Cash Plusアカウントのお申込みガイド – ウェブ版

Cash Plusアカウントの手続きは完了しましたか?

はじめての方向けにお申込みガイドを準備しました!

モバイルデバイスからお申し込みの場合はこちらをご覧ください モバイル版.

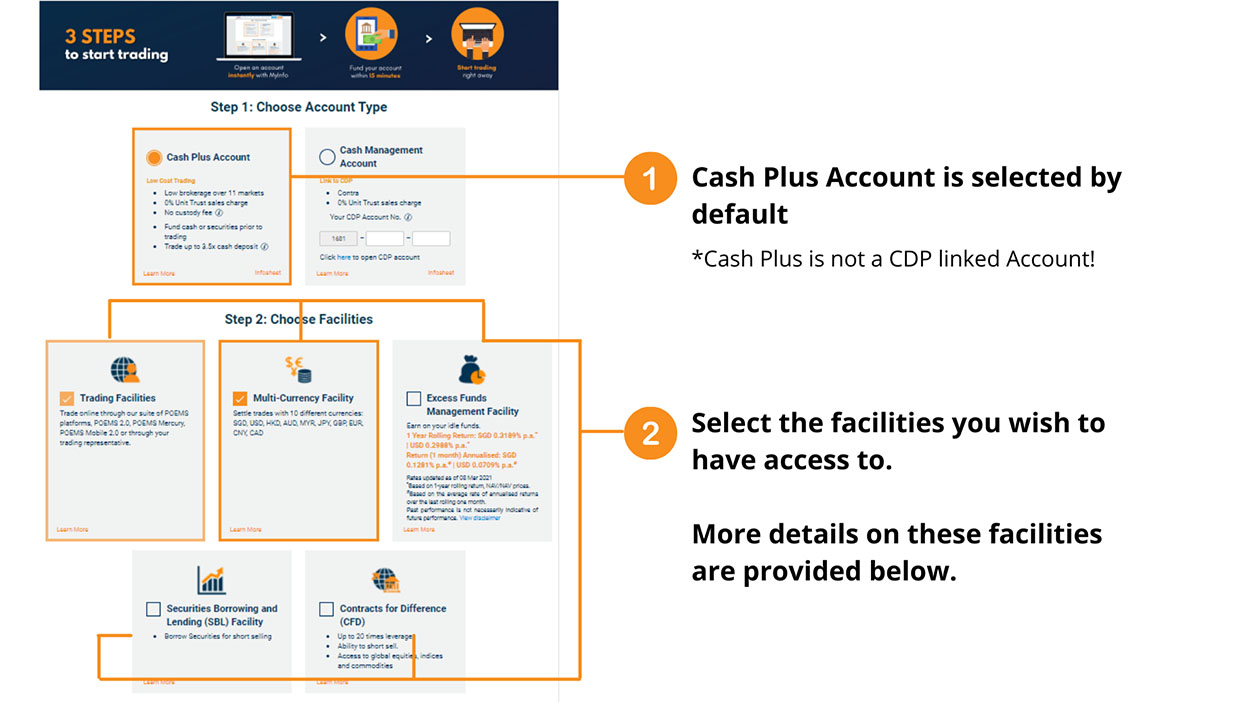

ウェブブラウザからのお申込み

詳細はこちら Excess Funds Management Facility page.

