研报 | 中国航油 China Aviation Oil (新加坡):表现持平

2019年5月2日

买入 (维持)

收盘价:SGD 1.370 | 预测DIV:SGD 0.004

目标价:SGD 1.670 | 总回报:22.2%

摘要

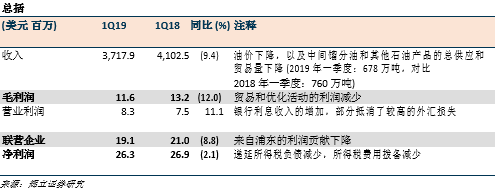

2019年一季度收入和净利润符合我们的预期。中间馏分油的产量温和增长,但其它石油产品的产量暴跌。由于平均油价下跌,浦东的表现不佳。基于12个月的市盈率为11.5倍,我们将2019财年末的每股盈利维持在10.7 美分,并维持买入评级建议,目标价不变仍为新元1.67。

积极方面

中间馏分油供应量和贸易量温和增长。如图1所示,由于恢复对中国的供应,2019年一季度的航空燃油量同比增长6%。在此期间,71%的航空燃油供应给了中国,而在最近几个季度,这一比例超过了60%。由于燃料市场的燃油被含硫量较高的燃料油所替代,所以对柴油的需求增加。

消极方面

整体供应和贸易利润率持平。以毛利润/吨计算的供应和贸易利润率,在2019年一季度,同比下降1.4% 至1.71美元/吨 (1018年一季度:1.74美元/吨)。风险较高的交易头寸减少,导致利润的增幅降低。其它石油产品的产量骤降。如图1所示,其它石油产品的大幅度下降是由于燃料油产量不足造成的。2020年国际海事组织的燃料含硫量新法规将逐步淘汰高硫燃料油。因此,对这类燃料油的需求急剧下降。展望未来,其它油产品产量预计将徘徊在当前水平。

来自浦东的利润贡献略有减少:受平均油价下跌和燃油补给量持平的影响,2019年一季度,来自浦东的利润为1720万美元 (同比减少8.9%)。在此期间,燃油补给量达到110万吨,与2018年一季度的数量相当。

前景

预计供应和贸易业务将保持稳定。由于地缘政治风险和市场不确定性不断加剧,贸易业务规模收紧,增长放缓。第五跑道已投入使用,但由于国内对飞机着陆的管控,尚未得到很好的利用。在可预见的未来,我们确实预计浦东机场的航空客运量将会逐渐增长,而我们对2019财年末的预期利润增长的贡献为4.6%。

维持买入评级,目标价不变仍为新元1.67

我们对2019财年末的每股盈利维持在10.7美分。基于对平均远期12个月市盈率为11.5倍保持不变,我们维持买入评级,目标价不变仍为新元1.67。

本文为英文翻译版本,仅供参考,一切请以英文版本为准。如果有想了解更多全球股市资讯,请关注微信公众共 “辉立资本新加坡” (SGPSPL)。同时提供在线免费开设股票账户,一个账户轻松交易美股,港股,新加坡股

关键字:新加坡股票研报,新加坡股,新加坡研报,新加坡账户,交易新加坡股票,新加坡股票开户,免费开户,在线开设新加坡股票开户,新加坡证券,新加坡券商,投资组合