户中获得流动资金。请访问 https://www.poems.com.sg/excess-funds-management/?lang=zh-hans了解更多好处。

货币市场基金可以在市场波动时作为存放多余现金的安全场所。

它们还可以作为一种工具,使您的存款多样化,而不仅仅是银行存款。

虽然没有任何保证,但货币市场基金的亏损风险很低。资金投资于高信用质量的产品,而且这些产品的短期性质也意味着它们不会受到利率上升带来的价格风险的影响。辉立新币市场基金已运行 22 年之久,信用违约和价格缩水记录均为零。

存放多余现金的安全场所,同时赚取可观的收益。

存款多样化的途径。

共同基金是一种类似于单位信托的投资结构,投资者的资金被集中起来投资于一些相关证券。共同基金有股票共同基金、债券共同基金,甚至还有货币市场共同基金。因此,重要的是不要混淆投资结构和基础资产类型。

如图所示,辉立新币货币市场基金等货币市场基金的利率一直远远高于银行存款利率。