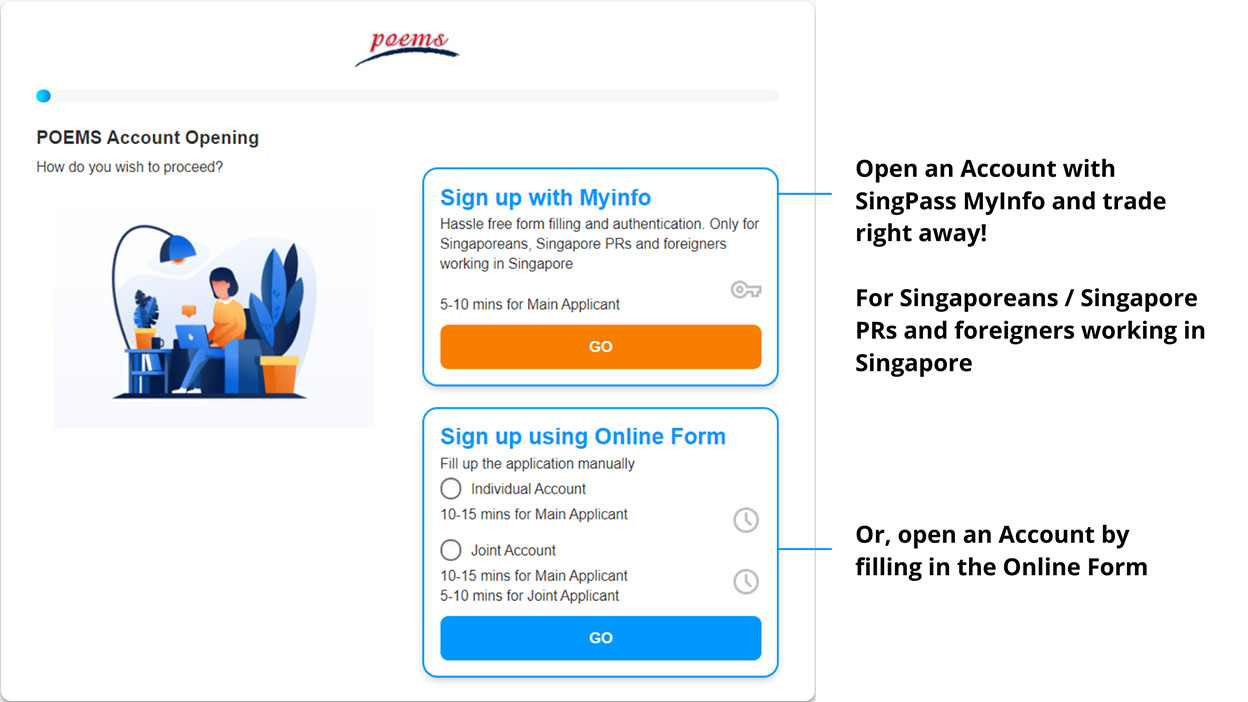

MyInfoまたはオンラインフォームに記入して口座をお申込みできます。

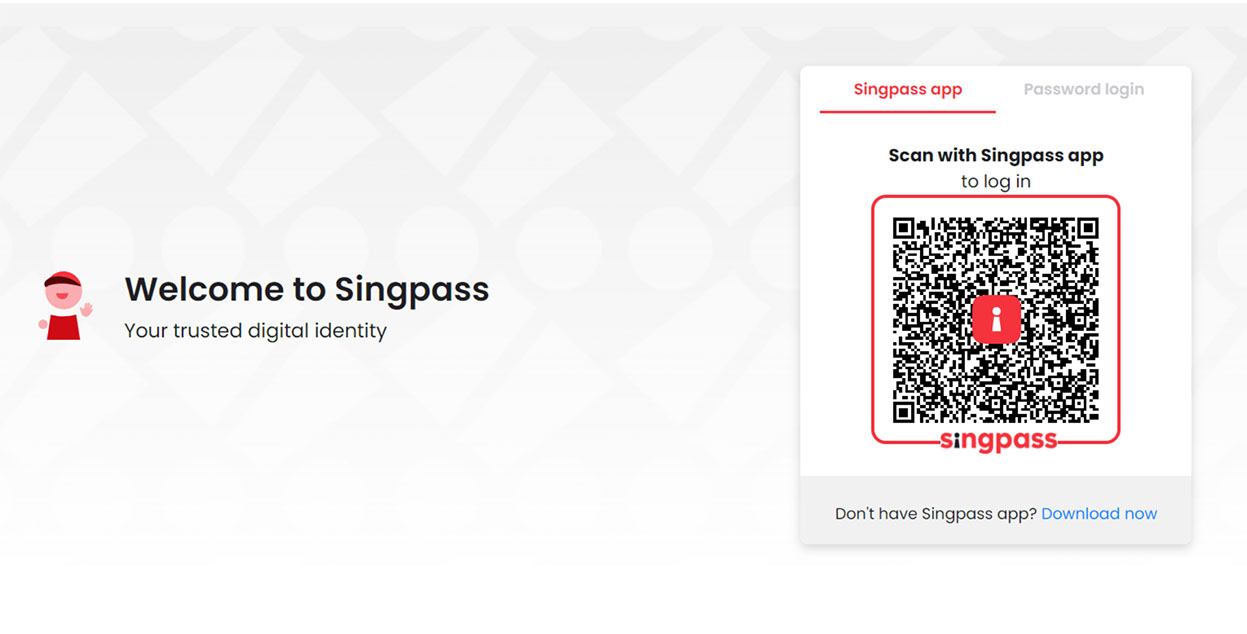

MyInfoを選択した場合はSingPassのログインが必要です。

オンラインフォームを選択した場合は下記をご準備ください。

- 国民登録IDカード (シンガポール国籍 / シンガポール永住者 / マレーシア国籍) またはパスポート(6か月以上有効)

- 住所証明(3か月以内に発行された英語または日本語の書類):

- 携帯電話の明細 / 光熱費の明細 / バンクステートメント

- その他金融機関からのステートメント

- サインの写真ファイル

- Tax Identification Number (またはマイナンバー)

- 銀行口座情報(任意)

