Title: Oxley’s 6.9% Exchange Offer to the New 7.25% Notes

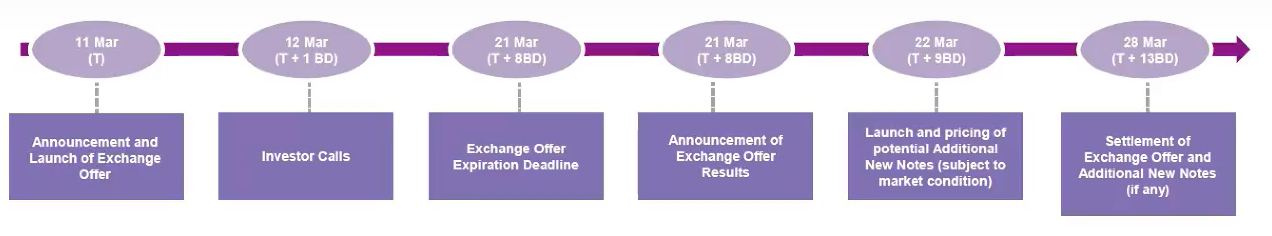

On 11th March 2024, Oxley announced the exchange offer for their bondholders to exchange their existing Oxley 6.9% 8July2024 notes for the new 7.25% notes. The exchange offer came just 4 months before the maturity date of the current 6.9% notes on 8th July 2024. The new notes are expected to be issued on 28th March 2024 with a slightly higher coupon rate of 7.25%. Additionally, there will be 3 coupon payments for the new notes payable on 28 September 2024, 28 March 2025 and 28 July 2025 which is also the maturity date.

Overview of New 7.25% Exchange Note

Bond Name: Oxley 7.25% 28July2025

Tenor: 16 Months

Settlement Date: 28 March 2024

Coupon Dates: 28 September 2024, 28 March 2025, 28 July 2025

Hence, should investors consider this offer? Let’s take a closer look.

Quick Company Overview

To refamiliarize ourselves, Oxley Group is a property developer with business presence across six geographical markets including Singapore, the United Kingdom, Ireland, Cambodia, Malaysia and the People’s Republic of China. The Group specializes in the development of quality residential, commercial, industrial and hospitality projects. Oxley is listed on SGX (ticker:5UX) with a market capital of $386.28m as of 14th March 2024. The group does not have any credit rating unfortunately.

Oxley 1HFY2024 Financials

In 1HFY2024, Oxley’s recorded a revenue of $164.4m. This is -63% lower YoY as compared to $438.3m in 1HFY2023. Additionally, its 1HFY2024 revenue was also made up of 38% from its Developed Market sector (Singapore, United Kingdom, and Ireland) and 62% from its Emerging Market sector (Cambodia, Malaysia and Others). The reduction in revenue was due to lower revenue recognized in its Singapore property projects as the projects have been fully sold, hence the reason why its Emerging sector’s revenue was more than its Developed sector this time around. However, the lower revenue was partially offset by higher revenue recognized from its Oxley Tower KLCC project and its hotel operations in Singapore. Also, the group’s reduction in the bank’s borrowings has lowered its finance cost by -28% YoY from $74.2m in 1HFY2023 to $52.8m in 1HFY2024.

Diving into the group’s liquidity, Cash and Cash Equivalents have also fallen by -68% YoY from $152.8m in FY2023 to $48.9m in 1HFY2024 mainly due to the repayment of bank and debts obligation to lower financing costs. As a result, the gearing ratio for the group has improved from 1.62 times in FY2023 to 1.44 times in 1HFY2024 due to lower net borrowings in 1HFY2024. The group’s management has also stated during their exchange meeting that they will remain focused on further lowering their gearing moving forward. The management also shared their cashflow visibility which they indicated that they are expecting cashflows to come in from their Oxley Tower KLCC and Riverscape projects

