Treasury Bonds

:

SGS T-Bills, SGS Bonds, U.S. Treasury

(Details as of 24th February 2023)

Want to get exposure on Treasury Products but not sure how? Fret not as investors are now able to trade Singapore Government Securities and US Treasuries with us with a minimum lot size of SGD250k for Singapore Government Securities (SGS) Bonds and USD200K for US Treasuries bills. For Singapore Treasury bills (T-bills), investors will be able to apply with minimum lot size of SGD100K with us through the primary market, while SGS bonds and US Treasuries will only be available on the secondary market basis.

Do note that Phillip Bond Desk will be charging a 0.1% on the issue price for Singapore T-bills as well as a SGD15 charge if allocation size is less than SGD100k. More details can be found on the Pricing table below.

What are Treasury Products?

Singapore

Singapore Government Securities (SGS) are debt obligations issued by the Government of Singapore to finance its spending and raise funds. They are backed by the full faith and credit of the Singapore Government which offer investors a safe and liquid investment option with predictable returns. Singapore Government Securities are issued in several maturities, ranging from short-term bills (T-bills) to long-term bonds (SGS bonds) and they are widely used as benchmark investments by individuals, institutions, and governments. The Government of Singapore issues SGS bonds and T-bills on a regular basis through public auctions.

United States

Similar to Singapore Government Securities, US Treasury securities are debt obligations issued by the US government to raise funds to finance its operations. Treasuries are considered to be among the safest investments in the world, as they are backed by the full faith and credit of the US government. There are several types of Treasury securities, including Treasury bills (T-bills), Treasury notes (T-notes), and Treasury bonds (T-bonds). T-bills are short-term securities with maturities of one year or less, T-notes have maturities ranging from two to ten years, and T-bonds have maturities of more than ten years. Treasuries are widely used as benchmark investments by individuals, institutions, and governments around the world.

Pricing

| SGS T-Bills | SGS Bonds | U.S Treasury | |

| Trading | Primary | Secondary | Secondary |

| Min Size | SGD 100,000 | SGD 250,000 | USD 200,000 |

| Custody Fee | N/A | 0.05% p.a | 0.05% p.a |

| Fees | 0.10% (Additional SGD15.00 T-bills small size fee if allocated size is less than 100k) | Please refer to POEMS for indicative bid/offer | Please refer to POEMS for indicative bid/offer |

Note:

- Singapore Government Securities (SGS) purchased via wholesale institutional tranche are cleared through MAS MEPS+ system and cannot be sold on SGX retail platform.

- Not Applicable for CPF OA/SA and SRS

Why Treasury Bills/Notes/Bonds?

Treasury Bills are debt obligation issued by the government to fund various public projects. These bills commonly have a short maturity from either 6 months to a year period or for those that has a longer tenor which are normally called notes/bonds. The maturity will tend to span from 2 – 50 years. These securities are widely regarded as low-risk and secure investments which is a good option for risk adverse investors who wish to park their idle funds to grow some interest.

How to trade SGS Bonds and US Treasuries with us? (Secondary Market)