- PCのウェブカメラ機能

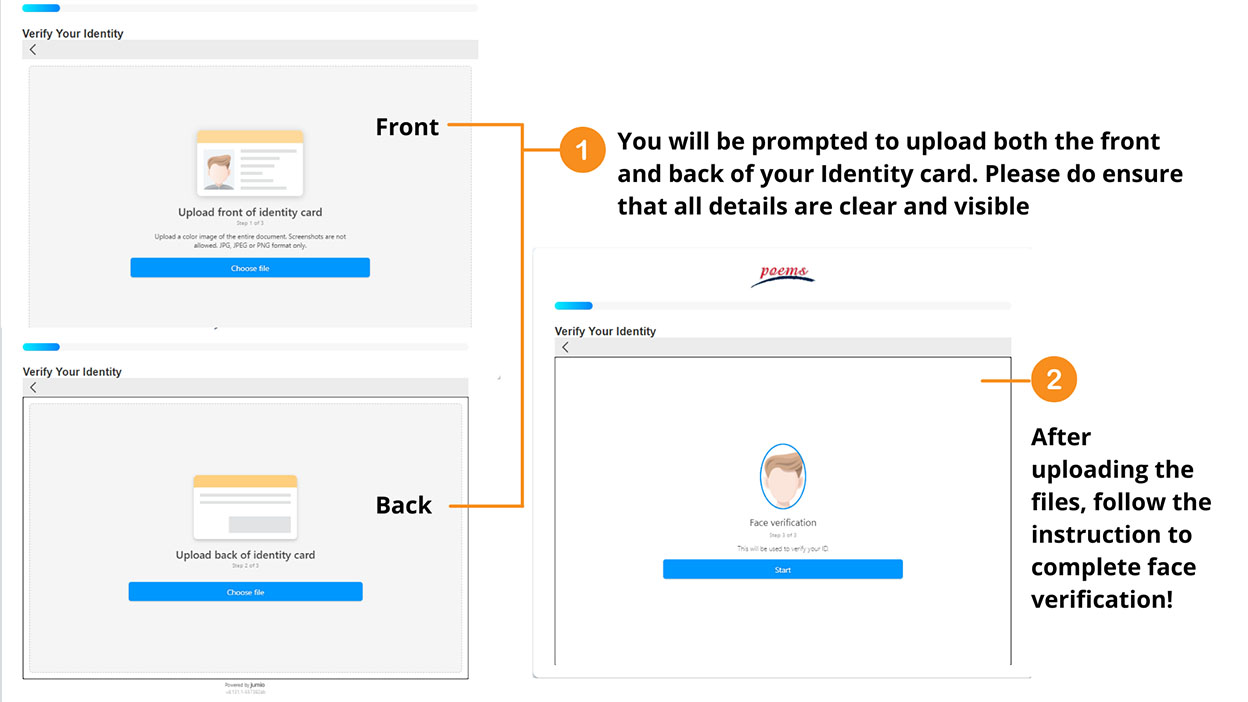

国籍を選択して身元を証明するように求められます。

本人確認のためウェブカメラで撮影またはファイルをアップロードするか選択できます。

