促销

我们理解市场可能会上涨或下跌。这就是我们一直无懈地寻找方式来答谢您选择我们。无论是开立账户还是通过我们的交易平台进行交易,我们一直努力完善 为您提供更好的交易方式。

Promotions

Markets can go up and come down.We understand.That’s why we are always fighting to find ways to reward you for choosing us. Whether its opening an account or trading through our trading platform, we are always looking for ways to give you a better deal.

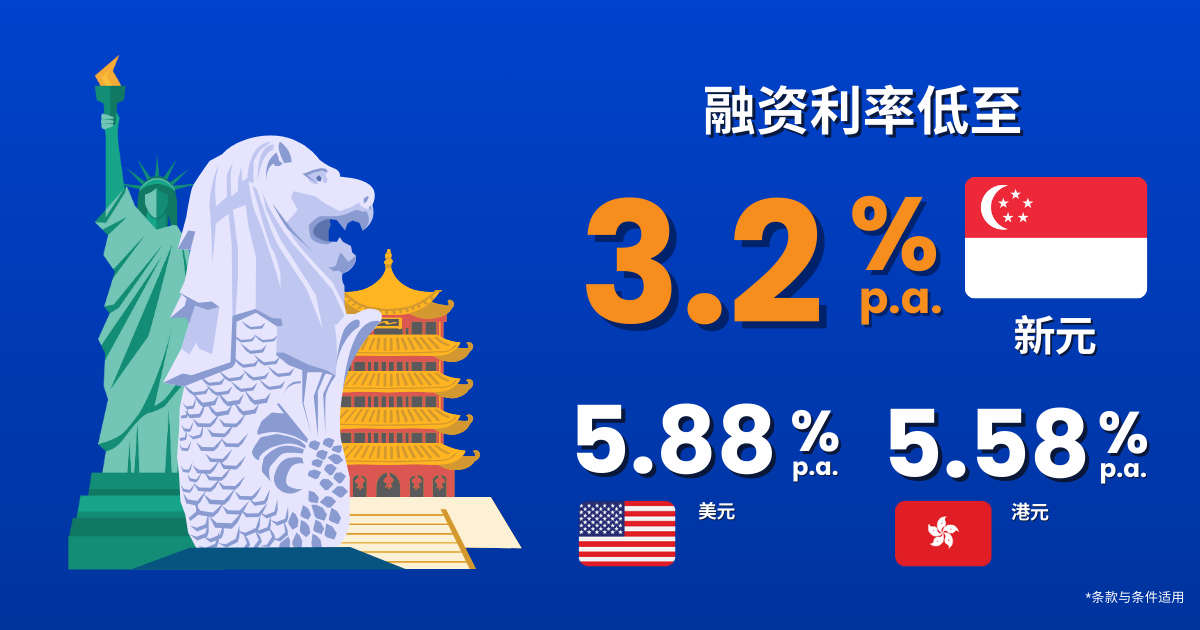

尽享低至 3.2% p.a. 的股票融资利率

开设保证金账户即可享有专属融资利率*!超过 2,000 只股票,最高可获 80% 融资,以及 100 只债券。在 2026 年 7 月 31 日前,交易新加坡股、美股及港股市场,佣金低至 0.18%! *条款与条件适用。

无需支付最低佣金即可交易新交所上市的 ETF!

交易越多,积分越多

| Trade | Earn | Redeem |

通过 POEMS 2.0、POEMS Mobile 2.0、POEMS Mobile 3 和 POEMS Pro 交易股票*,每收取1 新元佣金,即可获得 1 POEMS 奖励积分,感谢您使用 POEMS 进行交易。

*适用于本地市场(单位份额交易除外)和部分海外市场。欲了解更多信息,请参阅我们的条款和条件。

获取专属奖励

作为 POEMS 的尊贵客户, 您可以享有各种专属奖励。用您的 POEMS 积分兑换成各种奖励,包括实时价格、优惠券、杂志和服务。请登录 POEMS 2.0 查看所有奖励项目。

