- ホーム

- Warrants

Warrants

Why Us?

Why Trade Warrants

What Are Warrants

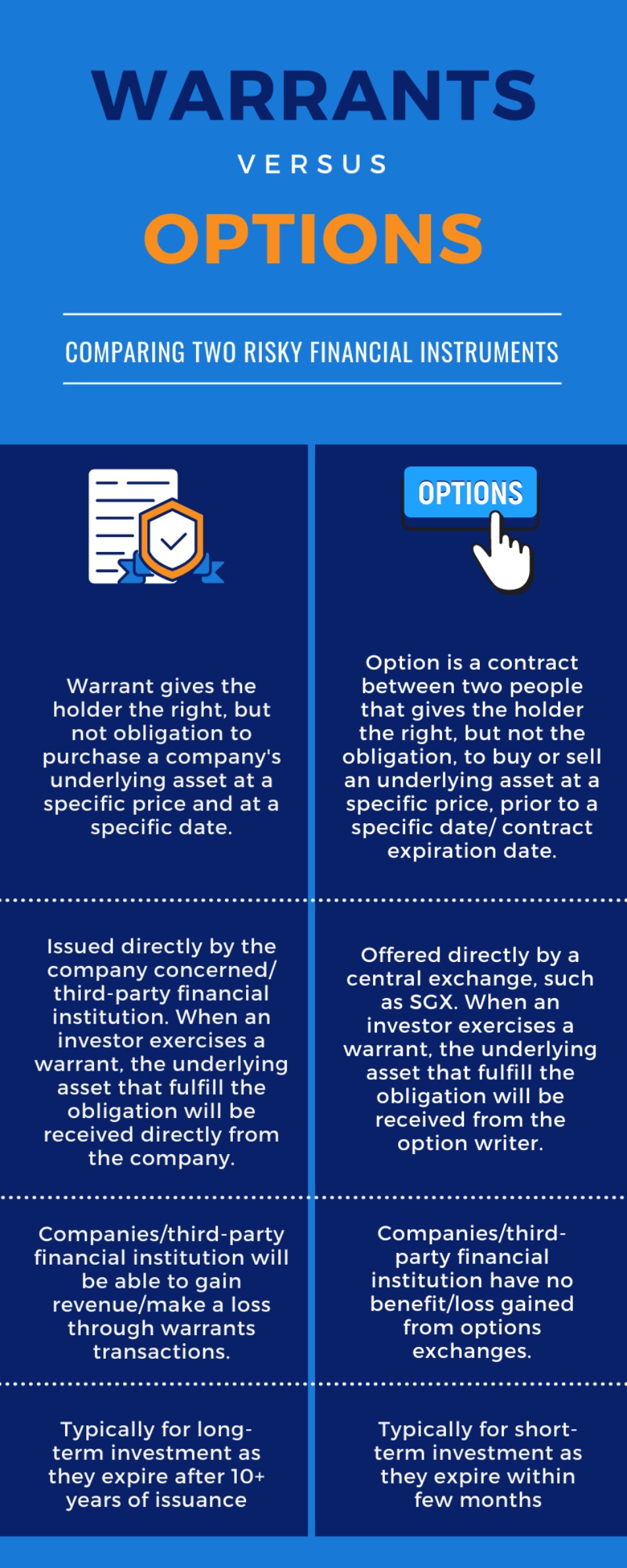

Similar to options, warrants give the holder the right but not the obligation to purchase securities from the issuer at a specific price within a certain time frame. Warrants are a form of derivative – that is, they derive their value from another underlying/reference instrument. These instruments are usually shares and ETFs.

Warrants as financial instruments evolved over time and expanded their ranges, making it harder to specifically define characteristics of all warrants. But one thing for sure is that warrants cover a wide spectrum of risk-return profiles and have diverse investment objectives to meet.

Types of Warrants Available on POEMS

Company warrants are call warrants issued by companies (with their own stock as the underlying) for the purpose of raising capital. Companies are not required to appoint market makers* for the warrants they issue over their own stock. This type of warrants is considered to be suitable for long-term investment and are generally held until expiry by investors.