個人情報、雇用情報、財務情報を入力して進みます。

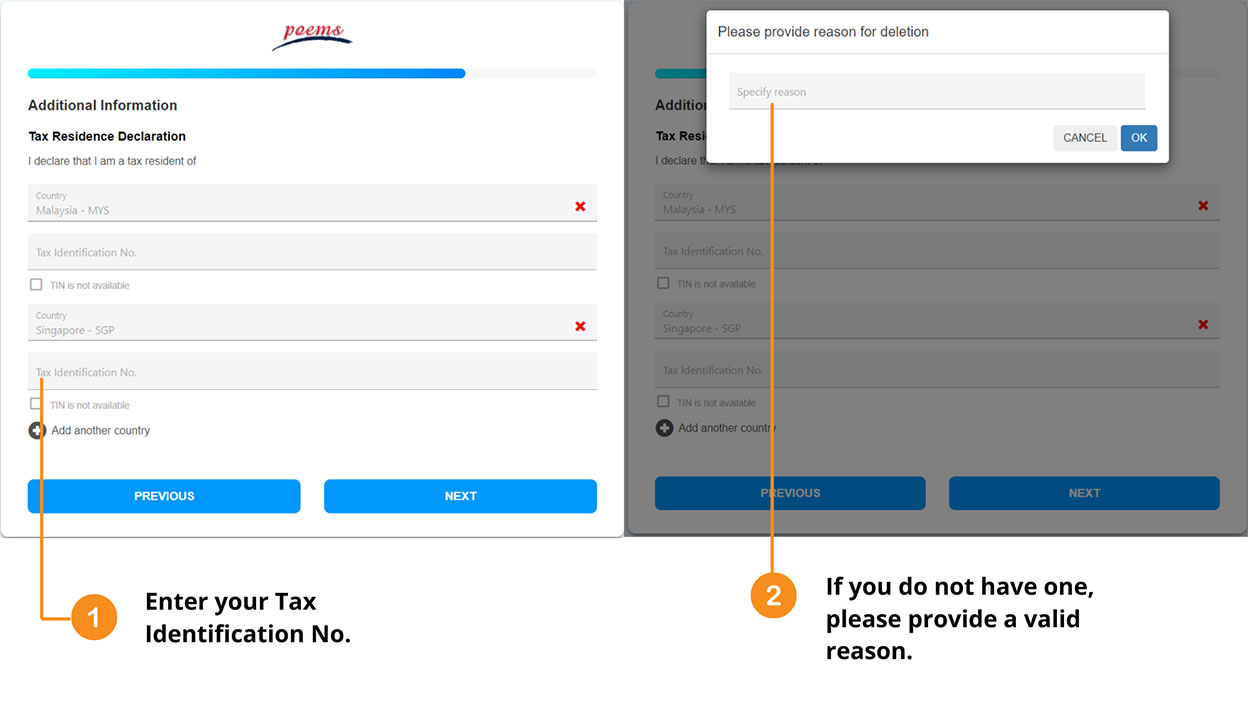

次にTax Identification No.(またはマイナンバー)を入力。

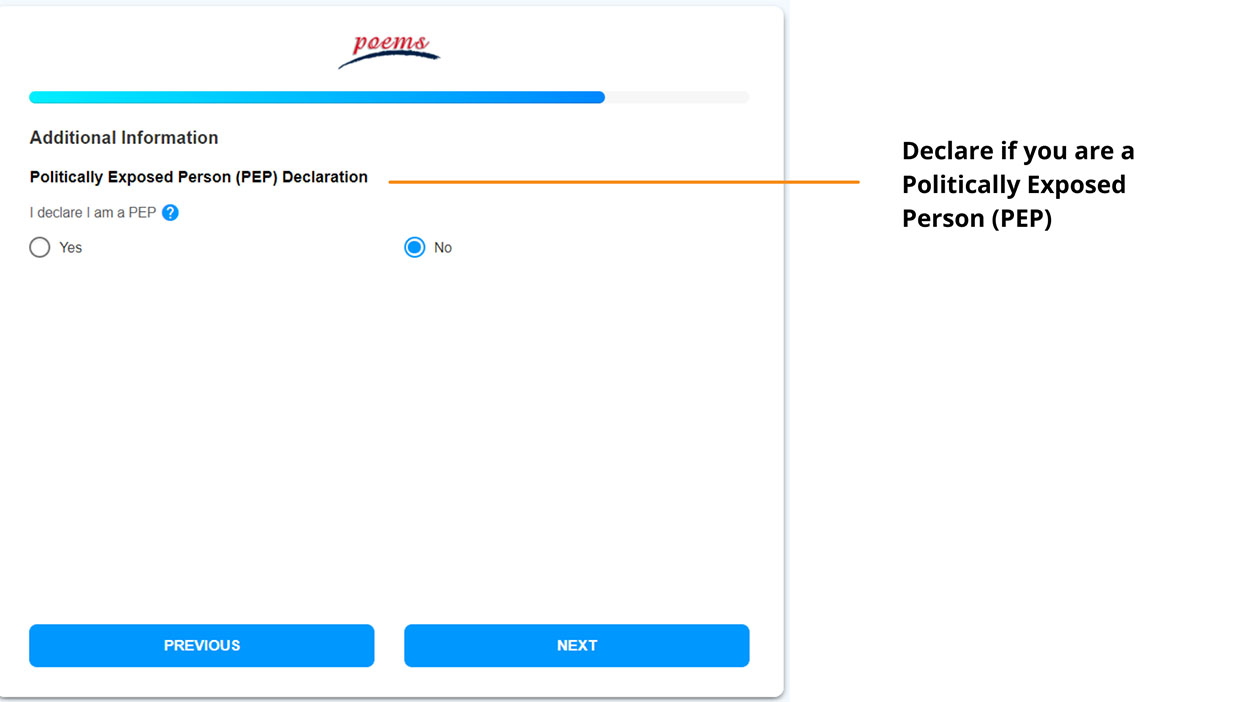

