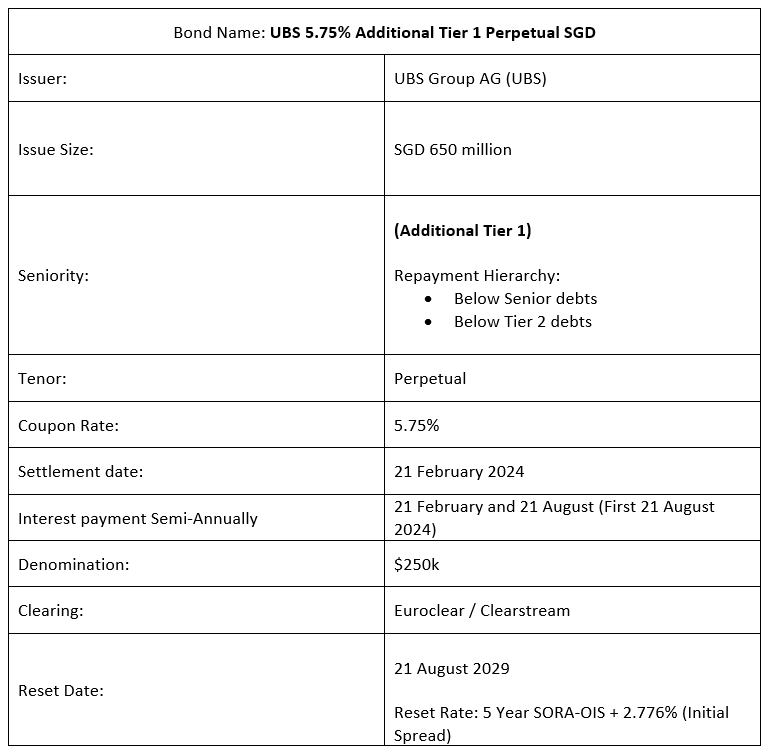

UBS Group recently announced the issuance of its NC5.5 Additional Tier 1 perpetual notes at 5.75%. These bonds will be callable on 21 February 2029 and every interest payment date thereafter. In the event the notes are not recalled by 21 February 2029, the bonds will then be reset at the prevailing Mid-Market Swap Rate (5-year SORA-OIS) plus the initial margin of 2.776%. These bonds come with a semi-annual coupon payment scheduled on every 21st February and 21st August each year, with the first coupon payment commencing on 21st August 2024. The expected rating for this issuance is Baa3/BBB- (Moody’s/Fitch).

(Risk associated with this issuance)

Do note that these bonds’ interest payments are non-cumulative. The notes will be subjected to Loss Absorption Trigger Events such as Write Down and Conversion if UBS’s CET 1 ratio falls below 7%, because these bonds constitute as additional tier 1 capital for the bank.

- Write Down – The full principal amount of, and any accrued and unpaid interest (whether or not due and payable) on, each Note will automatically be written down to zero.

- Conversion – Each note will be redeemed on the applicable Conversion Date by the delivery of new fully paid Ordinary Shares to the Settlement Share Depository on behalf of the Holders and the cancellation of any accrued and unpaid interest on the Notes (whether or not due and payable)

* The Conversion Price is SGD 33.30, subject to adjustment in the circumstances*

Company Overview

Headquartered in Zürich (Switzerland), UBS is a multinational investment bank and financial services company. Its main business sectors constitute Private Banking, Wealth Management, Asset Management, and Investment Banking. As of 16 February 2024, UBS group has a market cap of USD 89.431 billion and a credit rating of A3/A-/A (Moody’s/S&P/Fitch).

4Q2023 Financial

In 4Q23, UBS total revenue increased by +35.2% YoY (from US$8bn in 4Q22 to US$10.8bn in 4Q23) largely due to the consolidation of Credit Suisse revenues of $2.9bn, which included $925m of accretion impacts resulting from Purchase Price Allocation (PPA) adjustments. Operating expenses have almost doubled by +88.5% YoY (from $6bn in 4Q22 to $11.5bn in 4Q23), largely attributable to the consolidation of Credit Suisse expenses of $4.1bn and included total integration-related expenses of $1.7bn.

On the integration-related expenses front, as of FY2023, 33% of the integration cost has been incurred. The management has guided that in FY2024 we should expect an additional 34% increase which brings the total cost being used for integration up to 67%. Despite the doubling in expenses, UBS group has stated that the group will be targeting the achievement of US$13bn gross cost savings by the end of 2026. At the current juncture, 30% of this US$13bn cost savings has been achieved while expecting it to progress to 45% in 2024,75% in 2025, and to be fully achieved in 2026. Hence, moving forward, we should expect UBS’s cost to taper down in the years to come.

Moving onto the credit aspect of UBS, the bank has maintained a CET1 ratio of 14.5% (a slight bump up from 14.4% in the previous quarter). This number is above the regulatory requirement of 10.62% and within the CET1 capital ratio guidance of 14% that the bank announced. Additionally, the bank has a 17% going concern capital ratio and a 36.6% Total Loss-Absorbing Capacity (TLAC). Similarly, these ratios are above the requirement of 14.92% & 25.64% respectively.

All in all, it appears that even after the acquisition of Credit Suisse. UBS’s capital buffer is still well-managed and stays ahead of regulatory requirements. In this latest issuance, the size of this issuance was $650m, and the order book was over $1.65bn (approx. 2.5 times oversubscribed). Thus, it appears that investors are confident in UBS’s acquisition of Credit Suisse and its road map ahead while this confidence was further bolstered by the positive capital buffer that was released in its latest results.

As the primary market for this issuance is already over. Investors interested in snagging some of these bonds on the secondary market can do so by looking at the price that the bond is currently trading on the secondary market through our bond screener. We would like to reiterate that this issuance is considered an Additional Tier 1 capital instrument for the bank (risk as stated at the beginning of this write-up). Hence, investors should be aware of its risk and exercise caution.

Bond Overview

ID: @349vshmi

ID: @349vshmi