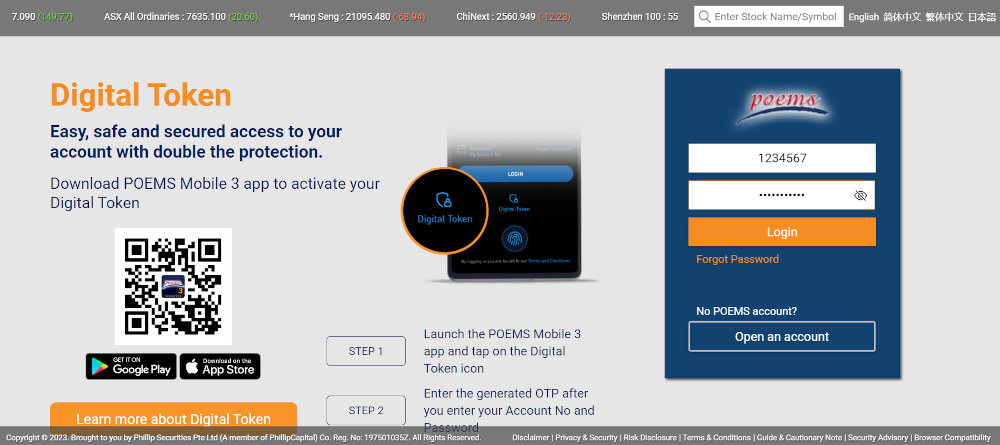

Firstly login into your Poems account

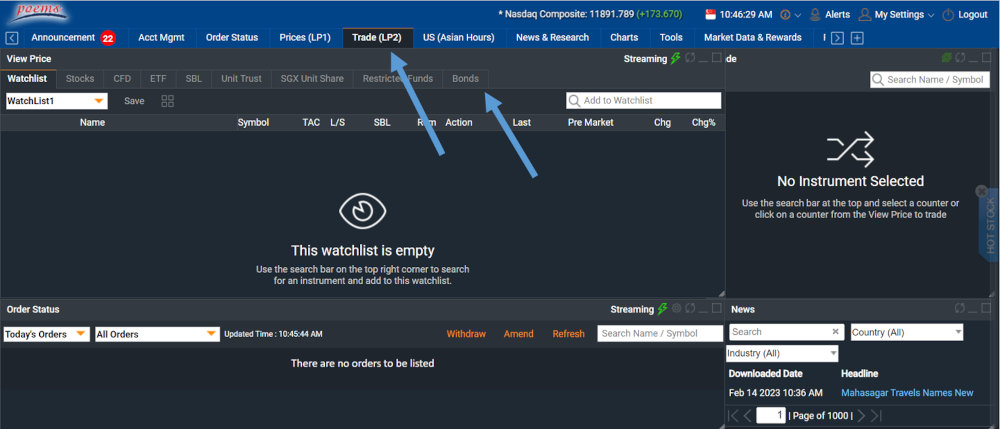

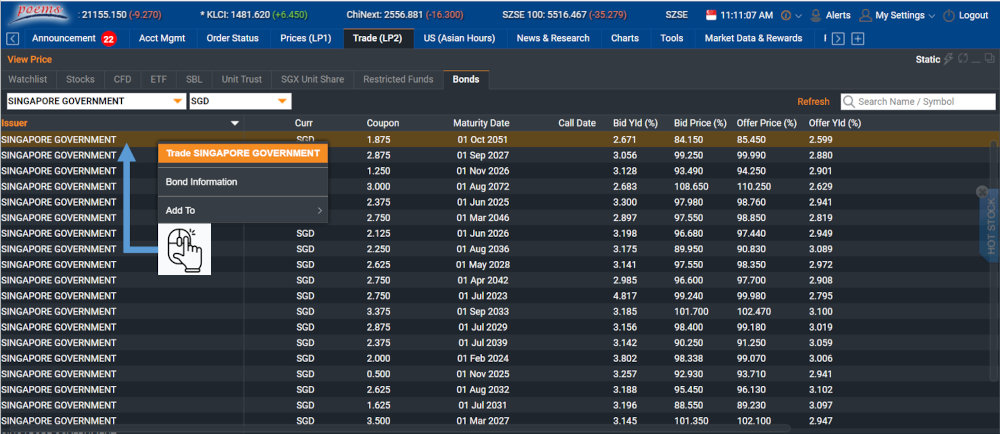

Once you have logged into your Poems account, click on “Trade (LP2)” and select the Bonds tab

