蚂蚁官宣沪港两地上市,相关概念股一览

7月20日,蚂蚁集团宣布,启动上市计划,寻求在上海证券交易所科创板和香港交易所主板寻求同步上市。上市募集的资金主要用于进一步支持服务业数字化升级,做大内需,以及支持公司技术研发和创新。

消息一经出台,隔天股市相关概念股纷纷走强,这里辉立整理了大家最常问的五个问题,让大家更了解蚂蚁集团,以及谁会从蚂蚁上市中收益。

Q1:蚂蚁的主要业务和估值水平 – 科技公司而不是金融公司

蚂蚁集团的前身是蚂蚁金服(Ant Financial),其主打产品支付宝(Alipay)是拥有超过12亿的全球用户的”超级app”。另外蚂蚁集团旗下的产品涉及货币市场基金余额宝,芝麻信用、蚂蚁聚宝、网商银行、蚂蚁小贷、蚂蚁金融云、余额宝、招财宝、蚂蚁花呗等。

另外,支付宝也不断拓展他的服务范围,从信息咨询到餐厅点评,到线上购物均有涉及,其服务生态系统不断扩大。而蚂蚁在6月将其名称从蚂蚁金服(Ant Financial)更名为蚂蚁集团,也是在强调它是一家科技公司,而不是金融公司。

在最近一次筹资中(2018年年中),从淡马锡(Temasek)、泛大西洋投资集团(General Atlantic)、华平投资(Warburg Pincus)和Baillie Gifford等投资者中筹集约140亿美元,当时估值已近高达到1500亿美元。与它对标的Paypal 公司的当前市值约为2090亿美元。

Q2:蚂蚁与阿里巴巴的关系是什么 – 阿里巴巴及阿里系成员大约持有蚂蚁集团83%的股权

根据阿里巴巴2020财年报告显示,股权结构上,阿里巴巴持有蚂蚁集团33%的股权,君瀚和君澳持有蚂蚁金服50%股权。

另外,君瀚所持有的股权属于马云、谢世煌、蚂蚁金服员工、蚂蚁金服关联方、蚂蚁金服参股公司员工;君澳持有的股份属于阿里巴巴合伙的部分成员。

由此可见,阿里巴巴及阿里系成员大约持有蚂蚁集团83%的股权。马云持股约8.8%,并拥有50%表决权。

Q3: 为什么蚂蚁集团选择上海香港两地上市

结合科创板和港股近来的发展状况来看,蚂蚁集团选择两地上市将获得更高的市场热情,以及更大资本吸引。

科创版方面,尽管仅开板一周年,但科创板已经迎来逾130家科创企业,其中不乏中芯国际、寒武纪这样备受瞩目的明星企业,京东数科也正赴科创板上市。中芯国际上市首日更是大涨超240%,国内投资者对此类独角兽企业的投资热情高涨

香港主板方面,在2018年改革上市制度后,港交所吸引了包括小米、美团等新经济公司赴港上市解。之后更是迎来阿里巴巴、网易、京东等知名中概股回港二次上市。相比此前金融地产占绝对上风的格局,如今港交所的新经济以及科技属性大大提升。

随着上市制度的改变,科创板和香港联交所近年推出了一系列改革和创新的举措,为新经济公司能更好地获得资本市场支持包括国际资本支持创造了良好条件,在新的资本环境下,“A+H”的优势足以抵消纳斯达克在以往的吸引力。

Q4: 相关上市时间表 – 科创板有着18天最快上市记录

2020年10月26日晚,蚂蚁集团揭开了发行价悬念,在公告中首次披露了科创板IPO的战略投资者阵容,包括国内外29家投资者,覆盖主权基金、保险公司、银行、大型国企以及民营企业等。

港股发行价为80港元/股。蚂蚁集团公告显示,预期H股将于2020年11月5日上午9时开始买卖,H股将以每手50股进行买卖,H股的股份代号为6688

由于海外IPO不向本地监管机构提呈招股书,新加坡本地散户海外IPO申购条件:20万新币起。合格投资者(accreditedinvestors)可通过本地证券行申请认购海外IPO。

财务状况

2020 年前三季度,蚂蚁集团实现营业收入 1,181.91 亿元,同比增长 42.56% ,主要来自数字金融科技平台收入的增长;实现毛利润 695.49 亿元,同比增长 74.28% ;整体毛利率从去年同期的 48.13% 增长至 58.84% 。

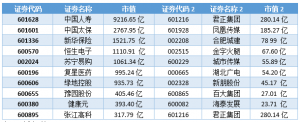

Q5:上市在即,哪些概念股将受益

在这次规模庞大的上市计划中,受益的不仅是蚂蚁集团的股东,包括众多投行、金融中介服务商,以及交易所甚至支付宝客户,都将从中获益。这里为大家整理了相关概念股一览:

来源:新浪财经

值得说的就是,在蚂蚁集团赴港上市交易的前一天,您可以通过辉立暗盘提前买入蚂蚁股票(6688.HK)。

暗盘交易介绍:

根据新加坡金融管理局规定,参加香港新股打新(IPO),需满足一次性申请200k 新币以上。

如果您想参与新股打新(ipo), 如果错过新股申购,不用担心,辉立证券证券提供暗盘交易。让你快人一步,交易蚂蚁集团股票。不懂什么是暗盘和交易细节?下文五个问题与解答帮您全面了解暗盘交易。

Q1:暗盘交易是什么?

通常暗盘交易都是在新股上市前一天,不过不是通过交易所的系统,而是通过券商内部的系统进行撮合报价。关于暗盘价和上市价的关系,尽管暗盘的涨跌从一定程度上体现了新股的受追捧程度,但暗盘价并不能全面反映市场需求,买卖盘透明度不高,因此暗盘价并不能被视作该股的走势指标。

Q2: 辉立暗盘交易细则

新加坡/北京时间:

全天交易:04.15pm – 06.30pm

半天交易:02.15pm – 04.30pm

Q3: 辉立暗盘是否有实时价格?

暗盘是有实时价格的,且无需单独订阅。

Q4: 交易佣金是多少?

与您当前使用账户交易港股佣金相同

Q5: 结算细节是如何?

通过暗盘进行的交易也将遵循香港结算周期规则。在暗盘交易中成交的订单,交易日期将是新股上市日期,同时也有资格享有合并协议和对敲。结算日期:从交易当天算起的后两个市场交易日(T+2)。

结算货币:港币或新币。

辉立暗盘交易细则

在香港,辉立证券是第一个为客户提供暗盘交易渠道的券商,交易时间一般为新股上市前一个交易日的下午4点15至下午6点半,半日市的交易时间为下午2点15至下午4点半

了解更多,请访问 辉立暗盘交易页面

如果有想了解更多全球股市资讯,请关注微信公众号 “辉立资本新加坡” (SGPSPL)。同时提供在线免费开设股票账户,一个账户轻松交易全球股票和ETF

美股,港股,新加坡股,中国A股,越南股票,韩国股票,德国股票,马来西亚股票,泰国股票,印尼股票,菲律宾股票,日本股票,澳大利亚股票,台湾股票,加拿大股票,英国股票,法国股票,荷兰股票,葡萄牙股票,比利时股票,土耳其股票

如果本文是英文翻译版本,一切请以英文为准