- ホーム

- Special Purpose Acquisition Companies (SPACs)

Special Purpose Acquisition Companies (SPACs)

Why Trade SPACs?

Lower fees

Higher certainty and transparency

Higher valuations and less dilution

Faster execution than IPOs

What is SPAC?

Special Purpose Acquisition Companies (SPACs) are formed to raise capital through IPOs for the sole purpose of acquiring operating business(es) or asset(s) (i.e. business combination). Such acquisitions may be in the form of a merger, share exchange or other similar business combination methods. Prior to a business combination, SPACs are listed investment vehicles with no prior operating history and revenue-generating business/asset at IPO.

What is SPAC Sponsor?

A SPAC is generally established and initially financed by experienced and reputable founding shareholders (typically referred to as sponsors). These sponsors are usually considered the management team which forms the SPAC entity to acquire or merge with a private operating company. Sponsors may include but are not limited to private equity or venture capital firms and asset managers with expertise and track records of identifying acquisition targets for shareholders. Sponsors are typically entitled to sponsor’s promote shares to increase their equity holdings in a SPAC. These shares are typically purchased at favourable terms (i.e. at minimal nominal sum) to incentivise sponsors for their risks taken in setting up a SPAC and acquiring a target company.

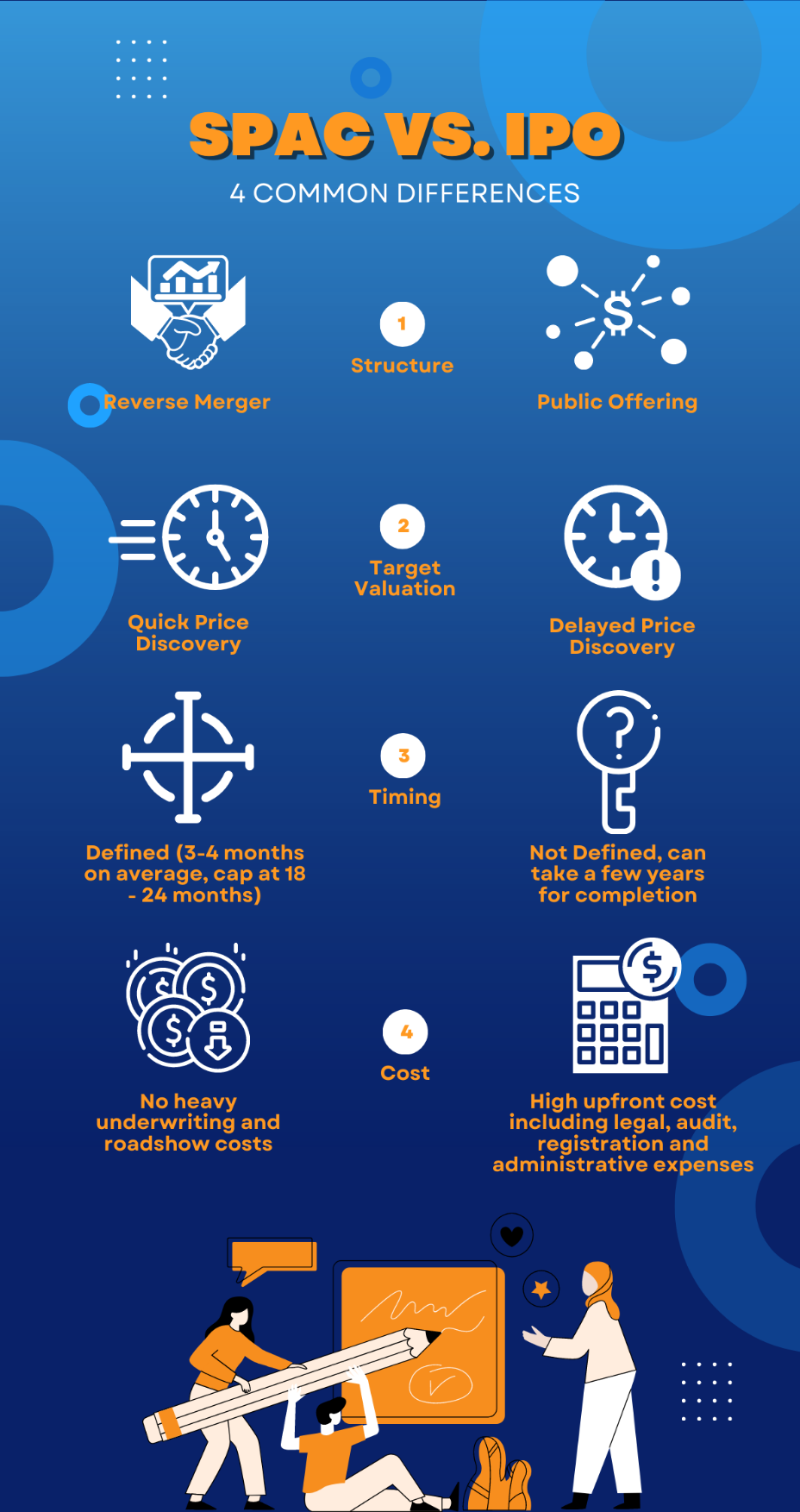

Difference of SPAC and Traditional IPO

Unlike traditional IPOs, SPAC listings have a shorter time to market due to the absence of business fundamental operations and financials at IPO. SPACs do not have historical financial results, assets description, nor minimal business-related risks at IPO. Investors will find more information on a SPAC’s target assets/business upon announcing a proposed business combination agreement (i.e. a proposal to acquire or combine with an operating company).

For more information on individual SPACs, please review the content of the SPAC’s IPO prospectus and related documents or contact your broker and/or financial advisors.

Investing in SPACs

Investing in a SPAC listing can be largely seen as investing in the founding shareholders’ profile and abilities to identify companies and execute business combination transactions. SPAC sponsors must complete a business combination (i.e. de-SPAC) within 24 months from IPO with an extension of up to 12 months (subject to fulfilment of prescribed conditions).