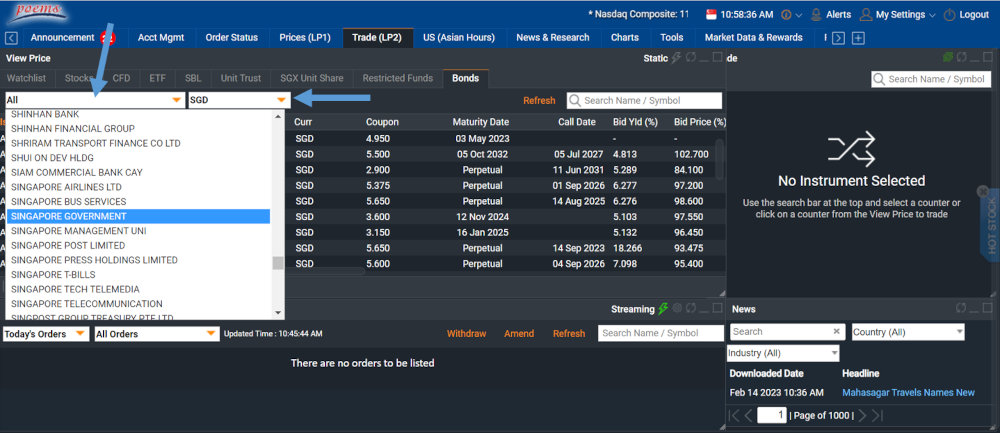

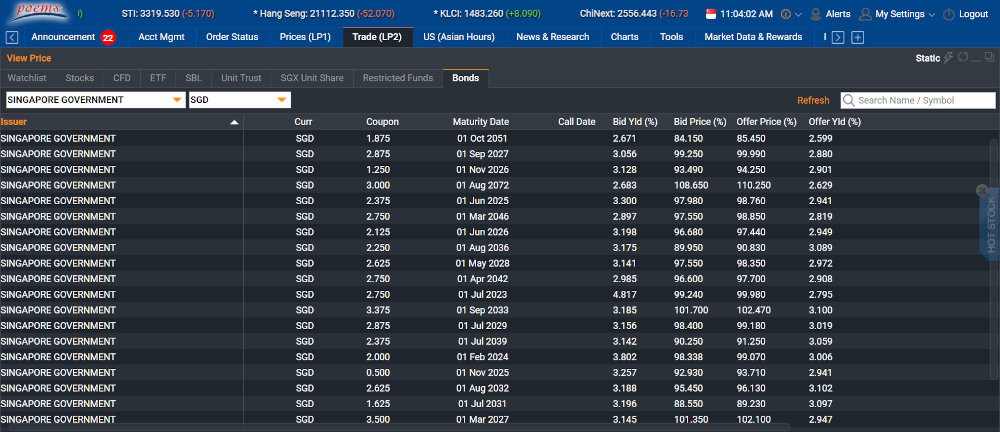

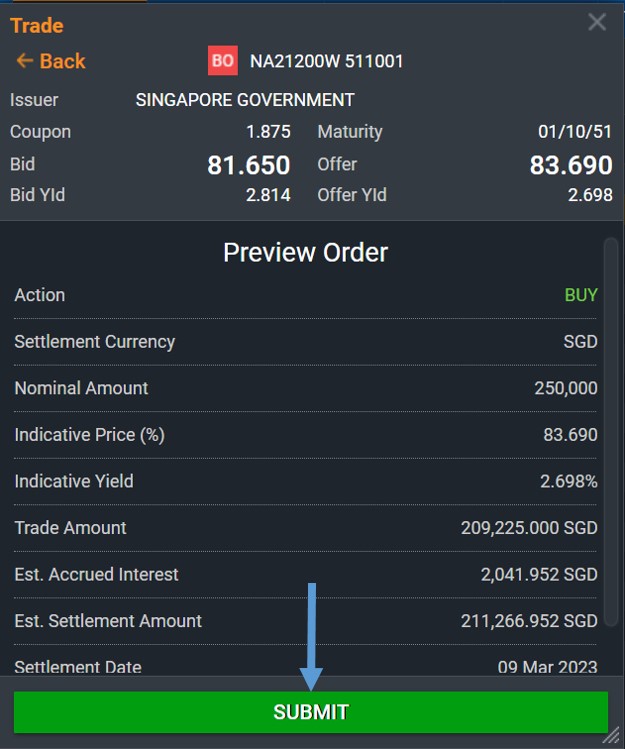

For secondary trading of Singapore Government Securities (SGS) Bonds:

- Click on the Issuer tab and select “Singapore Government”

- Currency select “SGD”

An array of SGS bonds that are currently trading on the market will be displayed.

