新加坡股票研报 | 嘉德置地集团 (CapitaLand Limited)

投资概要

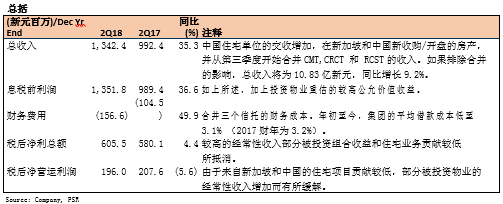

营收和调整后的净利润符合我们的预期。

在经常性收入增长的推动下,盈利强劲增长。

仅两个季度就实现了30亿新元的年度资产再循环的目标。

中国是CAPL最大的市场,同类型的商场同比的租赁销售增长稳定在5.4% 。

受中国市场强劲表现的推动下,整体服务式公寓的年增长率同比为4%。按投资组合估值计算,中国是集团最大的市场。

维持增持评级,目标价不变仍为新元4.19。

积极方面

在经常性收入增长的推动下,盈利强劲增长。2018上半年,虽然来自房产开发的息税前利润下跌了44%,但零售,写字楼和服务式公寓部门的经常性收入增长了54%,为这一下跌起到缓冲作用。排除CMT, CRCT和RCST 三家信托的合并影响,我们估计,这些经常性业务的息税前利润同比增长了20%。

2017财年末设定30亿新元的年度资产再循环目标仅用两个季度实现了。2018上半年,集团已剥离31亿新元的资产,实现了1.4亿新元的收益。这季度值得注意的资产剥离包括Twenty Anson,售价为5.16亿新元,比2017财年的估值高出19%。尽管如此,我们不会对资产的进一步周转感到意外,尤其是在集团的核心市场有宽松的上限利率的情况下。

中国是CAPL 最大的市场,同类型的商场同比的租赁销售增长稳定在5.4%。整体租赁销售同比增长了20%,这是自2017年二季度以来,由Raffles City 长宁,深圳和杭州开业以来零售业务的增长推动的。在同类型的商场基础上(不包括2017财年新开业的商场),租赁销售同比仍有5.4%的健康增长。这两个数字都与2017财年报告的数字相当。

受中国市场的强劲表现推动下,整体服务式公寓的年增长率同比为4%,按投资组合估值计算,中国是集团最大的市场。中国同类店铺的年增长率同比为8%,抵消了东南亚和澳洲地区6%的跌幅 (不包括新加坡),按投资组合估值计算,这是集团的第二大市场。

消极方面

由于房产的降温措施,在中国的发售推迟。截至2018年6月30日,集团在中国发售的单位中,有97%已出售,但由于持续的降温措施和某些项目的售价限制,集团推迟了几个项目的发售。在未来6个月里,集团已有近4,200 个单位待售。

前景

集团在中国和越南出售的住宅库存价值近40亿新元,尚未移交 (中国为32亿新元,越南为8亿新元)。

我们估计,其中近一半将在2018下半年确认,这将为经常性收入以外进一步提供盈利支持。在零售,写字楼和服务式公寓的集团经常性收入组合(占总资产的80%以上)的基本经营指标正在企稳或改善。集团已反复制定计划,在新兴市场和发达市场之间保持50:50 的资本配置平衡,同时保持80%的经常性收入资产敞口。这可能意味着,集团的目标将进一步投资于如越南等的新兴市场的房产交易。

投资行动

维持增持评级,目标价不变仍为新元4.19。

我们维持增持评级,目标价不变。我们目标价转化为2018财年末的P/NAV 比率为0.97。

关键字:新加坡股票研报,新加坡股,新加坡研报,嘉德置地商业信托 ,新加坡账户,交易新加坡股票,新加坡股票开户,免费开户,在线开设新加坡股票开户,新加坡证券,新加坡券商,投资组合,新能源汽车,补贴新政