Trade Gold for Gold

Be the top SPDR Gold Shares trader and win a ½ oz PAMP Gold Bar (worth S$3,000*)

Welcome Gifts for New Customers

Open a Cash Plus Account with SMART Park opt-in can enjoy rewards up to S$1,888!

Amova selected ETFs via Share Builders Plan Cash Back Promotion from 06 Jan 2026 – 31 Mar 2026!*

Receive S$30 Bonus Credits per S$300 Regular Investment into Amova ETFs!* Up to S$150*

Claim Your $10 Singapore Depository Receipts (SDR) Coupon and Maximise Your Trades!

Redeem your coupon and trade SDRs within the month to receive S$10 Cash Credit. First come, first served!

Enjoy our CDP Mass Share Transfer Promotion for a limited time till 31 Mar 26

Submit your request now and earn up to S$1,888 worth of SMART Park Credits

Earn Up to S$600 in Rewards!

Your Referee will Enjoy Free Trading & Live Prices, and Free Stock Coupons! From 12 January 2026 onwards. T&Cs Apply.

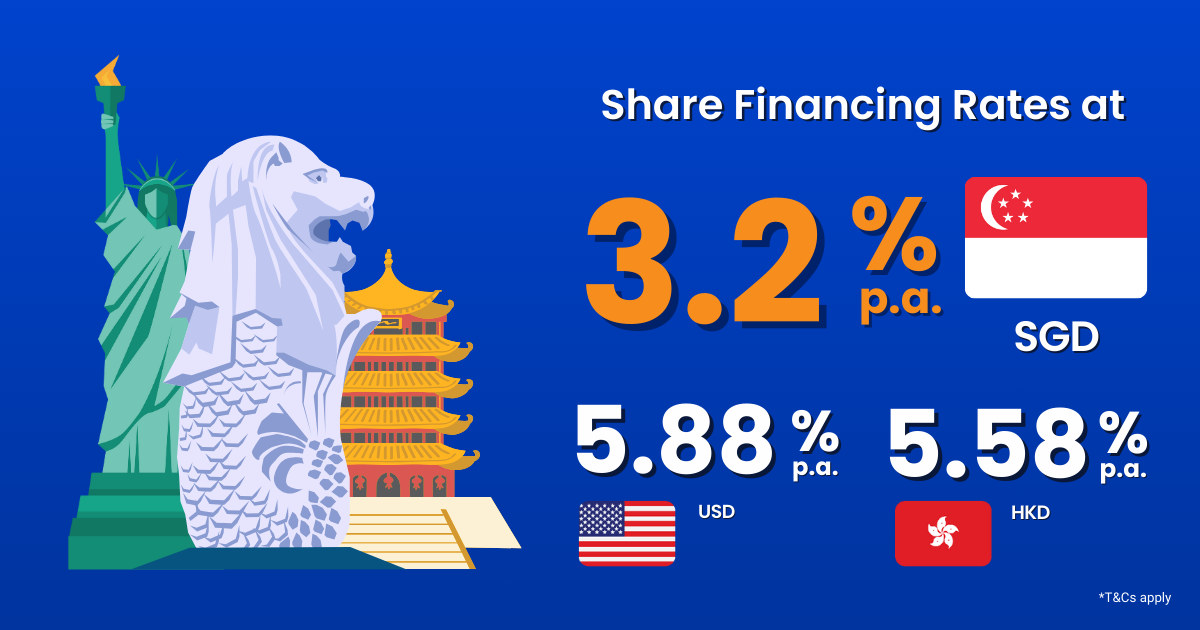

Enjoy Share Financing Rates from 3.2%p.a.

Open a margin Account to enjoy exclusive financing rates*! Receive up to 80% financing for over 2,000 stocks and 100 bonds. Enjoy commission rates from 0.18% for SG, US & HK markets until 31 July 2026! T&Cs Apply.

Maximise Your US Market Access — Now Even More Flexible on POEMS

From 9am SGT to after hours, trade the US Market on your time

Enjoy 5 Free US Fractional Trades Every Month and more!

This offer is only applicable to investors aged 18 to 25 years old.