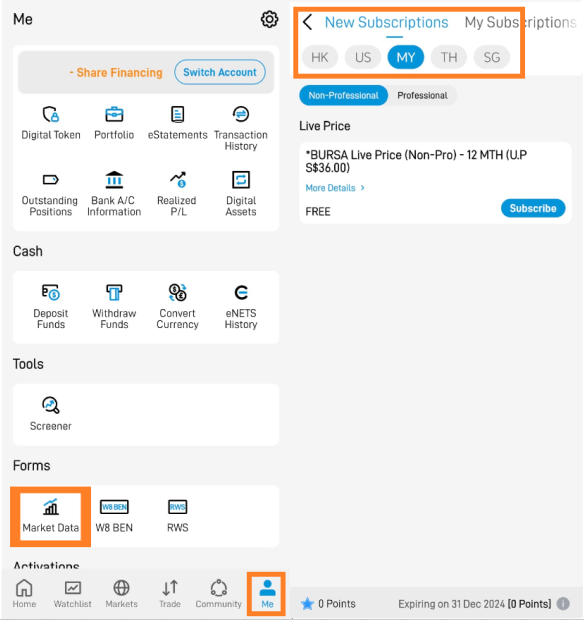

在POEMS Mobile 3 App 中,您可以使用您的POEMS奖励积分兑换来自各种市场的市场数据实时价格。登录 POEMS Mobile 3 App> “我”页面 > “市场数据”图标 > “新的订阅”

奖励积分有效期

您的 POEMS 积分有效期为一年,从积分获得之日算起,即每季度结束时失效。下面举例说明如何操作:

| 获得的积分 | 积分有效期 |

|---|---|

| 2023年2月27日 | 2024年3月31日 |

| 2023年5月25日 | 2024年6月30日 |

| 2023年8月12日 | 2024年9月30日 |

| 2023年12月21日 | 2024年12月31日 |

| 2024年1月29日 | 2025年3月31日 |

常见问题

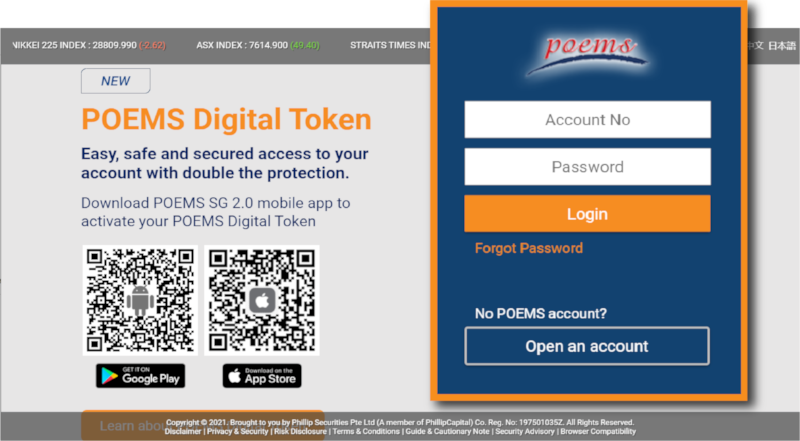

- 登录 POEMS 2.0

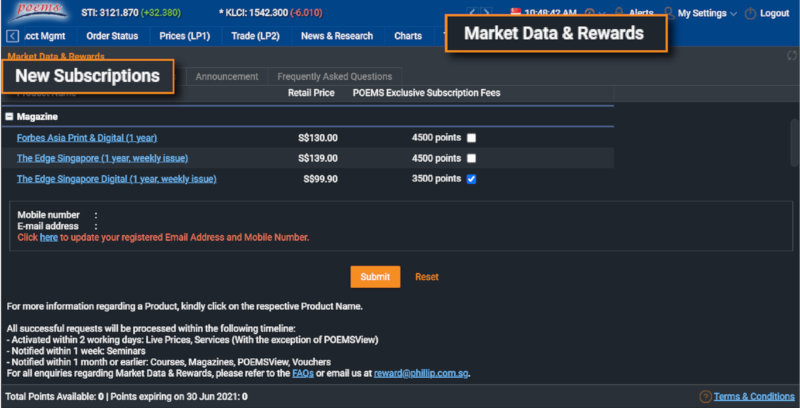

- 单击 "市场数据和奖励 "选项卡,然后单击 "新订阅 "子选项卡

- 左下角显示可用总积分

- 在 POEMS 2.0 中,单击 "市场数据和奖励 "选项卡,然后单击 "新订阅 "子选项卡

- 点击旁边的复选框,选择要兑换的产品

- 从下拉列表中选择订阅月数(如适用)

