中国银行板块: 资产基本面良好,资金涌入有望提振估值

2019年5月26日 : 增持

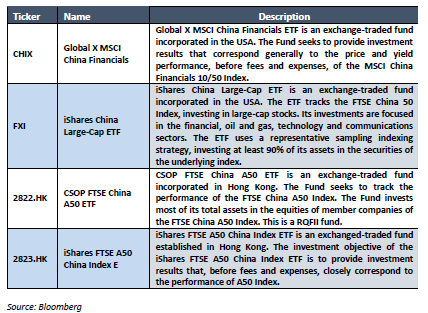

Global X MSCI China Financials | 代码: CHIX | 闭市价格: USD 15.50 | 年初至今回报: +5.87%

iShares China Large-Cap ETF | 代码: FXI | 闭市价格: USD 39.93 | 年初至今回报: +2.18%

CSOP FTSE China A50 ETF | 代码: 2822 HK | 闭市价格: HKD 13.80 | 年初至今回报: +20.24%

iShares FTSE A50 China Index E | 代码: 2823 HK | 闭市价格: HKD 13.72 | 年初至今回报: +20.35%

摘要

我们长期看好中国银行板块,中国股份制银行股息收益率平均保持在5%左右

银行资产基本面良好,总体量升质优,资产扩张带动贷款量上升。

外资与社保等大量资金涌入,银行板块估值有望得到提振。

我们长期看好中国银行板块,银行板块得益于社融的回暖,宽信用推行,定向宽松货币政策,银行资产持续扩张,同时带动贷款量上升。外部环境下社保改革以及外资加码中国股市会带来大量资金进入A股市场,高股息,占市值权重较大的银行板块估值有望得到修复。

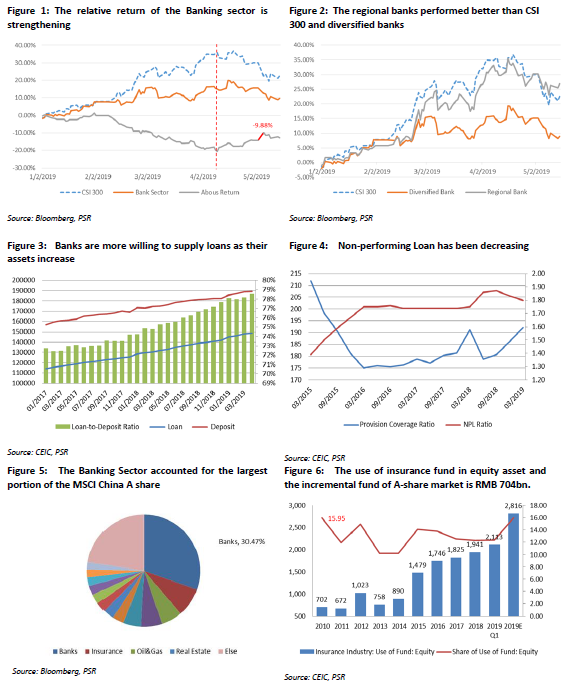

银行表现回顾:年初以来,在大盘整体强势的背景下,截至5月15日,沪深300中银行板块涨9.65%,跑输同期沪深300指数。4月10日以来,相对沪深300指数的相对表现开始走强,5月6日,中国央行宣布定向降准,银行相对表现进一步差距收窄。

同时我们注意到银行板块内部表现分化。由于2019 年金融供给侧改革强调提高中小银行的数量及业务比重,中小银行的战略地位提升,区域性银行表现突出,平均上涨26.81%,跑赢同期沪深300指数4.23%。其中表现突出的银行有宁波银行(38.72%),江苏银行(24.79%),南京银行(20.52%)。

宽信用宽货币推行,银行的核心资产基本面持续向好。2019年宽信用,定向降准政策深入推进,银行资本扩张,银行业贷款量升趋势明朗。资产扩张将是银行业2019 年盈利释放的核心驱动,资本充裕并且具有核心资产优势的银行更受益。

1. 资本和流动性改善。银行资本持续扩张,内部渠道上央行于2019年初将存款准备金率下调1%,并于5月6日再次宣布进一步下调中小银行存款准备金率。外部渠道上,中国银行业保险监督管理委员会(CBIRC)支持银行通过多种渠道补充资本,推动发行永续债。2019年1月25日中国银行成功发行首单银行永续债。一次性完成400亿元上限发行,实现2倍以上认购,发行利率处于预测发行区间的下限。

2019年,商业银行核心一级资本增至16.56万亿元人民币,同比增长15.88%。4月末,贷款规模升至148.64万亿元,同比增长12.9%。

我们认为降准和永续债的发行补充扩张了银行的资本金。银行信贷供给能力与信贷供给意愿进一步提高。

2. 资产质量方面,随着2019年减税政策的实施,减免共约95万亿元的税收支出。我们观察到不良贷款下降。我们预计中国银行业的资产质量将保持稳定。2019年第一季度,不良贷款拨备覆盖率为192.17%。在监管机构将拨备覆盖率监管要求降至120%-150%的背景下,行业具有更大的抗风险空间。

长期机构基金预计将继续流入中国的A股市场。银行业在市值中所占份额较大,股息收益率较高,预计大量资金流入,提升其估值。

1. 首先,中国金融市场的开放将吸引外资进入A股市场。包括QFII扩张在内,摩根士丹利资本国际富时指数的旗舰指数纳入中国A股。摩根士丹利资本国际(MSCI)2月28日宣布,将A股的纳入指数通过三个步骤从5%提高到20%。目前纳入摩根士丹利资本国际新兴市场指数的241只大盘股中,银行股占22只,占总市值的30.47%。根据追踪摩根士丹利资本国际新兴市场指数的基金规模(约1.8万亿美元),我们估计该基金将为银行业带来约143.1亿美元的资金流入。

2. 其次,社保基金、保险等机构性基金改革步伐加快,预计将加大对中国A股市场的投资。2019年2月,中国银行保险监督管理委员会主席易会满提议进一步为社会保障基金等各类机构投资者开放A股市场。考虑到保险和社保基金规模大、评估间隔长和以保值为主要目标,高股息收益率的银行股有望成为重要投资标的。

2019年第一季度,保险基金在股票资产上的投资开始上升,但仍处于历史低位。2019年第一季度,保险资金使用余额达到17.05万亿元,其中股权投资占12.38%,较2018年底增长0.67%。如果保险基金使用余额同比增长11.74%(与2019年第一季度持平),保险基金在股票和基金上的投资比例升至15.95%(历史最高水平),A股市场增量资金将达7040亿元。

除保险资金外,我们预计社保基金的入市节奏也有望加快。自5月1日起,27个省实施社会保险费降低3000亿元的政策,社会保险费率由20%降至16%。社会保险费率下调4%对养老基金的保值增值提出了挑战。在这种情况下,当局可以增加对A股市场的投资比重。

投资建议:

我们长期看好中国银行板块。我们认为,该行业强劲的资本和不断增加的资本流入将进一步提升估值水平。

中国银行业的部分ETF包括:

本文为英文翻译版本,仅供参考,一切请以英文版本为准。如果有想了解更多全球股市资讯,请关注微信公众共 “辉立资本新加坡” (SGPSPL)。同时提供在线免费开设股票账户,一个账户轻松交易美股,港股,新加坡股

关键字:新加坡股票研报,新加坡股,新加坡研报,新加坡账户,交易新加坡股票,新加坡股票开户,免费开户,在线开设新加坡股票开户,新加坡证券,新加坡券商,投资组合