Right click on a particular bond that you are interested in and click on “Trade XXXX”

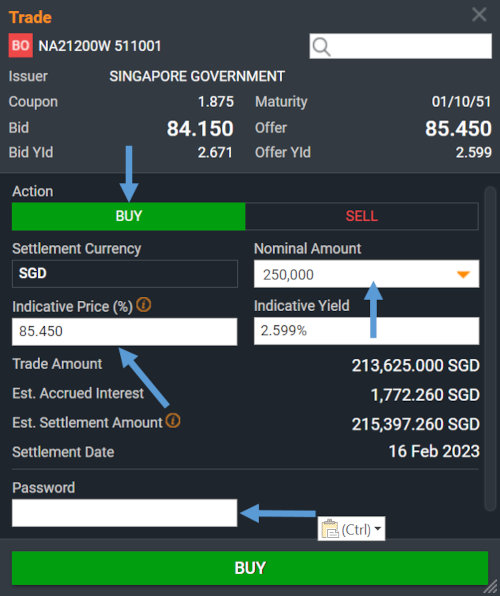

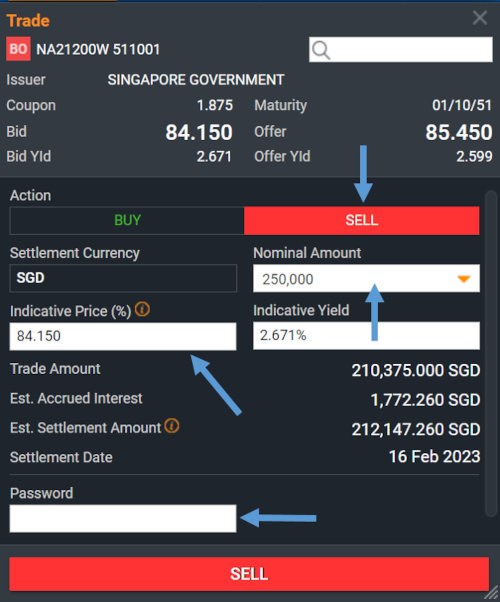

Next, select Buy or Sell while indicating the Nominal Amount and Price that you are looking for and finally type in your password to place an order with us!