- 点击下面的 "提交 "按钮

- 查看您的兑换申请

- 点击旁边的复选框确认您的电子邮件地址(如适用)

- 点击 "确认 "按钮提交兑换申请

注意:

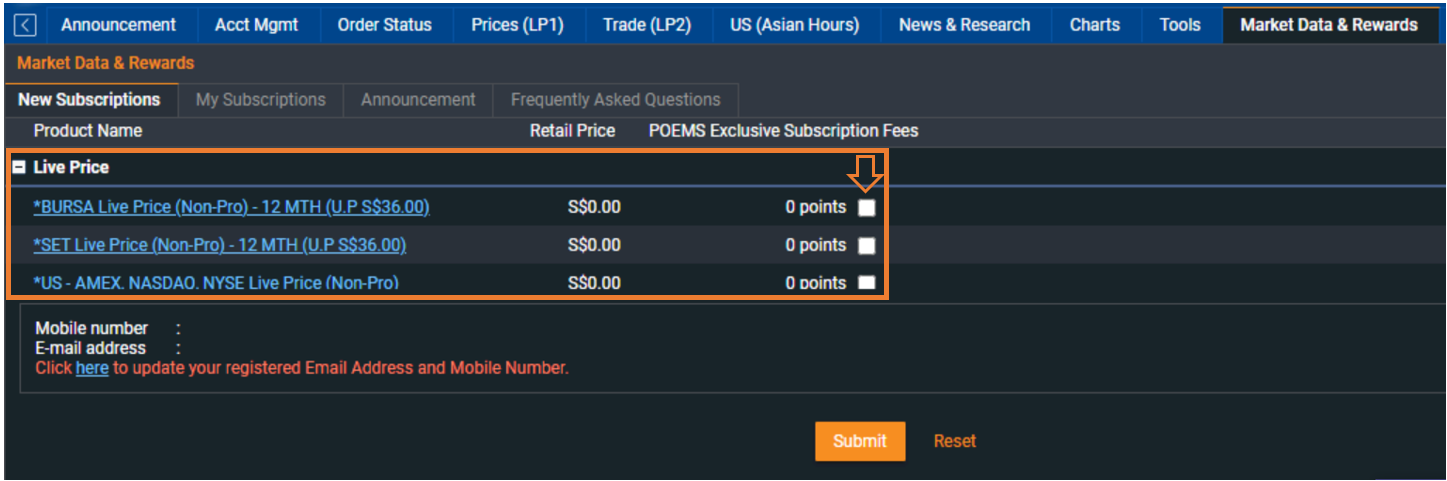

对于现场价格(非专业),您需要在点击复选框后填写在线协议表。

对于现场价格(专业),请单击 "协议 "链接并完成指定步骤。请注意,认购人将承担申报专业投资者或非专业投资者身份的所有责任,如果申报不正确,将承担所有适用的罚款和/或交易所费用。请注意,如果您希望在订阅到期日之前终止任何服务,则不会退还未使用部分的订阅费用。

奖励积分仅适用于通过POEMS 2.0、POEMS Mobile 2.0、POEMS Mobile 3及POEMS Pro在本地市场(以单位股或碎股进行的交易除外)及指定海外市场(纽约证券交易所、美国证券交易所、纳斯达克、香港交易所、证券交易所、新加坡证券交易所、东京证券交易所、伦敦证券交易所、上证交易所-A、深证交易所-A)进行的股票交易。

由您的交易代表撮合或协助进行的交易将不符合赚取POEMS奖励积分的资格。