- SPAC Structure

- SPAC Framework

- SPAC Lifecycle

- Trading Information

Currently, POEMS offers SPACs for both Singapore (SGX) and US (NASDAQ & NYSE) Markets. For the full list of SPACs, please visit the respective official page and search up “SPAC” in the IPO screener.

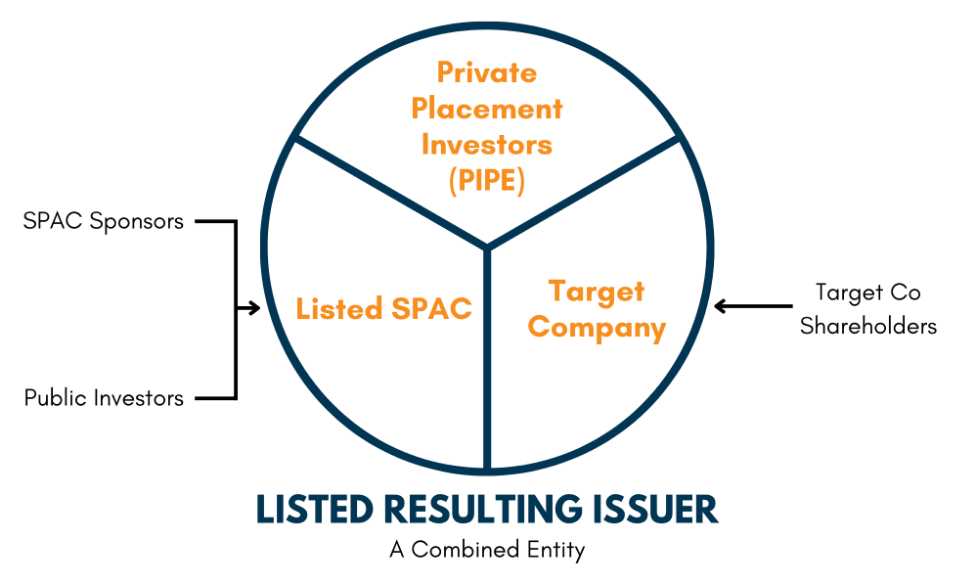

SPAC Structure

1. Listed SPAC: Cash raised through IPO to primarily acquire a target operating company

2. Target Company: SPAC acquires an operating company as part of its business combination

3. Private Placement Investors (PIPE): Additional equity fundraising with private investors to fund the business combination

4. Listed Resulting Issuer: Merging listed SPAC, Target Company and PIPE, results in a combined entity that trades as a publicly listed operating company

For more information on individual SPACs, please review the content of the SPAC’s IPO prospectus and related documents or contact your broker and/or financial advisors.

SPAC Framework

Pre-Listing

– Minimum market capitalisation: S$150 million

– Minimum IPO issue price: S$5 per unit

– At least 300 shareholders must hold minimum 25% of total issued SPAC shares (excl. treasury shares)

– SPAC sponsors must subscribe to at least 2.5-3.5% of the IPO units (depending on the market capitalisation)

SPAC Listed

Post-Listing

– At least 90% of gross IPO proceeds raised must be placed in an escrow account (operated by an approved independent agent)

– Business combination must take place within 24 months of IPO with an extension of up to 12 months (subject to fulfilment of prescribed conditions)

– Maximum percentage dilution to shareholders from conversion of warrants issued at IPO capped at 50%

– Shareholders have voting, redemption and liquidation rights in relation to a proposed business combination

– Independent valuer for business combination to be appointed in the event of an absence of

(i) PIPE financing; or (ii) where SPAC acquires a mineral oil and gas (MOG) or a property investment/development target

– Initial business combination to have a fair market value of ≥80% of the SPAC’s escrowed funds

– SPAC sponsor’s promote shares (sponsor’s entitlement to additional equity at nominal or no consideration) kept at a maximum of 20% of issued shares at IPO

– Sponsors are not allowed to divest their shares from IPO to de-SPAC. There will also be a 6-month moratorium after completion of the de-SPAC process, with a further 6-month moratorium thereafter on 50% of original shareholdings if certain criteria are met.