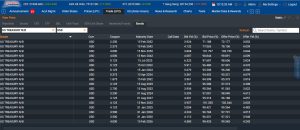

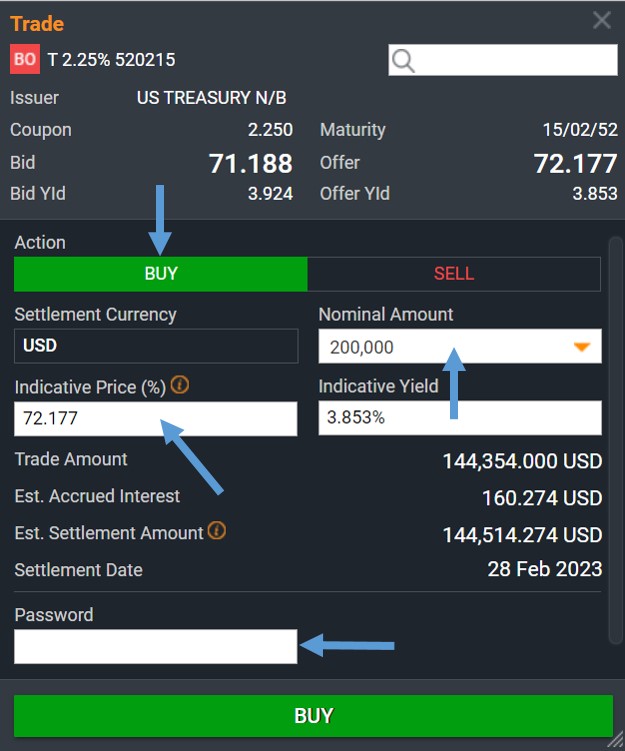

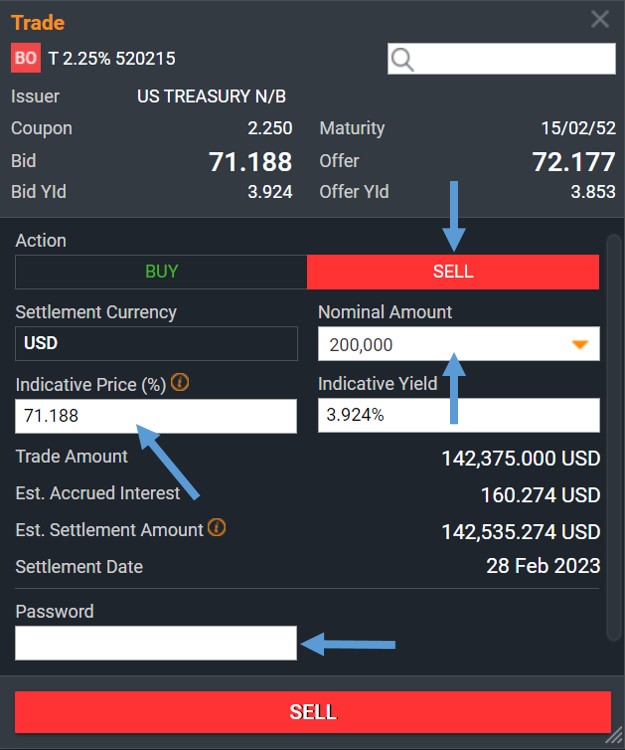

Likewise for secondary trading of US Treasuries:

- Click on the Issuer tab and select “US Treasury N/B”

- Currency select “USD”

A list of US treasury bonds that are currently trading on the market will be displayed.

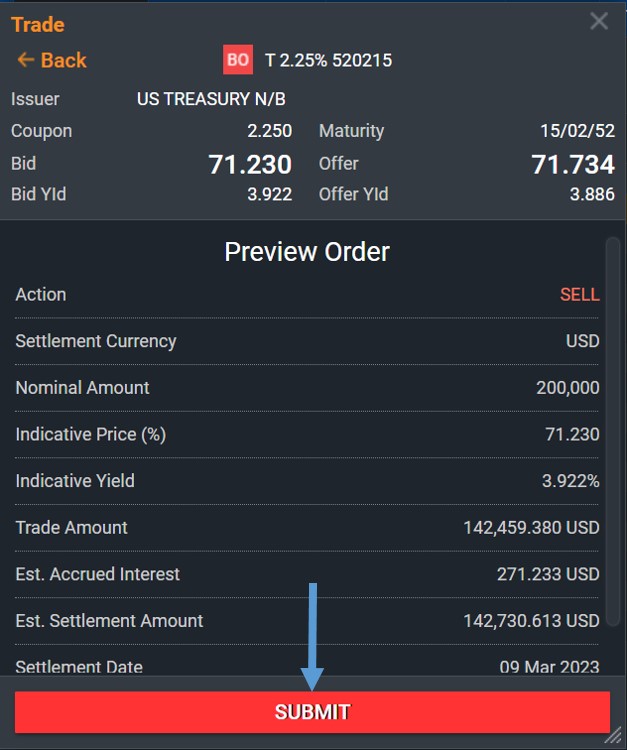

Select the particular bond that you are interested in and click on “Trade XXXX”

Similar to SGS Bonds, select Buy or Sell while indicating the Nominal Amount and Price that you are looking for and finally type in your password to place an order with us!