政府等の公的地位にある者又はその関係 (PEP)の有無について申告します。

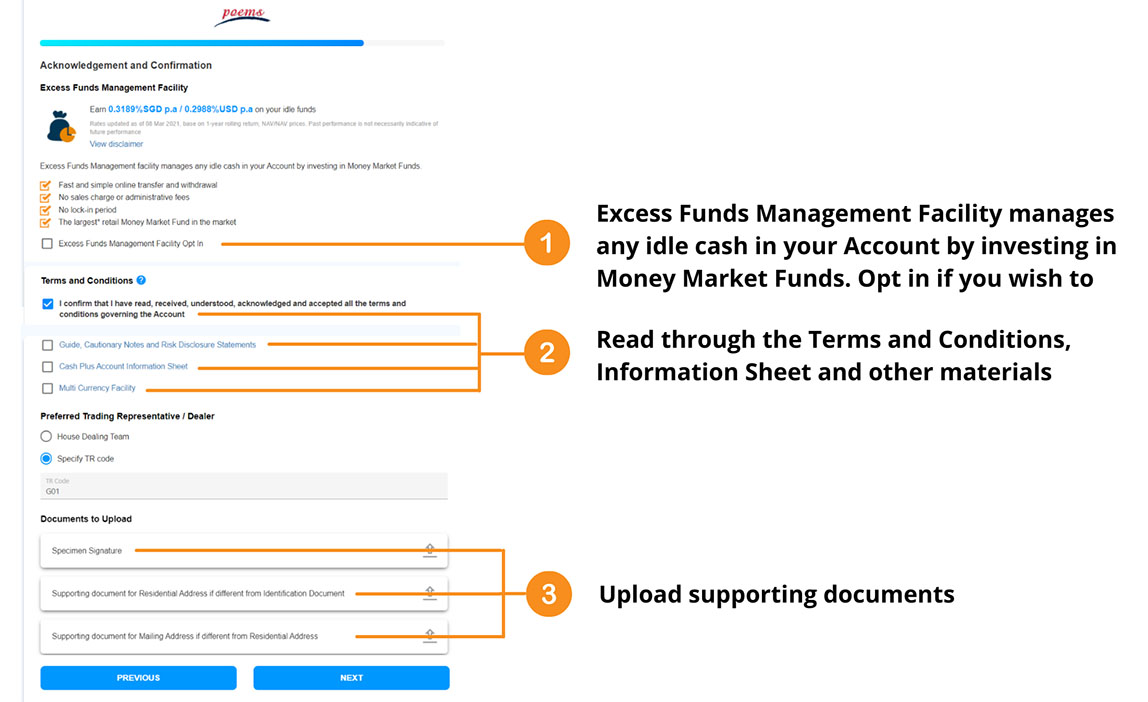

免責事項の確認と同意を行います。

もう少しで完了です! 入力した情報を再確認しましょう!

