New to Investing

Welcome to the world of investing. Take charge of your financial journey and get ready for your next stage in life

How to Invest

Investing does not always have to be complex. At PhillipCapital, we have simplified the investing basics into four simple steps below. Follow our step-by-step guide to get you started.

1. Set Your Goals

Before you can define any objectives, ask yourself what you would want to achieve. Is your goal to save for retirement, payment for mortgage or something else?

Pen it down

Instead of visualising, writing your objectives will make them more realistic

Set your investment timeframe

Is it short term (<1 year), medium term (1-5 years) or long-term (>5 years)?

Figure out how much you’ll need

Based on your goals, define your target rate of returns and therefore, figure out how much money you’ll need

2. Plan Your Investments

It is important to understand how much risk you can accept before embarking into the investment.

Understanding your Risk Profile

Determine your risk tolerance here to find out what level of risk and reward you are comfortable with.

Diversifying your assets

Based on your risk tolerance, see the suggested asset allocation. Remember that in order to further minimise your risk, it is important to diversify your investments within each asset class as concentration on a single investment is risky.

Risk Tolerance

You are a Low Risk Investor

Your primary objective is capital preservation and you have no or limited investment experience.

You view liquidity needs as important; and are able to stay invested for not more than 3 years.

You are willing to accept minor fluctuations in the value of the portfolio.

You are a Medium Risk Investor

You are a relatively experienced investor who is looking for moderate growth and diversification.

You do not have any liquidity needs in the short to medium term (between 3 to 10 years).

You are willing to tolerate moderate fluctuations in the value of the portfolio.

You are a High Risk Investor

You are a knowledgeable investor and are not concerned about short term fluctuations in the market. You have the ability to tolerate significant fluctuations.

You have a relatively long period of time before you will need to use these investments (more than 10 years).

You are an investor who is willing to accept significant risk with longer term fluctuation, including possible loos of principal while maximizing growth potential of assets

Portfolio Allocation

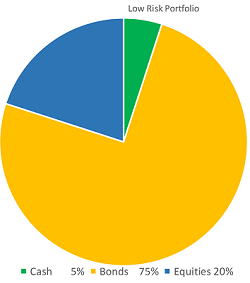

Low Risk Portfolio

Make use of our asset allocation models to rebalance your portfolio

Bonds

A debt investment in which an investor loans money to an entity (corporate or government) that borrows the funds for a defined period of time at a fixed interest rate.

Equities

Also known as stocks, it is the share in the ownership of a company. Stocks represent a claim on the company’s assets and earnings.

Cash

Cash and cash equivalents such as bank deposits, money market funds and Treasury Bills.

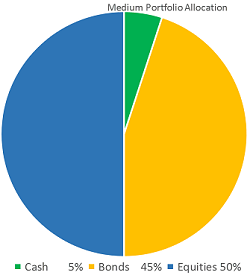

Medium Risk Portfolio

Make use of our asset allocation models to rebalance your portfolio

Bonds

A debt investment in which an investor loans money to an entity (corporate or government) that borrows the funds for a defined period of time at a fixed interest rate.

Equities

Also known as stocks, it is the share in the ownership of a company. Stocks represent a claim on the company’s assets and earnings.

Cash

Cash and cash equivalents such as bank deposits, money market funds and Treasury Bills.

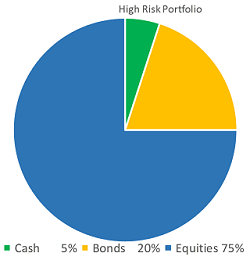

High Risk Portfolio

Make use of our asset allocation models to rebalance your portfolio

Bonds

A debt investment in which an investor loans money to an entity (corporate or government) that borrows the funds for a defined period of time at a fixed interest rate.

Equities

Also known as stocks, it is the share in the ownership of a company. Stocks represent a claim on the company’s assets and earnings.

Cash

Cash and cash equivalents such as bank deposits, money market funds and Treasury Bills.

3. Start Investing

Now that you know your Investment objective and have planned your investment, the next step is to put that into an action plan. Start your investment early to maximise the effect of compounding.

Open an account

At PhillipCapital, we have several types of accounts to best suit your investment needs. Find out more and open a Phillip Trading Account.

Transferring funds to your account

Investor Education

Explore the various educational tools available to help you in your investment decisions.

4. Stay Focused

It is important to regularly look at the progress you are making towards your investment objectives and rebalance your portfolio, if required.

Contribute regularly

Even modest contributions, when made regularly, will have a substantial effect due to the power of compounding.

Check your investment (s)

You’re working hard for your money, so ensure that your investments are also working for you. Check your investments regularly (more often if you have a riskier portfolio), especially if any major life events (such as getting married or welcoming a new child) occur as these may call for some adjustments in your portfolio.

Rebalance your portfolio

This is an important process in managing your portfolio because when the markets move, it requires commitment to stay on track. Remember that you may need to rebalance your portfolio by moving gains from assets that have done well to put them into those that may have high potential growth.

Product and Services

Find out more about full suite of investment products and services

Suite of Trading Platforms

Trading and investing is easy and convenient through our suite of platforms that cater to different needs of clients.

New to Phillip

Just opened an account with PhillipCapital? These are the essentials you need to know.

Set Your Goals

Set Your Goals  Plan Your Investments

Plan Your Investments Start Investing

Start Investing  Stay Focused

Stay Focused