More information can be found in SGX’s consultation paper.

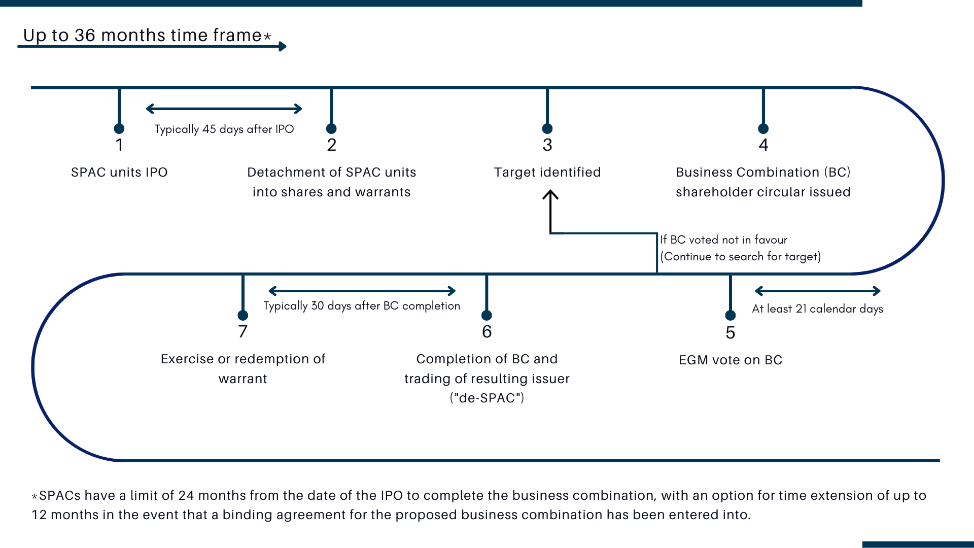

SPAC Lifecycle

1. SPAC units IPO:

– More than 90% gross IPO proceeds into escrow

– Commence search for target company

2. Detachment of SPAC units into shares and warrants

3. Target identifier:

– Negotiate terms with target company

– Secure PIPE investors if necessary

4.Business Combination (BC) share holder circular issued:

– Shareholders can exercise redemption rights

5.EGM vote on BC:

– If favourable, continue to phase 6

If unfavourable, back to phase 3 and search for new target

6. Completion of BC and Trading of resulting issuer (“de-SPAC”):

– New entity starts trading

7. Exercise or redemption of warrant

Trading Information

- Identification

- Automatic and Optional Detachment

- Board Lot and Trading Period

Identification

From IPO, the SPAC unit represents one SPAC share, and a fraction of a warrant stapled together. At detachment of the SPAC unit, the SPAC share and the SPAC warrant will detach and trade independently (on and beyond detachment date).

Trading name conventions are as follows:

- SPAC Unit: “CompanyName SPAC U”

- SPAC Share: “CompanyName SPAC”

- SPAC Warrant: “CompanyName SPAC WExerciseDate”

Note: exercise date indicative at time of listing. Refer to the Trading of SPAC warrants section for more information.

Automatic and Optional Detachment

Depending on the terms stated in the prospectus of the individual SPAC listings, the SPAC unit may be detached automatically or provide investors with the option to detach.

SPAC units with an automatic detachable feature will stop trading one day before the detachment date (typically 45 days after IPO date), where it will separate into shares and warrants. On detachment day, only SPAC shares and whole warrants can be traded (fractional warrants will be disregarded). SPAC units will be delisted two trading days post the detachment date.

Board Lot and Trading Period

Board lot for SPAC unit and share is 100. Board lot for SPAC warrant is 1.

| Security | Instrument Name | Board Lot | Trading |

|---|---|---|---|

| SPAC Unit | CompanyName SPAC U | 100 | Automatic detachment: units will trade from IPO Date until one trading day prior to the detachment date. Optional detachment: units will continue to be available for trading along with the SPAC share and SPAC warrant. |

| SPAC Share | CompanyName SPAC | 100 | From detachment day |

| SPAC Warrant | CompanyName SPAC WExerciseDate | 1 | From detachment day |

Enquiry

Have an enquiry? Get in touch with us at (+65) 6212 1818 or message us below!