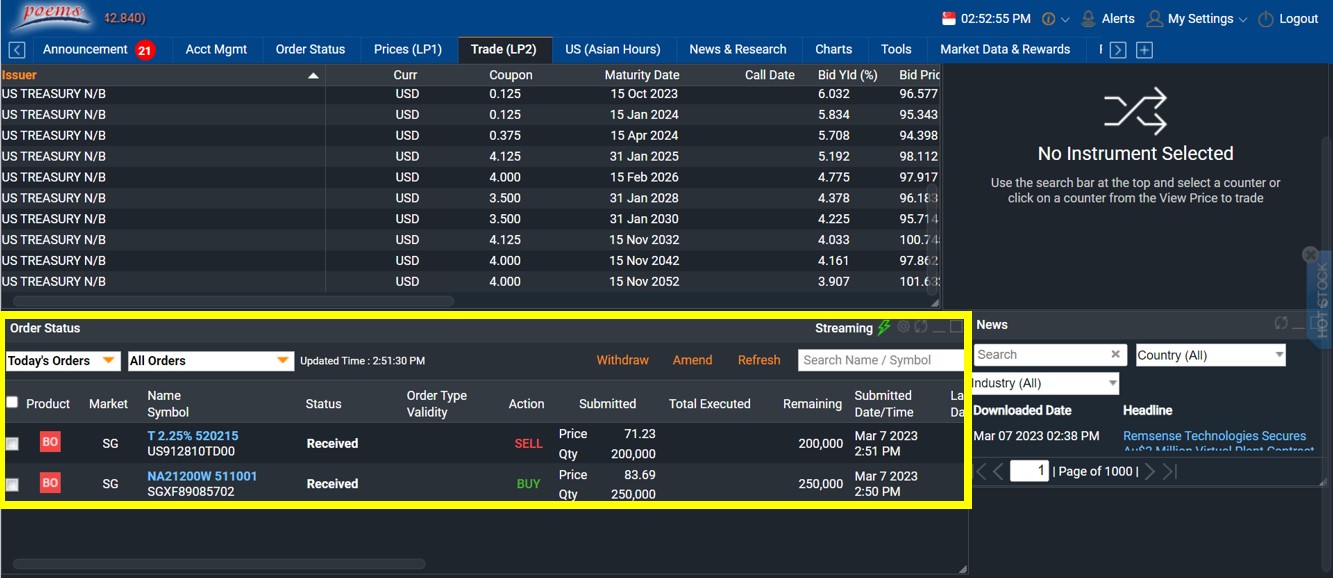

After placing a Buy/Sell order, the bonds that you have selected will be reflected in your order status bar below

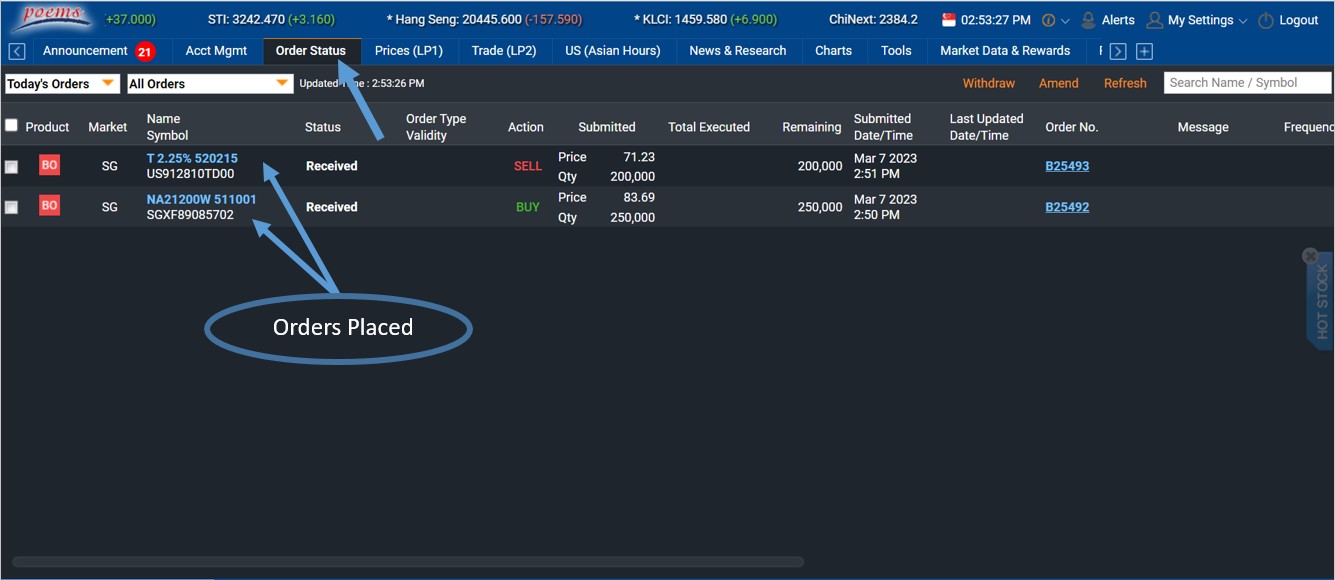

Or alternatively, you can view your order status within the “Order Status” tab

Video Tutorial – Navigate SGS Bonds and US Treasuries

How to buy Singapore Treasury Bills with us? (Primary Market)

Please contact your respective Trading Representative or Dealing team to place your bids in the primary market.