*The role of market makers is to provide continuous buy and sell quotes in the warrants they are designated for. In doing so, the market makers aim to provide a liquid market for the warrants so that investors can buy and sell the warrants without difficulty during normal trading hours.

Structured warrants are instruments issued by third-party financial institutions (issuers). Under SGX Listing Rules, issuers must appoint market makers* for the warrants they issue. Structured warrants listed on the SGX are designed as a trading tool and are usually not to be held until expiry.

Structured warrants are for investors who are willing to accept the risk of substantial losses up to the principal investment amount, possibly within a very short timeframe. Investors should also have sufficient understanding of the product and should possess either a high level of knowledge or sufficient trading experience to properly evaluate and assess the product structure, associated risks, valuation, costs and expected returns. All investors need to be Specified Investment Products (SIP) qualified to invest in structured warrants.

*The role of market makers is to provide continuous buy and sell quotes in the warrants they are designated for. In doing so, the market makers aim to provide a liquid market for the warrants so that investors can buy and sell the warrants without difficulty during normal trading hours.

Key Features of Warrants

Call or Put Warrants

Structured warrants can be issued either as call warrants or put warrants. Call warrants benefit from an upside price movement in the underlying asset, while Put warrants benefit from a downward trend.

Exercise Price / Strike Price

This is the predetermined price, which is in advance before the structured warrant is listed. It is a price at which the holder of the structured warrant can buy (for a call warrant) or sell (for a put warrant) the underlying asset.

Expiry Date

Structured warrants have a finite lifespan and will lapse on its expiry date.

Exercise Style

Structured warrants can be either American or European-style warrants. Structured warrants listed on SGX are primarily European-style warrants. American-style warrants can be exercised any time prior to and on the expiry date, whereas European-style warrants can only be exercised on the expiry date. Holders of European-style warrants will not be required to deliver an exercise notice. The exercise of such structured warrants will be determined by whether the structured warrant is In-The-Money. If such structured warrant is In-The-Money, the structured warrant will be deemed to have been automatically exercised on the expiry date at the time specified in the listing documentation. If the structured warrant is At-The-Money or Out-Of-The-Money, the structured warrant will be deemed to have expired on the expiry date at the time specified in the listing documentation. Holders of American-style warrants will be required to execute and deliver an exercise notice to the issuer in accordance with the requirements specified in the listing documentation. All investors should refer to the listing documentation for the relevant structured warrant to ascertain how that particular structured warrant is to be exercised.

Conversion Ratio

Conversion ratio (also known as “entitlement ratio”) is the number of structured warrants that a holder will need to buy (or sell) 1 unit of the underlying asset. A structured warrant with a conversion ratio of 5:1 means that 5 structured warrants are needed to convert into 1 unit of the underlying asset.

Underlying Assets

Structured warrants are a form of derivative as they derive their value from an underlying asset, which are the assets that investors have the right to buy or sell. Structured warrants can be issued on a wide range of asset classes. Currently, the structured warrants traded on SGX are issued on local or foreign underlying assets such as equities or equity indices.

Difference between Warrants and Options

Know Your Risks

Due to this characteristic of warrants, investors will need to trade warrants that have sufficient time to match the investors’ market expectations before its expiration.

This occurs when warrants are exercised but the warrant issuer is not creditworthy and unable to fulfill its obligations.

This occurs when a warrant holder is unable to sell his/her warrants for a reasonable price in the market due to insufficient calls.

Similar to other investments in the securities market, the market value of a warrant is susceptible to events that affect its demand and supply, causing its value to fluctuate accordingly.

This occurs when warrant holders have no preferential claim to any assets that an issuer may hold in the event that they are unable to fulfill their obligation

There will be exchange rate risks when the warrant traded is denominated in currencies other than Singapore dollar, meaning the foreign exchange rate will affect the value, price or return of the warrant.

Losses will be multiplied depending on the leverage, resulting in more losses if investors had invested directly in the underlying instrument.

Enquiry

Have an enquiry? Get in touch with us at (+65) 6212 1818 or message us below!