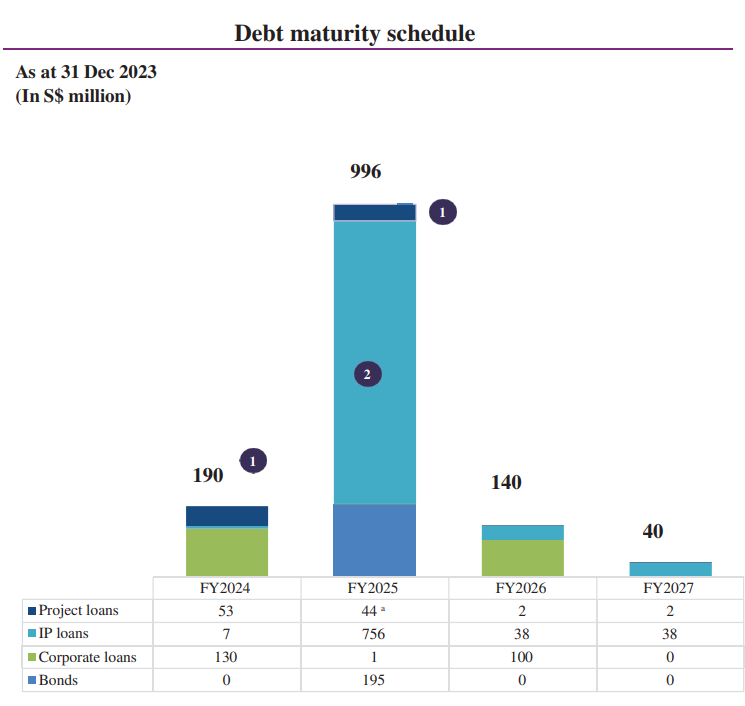

Focusing on the group’s debt maturity schedules, there is a steep tower that will be maturing in 2025 (approx. $996m) which the main bulk is mainly made up of $756m in Investment Properties Loans (IP loans) & $195m in Bonds. Of the $756m IP loans, $684m which are due within the next 12 months comprises the credit facilities of their Novotel and Mercure Singapore, the Rise@Oxley, the office unit of Oxley towers and Space@Tampines. As previously mentioned, as of Oxley’s latest result, the group currently only has $48.9m which will be insufficient to meet these debt obligations. Hence, the group management has sought an Exchange Offer this time around which translates to the $195m that is shown in in FY2025. The management has mentioned that they have already started the discussions on paring down the debt tower in 2025 using the sales proceeds collected from the sold units and asset divestments and are confident in doing so.

Source: Oxley

Cashflow visibility

Within the next 12 months, the Group will receive sale proceeds of approximately S$182 million progressively from Singapore development projects including Riverfront Residences, Affinity@Serangoon, Kent Ridge Hill Residences, Mayfair Modern and Mayfair Gardens. The sales proceeds will be used to pare down the Group’s project loans and corporate loans, and pay off the Remaining Series 004 Notes. The management of Oxley also expects to progressively receive sales proceeds from sold units of overseas development projects mainly Oxley Tower KLCC and Riverscape to come and use the sales proceeds from the sold units to pare down and/or pay off the balance.

Timeline of the Exchange Offer

- 11 March 2024 – Invitation for exchange offer

- 21 March 2024 11.00 a.m. (Singapore time) – Expiration Deadline

- 22 March 2024 – Pricing of the Additional New Issue (if any)

- 28 March 2024 – Settlement Date

For existing Oxley 6.9% note holders, accepting the exchange offer could be an option to consider if the investors still wishes to stay invested in invested in Oxley and wishes to lock in a higher rate for a slightly longer period till 2025, but a note of caution would be the uncertain cashflow visibility coming through in 2025 when their debt tower comes maturity. On the other hand for investors who are more apprehensive about this exchange then he/she should just hold their current 6.9% notes till maturity and wait for the redemption on 8 July 2024.

ID: @349vshmi

ID: @349vshmi