Frequently Asked Questions

POEMS offers both SG and US SPACs.

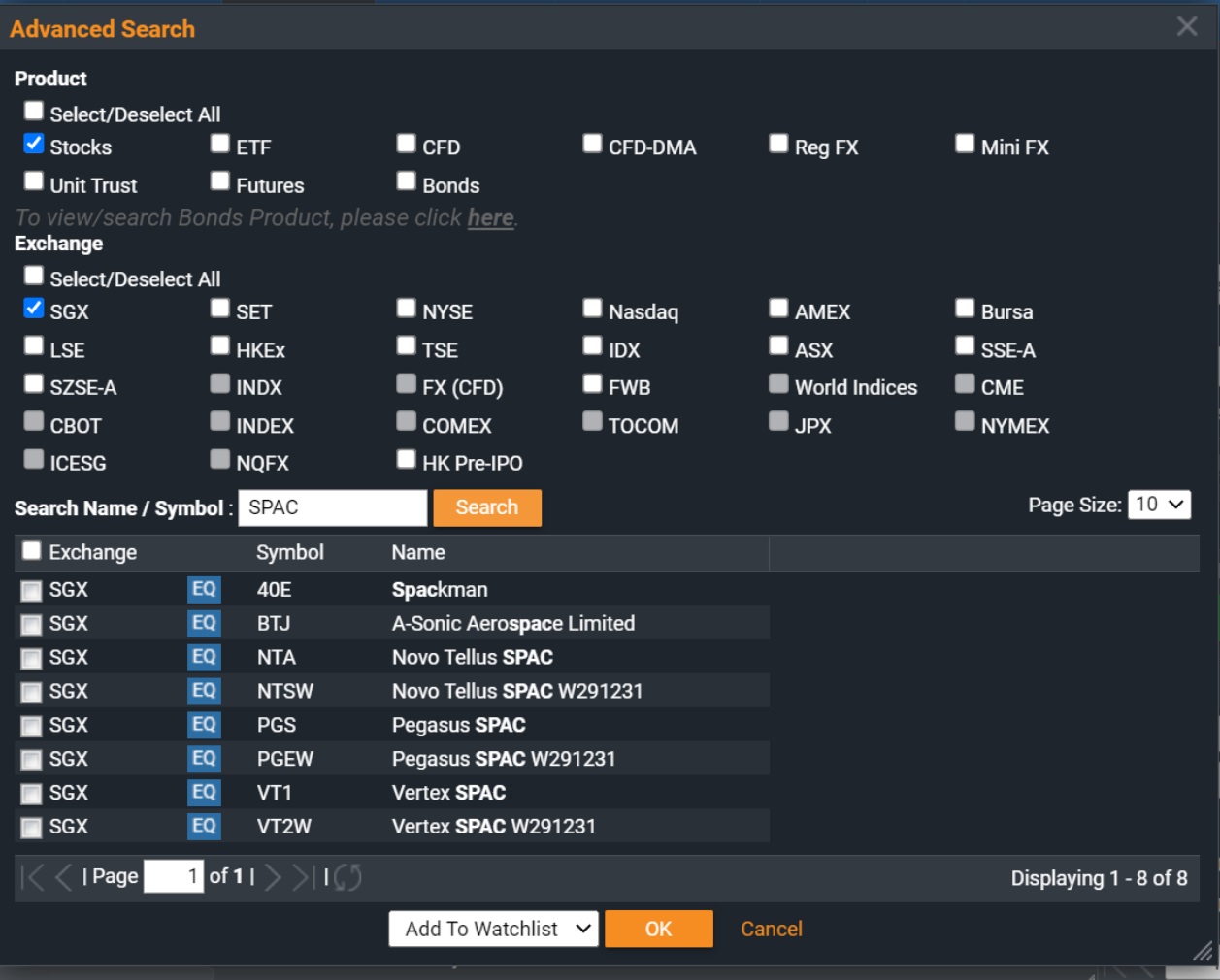

Simply go to “Advanced search”, select “Stocks” for product and “SGX/NASDAQ/NYSE” market for exchange, and key in the keyword “SPAC”. To identify SPACs product, find the word “SPAC” behind the company’s name. For example: Pegasus SPAC.

