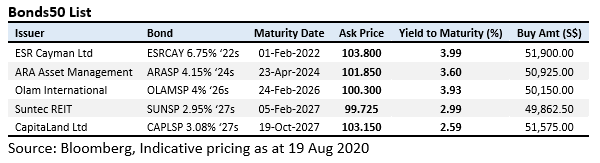

Bonds50 Product Launch: Greater Bond Flexibility

–>

–>

Who can purchase Bonds50?

To trade our new Bonds50, you’ll have to declare as an Accredited Investor, which has the criteria of minimum S$2 million in assets, or S1 million in financial assets, or at least S$300k in annual income. To complete the declaration, please download the form via this link. After completion, email the form (e-signature accepted) with images/scans of the relevant supporting documents (listed in the form) to your Phillip Financial Advisor or Trading Representative for processing. Be sure to be an existing POEMS account holder first. Not yet a POEMS account holder? Open an account online here. **Please select ‘Cash Plus Account’ type as Bonds50 is only available for custodian account trading. Bonds50 are only tradable online on the POEMS 2.0 trading platform. View current prices and place trades for the bonds here:- ARA ASSET MANAGEMENT LTD 4.150% 23Apr2024 (SGD)

- CAPITALAND TREASURY LTD 3.800% 28Aug2024 (SGD)

- CAPITALAND TREASURY LTD 3.080% 19Oct2027 (SGD)

- CLI TREASURY LTD 3.330% 12April2027 (SGD)

- CMT MTN PTE LTD 3.480% 6Aug2024 (SGD)

- HSBC HOLDINGS PLC 5.3% 26Mar 2029 (SGD)

- MAPLETREE TREASURY SVCS 3.400% 3Sep2026 (SGD)

- OLAM INTERNATIONAL LTD 4.134% 24February2026 (SGD)

- SINGAPORE AIRLINES LTD 3.130% 17Nov2026 (SGD)

- SINGAPORE TECH TELEMEDIA 4.050% 2Dec2025 (SGD)

- SUNTEC REIT MTN PTE LTD 2.950% 5Feb2027 (SGD)

- SURBANA JURONG PTE LTD 4.110% 3Oct2025 (SGD)

Why corporate bonds?

Corporate bonds have been largely inaccessible to the larger public other than through retail bonds. This is because of their high denominations of at least S$250k per lot exacting a heavy toll on many peoples’ cash flows. The corporate bond market is large and largely active by institutional investors such as insurance and CPF funds that rely on their promised yields and principal return. With Bonds50, more flexibility is provided to more investors. As it stands, bonds not only play a large part in generating passive and predictable income streams, but they also play key role in hedging investment portfolios. By having bonds in your portfolio, it helps to reduce overall volatility both in terms of portfolio value movement as well as cash flows received. And because bonds have a maturity date, or a date at which your principal is promised back to you, they’re a great alternative to fixed deposits, paying a higher return with lower exit penalties. Higher returns will entail higher risk, though. However, take heart that corporate bonds are generally lower risk than stocks due to their higher rank in the seniority chain. If a company goes bankrupt, bondholders and creditors get paid before shareholders.Important Notes:

- Open Market transactions Bonds50 are Odd Lot sized bonds and may not be able to transact via the Open Market due to smaller denominations.

- Transfer of Custody Bonds50 bonds will not be transferrable out of Phillip Securities Pte Ltd custody due to minimum denomination requirements of clearing systems.

- Rights to Vote As clearing systems only recognize votes cast for securities held in its intended denomination, Phillip Securities Pte Ltd reserves the right to vote, to give instructions or to give consents (or otherwise), on behalf of you, at any meeting or event as conducted pertaining to the security.

- Amalgamation All holdings of the same security will be amalgamated upon settlement.

- Payment for Purchases Your trading account must be pre-funded before any Bonds50 purchases. Funds will be automatically deducted from your trading account ledger upon settlement of the purchase.

- POEMS Account Types available for Bonds50 trading Only custodian based accounts with Phillip Securities are able to trade Bonds50. This includes the Custodian account, Cash Plus account, and Margin account.

- No Bond Financing Bond Financing facilities will not be available for Bonds50.

Bottom Line

With Bonds50, more flexibility is provided to fixed income investors; to build diversified bond portfolios and to access a larger piece of the wholesale bond market. You’ll be able to trade Bonds50 bonds online via our POEMS 2.0 trading platform or through your Financial Advisor at your convenience. Get any of your Bonds50 enquiries answered by emailing Phillip Bond Desk at bonds@phillip.com.sg or contacting us at +65 6212 1818.Get Started Today

Open an Account EnquiryFor assistance, call 6212 1818 | Visit our Phillip Investor Centres

ID: @349vshmi

ID: @349vshmi