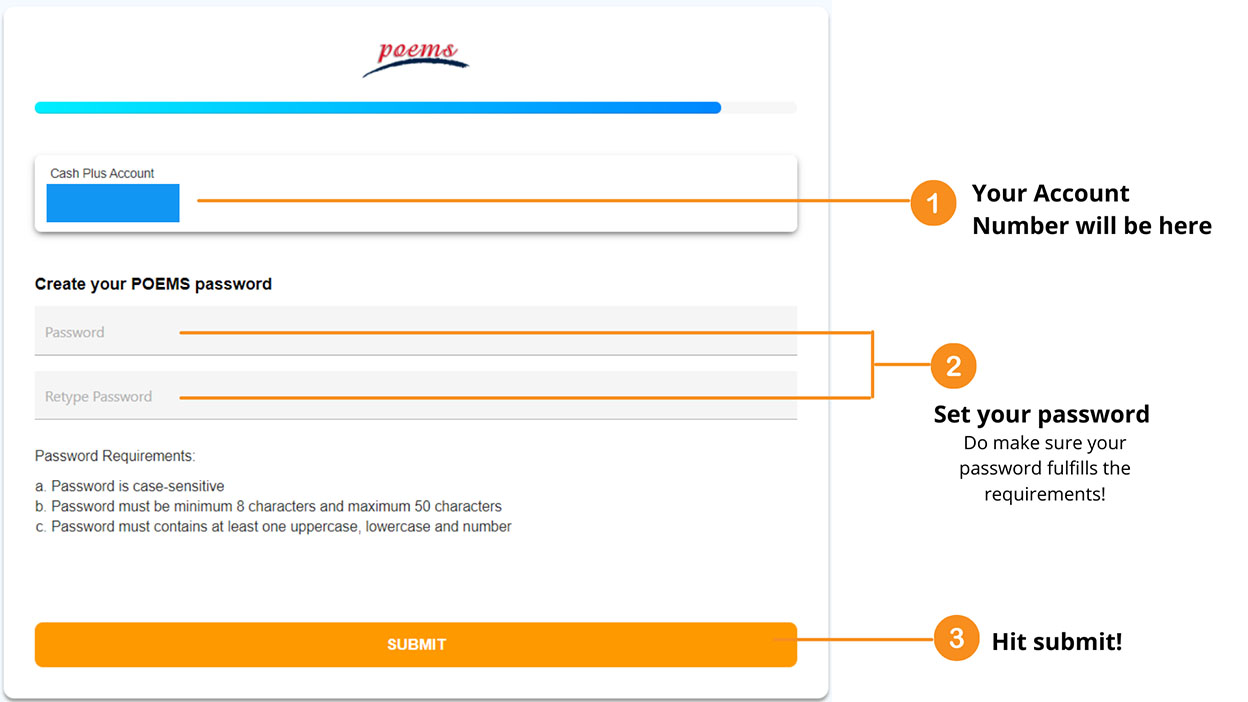

“Confirm(確認)”をクリックした後に取引口座にログインするためのパスワードを設定します。

全てのお手続きが完了しました。POEMSをお申込みいただき誠にありがとうございます!

口座開設の審査(1 – 3営業日)が完了すると、お知らせの通知メールが届きます。

証券口座の売買機能をアクティベートするために PayNow、 FAST 又は電信送金で入金しましょう。 ご入金方法の詳細 をご確認ください。

2021年4月1日から米国株と香港株の維持手数料が無料、米国株の仲介手数料はUS$ 1.88フラットになりました! (T&Cs Apply)

More details on Cash Plus Account can be found here.

ID: @349vshmi

ID: @349vshmi