Use your POEMS Reward Points to donate for a better cause with Community Chest

S$50 ComChest Donation Voucher can be redeemed with 2,500 POEMS Reward Points

Transfer in your Unit Trust and Receive up to S$1,000!*

Extended till 31 Mar 2026: Receive up to S$1,000* when you transfer in your Unit Trust Funds.

Trade Stocks & Get Rewarded with us!

Redeem FairPrice & Shopee E-Vouchers with your POEMS Reward Points! T&Cs Apply.

Income Insurance Share Liquidity Program (IISLP)

Click here for the latest developments including the Trade Date of the first tranche.

Be rewarded when you trade on POEMS

Start trading on the POEMS suite of platforms to enjoy exclusive perks and benefits today!

Trade More to

Earn More Points

| Trade | Earn | Redeem |

For every S$1 commission by trading equities* via POEMS 2.0, POEMS Mobile 2.0, POEMS Mobile 3 and POEMS Pro, you will be awarded 1 POEMS Reward point as an appreciation for trading with POEMS.

*Applicable for both local and selected foreign markets. For more information, please refer to our Terms & Conditions.

Get Exclusive Rewards

As a valued POEMS customer, you are entitled to a variety of exclusive benefits.

Redeem your POEMS Reward points with a selection of items including live prices, vouchers, magazines and services.

For POEMS Mobile 3, you may redeem your POEMS Reward points with a selection of Market Data live prices from various markets.

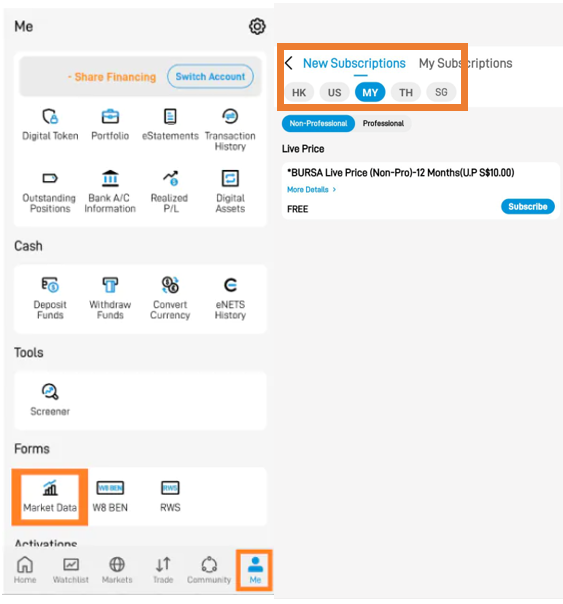

Login to POEMS Mobile 3 App -> under “Me” tab -> Click on “Market Data” icon -> “New Subscription”.

Reward Points Validity

Your POEMS reward points have a validity period of one year. They will expire one year from the date they are earned, at the end of the calendar quarter. To show you how that works, here is an example:

| Points Earned On | Points Expiry Date |

|---|---|

| 27 February 2025 | 31 March 2026 |

| 25 May 2025 | 30 June 2026 |

| 12 August 2025 | 30 September 2026 |

| 21 December 2025 | 31 December 2026 |

| 29 January 2026 | 31 March 2027 |

Frequently Asked Questions

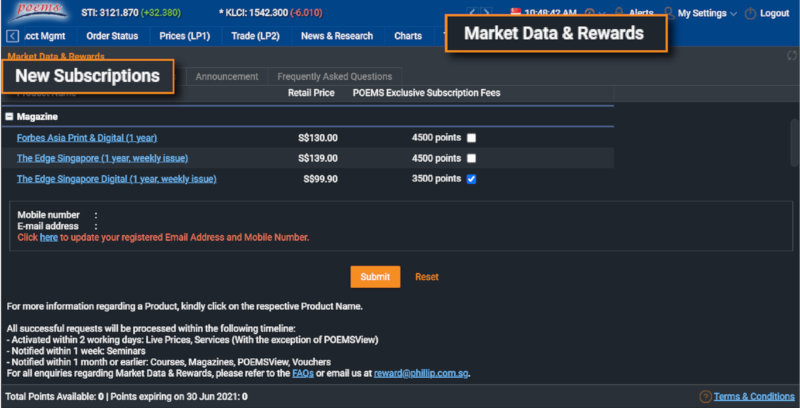

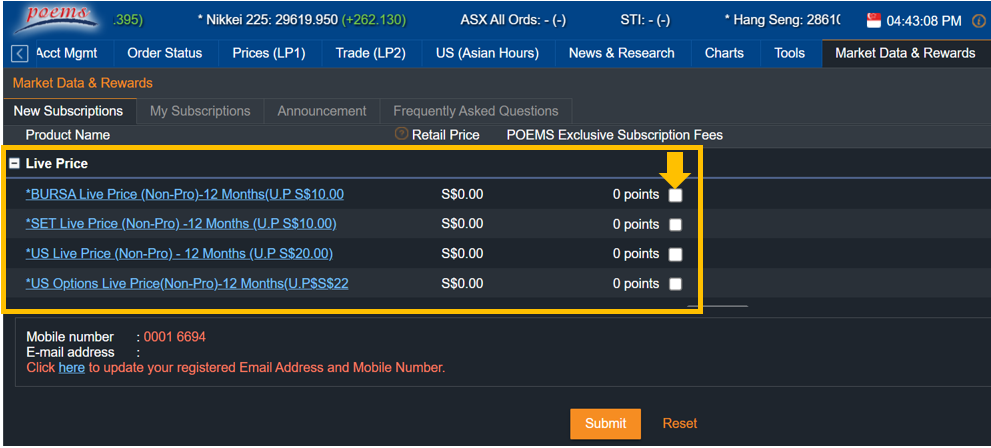

Subscribe to Market Data & Rewards* on POEMS 2.0

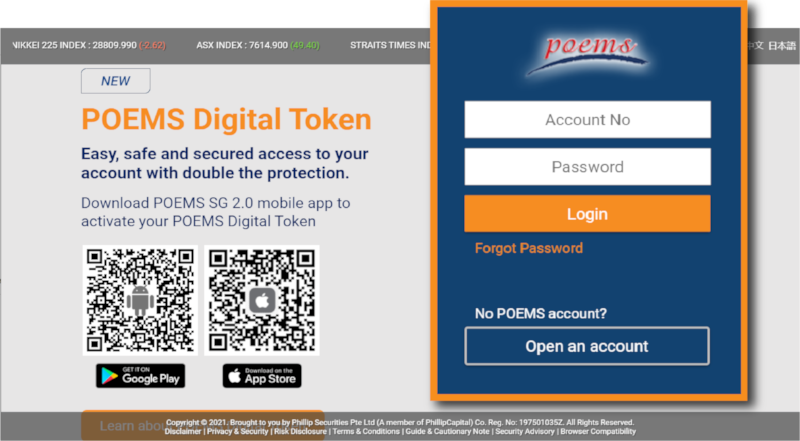

Login to POEMS 2.0 --> Market Data & Rewards --> New Subscriptions

- Click on the Market Data & Rewards tab, then click on the New Subscriptions subtab

- Select the product that you want to redeem by clicking on the checkbox next to it

- Fill out any required subscription agreement forms and select your subscription duration if needed

- Click on the ‘Submit’ button

- Review your redemption request and, if required, tick the email/mailing address checkbox

- Click 'Confirm' to complete your redemption

Subscribe to Market Data on POEMS Mobile 3 App

- Login to POEMS Mobile 3 App --> “Me” tab --> Market Data --> New Subscription

- Select the subscription duration from the dropdown list (If applicable)

- Click ‘’Subscribe’’ on the desired product and select ‘’Point’’ as the Subscription Method

- Click ‘’Submit’’ and review your redemption request

- Click on the "Confirm" button to complete your redemption

Your Total Points Available will be deducted upon successful redemption. Please note that upon successful redemption, no amendment and/or refund requests can be made.

*Rewards redemption is only available on POEMS 2.0

The reward points will only be awarded for equity trades done via POEMS 2.0, POEMS Mobile 2.0, POEMS Mobile 3 and POEMS Pro on both local and selected foreign markets (NYSE, AMEX, NASDAQ, HKEx, SET, Bursa, TSE, LSE, SSE-A, SZSE-A).

Trades that were keyed or assisted by your Trading Representative will not be qualify for POEMS Reward points.