研报 | 凯德置地集团(CapitaLand Limited):搭乘中国的顺风车

投资概要

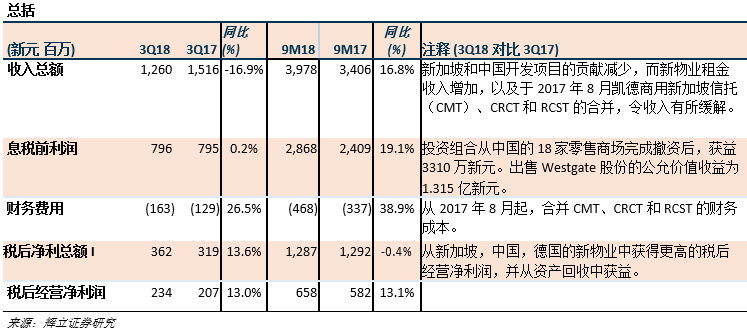

营收与税后净利与我们的预测相符。

集团通过RCCIP III 基金,收购美国多户型住宅投资组合和位于上海的第三座来福士城综合开发项目,提高其经常性收入。

凯德集团最大的市场,新加坡和中国的同店租户销售增长稳健。

2018年四季度成为中国住宅预售年度的丰收季;四季度发售至今的入住率已超过90%。

维持增持评级,调整目标价至新元4.00 (先前目标价为新元4.19)。

积极方面

经常性收入有所提高。凯德置地(CAPL) 投资了11亿新元的美国多户型住宅物业的投资组合以及持有印尼领先酒店运营商TAUZIA 70%的股份,从而提升了其经常性收入投资组合。来自新加坡,中国和德国的新物业,其税后经营净利同比增长了13.3%。本季度以外,CAPL 通过其莱佛士城中国投资合作伙伴三期 (RCCIP III) 基金,宣布其在上海的第三座莱福士城综合开发项目 – 预计将于2019年6月完工。这些都符合CAPL 到2020年使资产管理规模增加100亿新元的目标,以及其整体资产组合重组策略。

新加坡和中国的同店租户销售增长稳健。在2018年9个月里,新加坡零售投资组合受租户销售增长带动,同比增长2.2% (与CMT相比增长0.5%),主要受ION Orchard 的推动,今年三季度同比增长了2.9%。中国的零售投资组合 (CAPL 最大的零售投资组合) 在2018年9个月里,实现了20.9% 的强劲租户销售增长。

积极的资本重新部署。收购广州的两个主要住宅用地,到2021年将产生约1300个单位,紧随其后的是重庆的一处混合用途用地的收购。在新加坡,CAPL 以7.78亿新元成功收购了 (与City Developments Ltd 合资) Sengkang Central 混合用途用地。CAPL 从出售Westgate 70%的股权中,公允价值获益1.315亿新元也已得到确认。

消极方面

受房产的降温措施影响,中国的新发售仍有待推迟。CAPL 此前已多次推迟发售,原因是某些项目受到持续的房产降温措施以及售价限制的影响。

前景

管理层表示,今年四季度将是中国住宅预售的丰收季度,从9/10月份录得的中国住宅销售额达到约3.97亿新元(合计20亿人民币)就证明了这一点。从今年四季度至今推出的单位可以看到,La Botanica,The Metropolis,The Lakeside,和Parc Botanica均有超过90%的入住率。预计在今年四季度内,剩余约1850个单位将保持健康的势头,单位的发售将取决于监管机构的批准。投资物业的经常性收入 (占总资产的80%左右) 是稳定的,并以健康的经营指标为基础。

投资行动

维持增持评级,调整目标价至新元4.00 (先前目标价为新元4.19)。

在分析师变更后,我们维持增持评级,并调整目标价至新元3.91。我们的目标价转化成2018财年末的资产净值比率为0.72倍。

本文为英文翻译版本,仅供参考,一切请以英文版本为准。如果有想了解更多全球股市资讯,请关注微信公众共 “辉立资本新加坡” (SGPSPL)。同时提供在线免费开设股票账户,一个账户轻松交易美股,港股,新加坡股

关键字:新加坡股票研报,新加坡股,新加坡研报,新加坡账户,交易新加坡股票,新加坡股票开户,免费开户,在线开设新加坡股票开户,新加坡证券,新加坡券商,投资组合