SPACs have professional sponsors such as private equity firms whose mandate and expertise is investing into companies with a view towards a potential public listing. SPAC sponsors contribute sponsor equity and support operational expenses in the SPAC. This is in contrast with cash shell listed companies who may not have the necessary investment expertise nor the level of alignment of interest and support. Finally, SPACs are required to place at least 90% of the gross IPO proceeds in a trust/escrow account, providing safeguards for investors until the completion of the Business Combination.

Prior to the Business Combination, the SPAC entity is primarily a fund-raising vehicle governed under the SPAC framework. This provides a) alignment of interest between SPAC sponsors and independent shareholders and b) opportunities for investors to participate in private equity arrangements in a publicly listed company with the relevant investor protection considerations.

Upon completion of the Business Combination, the resulting entity is subjected to existing Listing Requirements – similar to a traditional IPO. Existing standards are equally applied to the resulting entity which will have an operational business post Business Combination (de-SPAC).

No. The Resulting Issuer (i.e. operating company acquired by a SPAC) is required to meet the same Initial Listing Requirement as a traditional IPO company seeking to list on the Mainboard; including the quantitative admission criterion, public spread and distribution requirements, and qualitative requirements such as the character and integrity of directors, executive officers and controlling shareholders.

The SGX SPAC framework references the US SPAC regime and as such certain features are identical. However, SGX SPACs further codify some of the market conventions with a focus on investor protection and alignment of interests of all stakeholders. SGX also places emphasis on a sponsor’s track record, reputation of founding shareholders and experience and expertise of the SPAC’s management team.

| Category | Requirement | SGX | US |

| General | Market capitalisation | Minimum of S$150 million (as per Mainboard rules) | Minimum of USD50 million |

| Issue price | Minimum of S$5 per unit | USD2-4 per unit but SPAC issues typically at USD10 per unit | |

| Public float | At least 25% float and at least 300 shareholders for the SPAC. At least 25% float and at least 500 shareholders for the resulting issuer (post de-SPAC) | At least 300 shareholders or 400 round lot holders depending on exchange | |

| Minimum IPO gross proceeds in escrow account | At least 90% | At least 90% | |

| Fair market value of initial acquisition relative to escrowed amount | At least 80% | At least 80% | |

| Detachable warrants | Permissible | Permissible | |

| Redemption rights | Permissible for all independent shareholders | Permissible for all independent shareholders | |

| Timeframe for completion of business combination | 24 months, with 12 months extension subject to fulfilment of prescribed conditions | 36 months | |

| Appointment of independent valuer for business combination | Compulsary in the absence of PIPE financing, or where SPAC acquires a MOG or property investment/development target* | No requirement | |

| Investor protection and alignment of interests | Minimum equity participation by Sponsor | 2.5-3.5% depending on market capitalisation | Commercially negotiated |

| Limit on Sponsor’s promote | Up to 20% | No limit | |

| Moratorium on Sponsor’s shares from IPO to de-SPAC | 6-month moratorium post de-SPAC and further 6-month moratorium thereafter on 50% of shareholders (for applicable resulting issuers) | Commercially negotiated | |

| Shareholders approval for business combination | More than 50% of shareholders and 50% of independent directors | More than 50% of shareholders | |

| de-SPAC process | Follows Mainboard Reverse Take-Over (RTO) rules | Treated as merger | |

| Maximum dilution arising from conversion of warrants | 50% | No limit |

*SGX retains discretion to require the issuer to appoint a competent and independent valuer to value the businesses or assets to be acquired under the business combination.

SPACs enable an investor to participate in private equity arrangements (eg. high growth companies) in the form of a publicly listed company. This is based on an investor’s risk appetite and just like any other stocks, the investor can trade in the different stages of the life-cycle of a SPAC.

For more information, please visit SGX Website or contact your trading representatives.

ID: @349vshmi

ID: @349vshmi